Is Artisan Partners (APAM) Worth Buying for Robust Dividends?

Amid high inflation and a looming global economic downturn in the near term, investors should accumulate high dividend-yielding stocks. One such stock is Artisan Partners Asset Management Inc. APAM.

This Milwaukee, WI-based investment management company focuses on providing high-value-added, active investment strategies to clients globally. Its investment teams manage a broad range of U.S., non-U.S. and global investment strategies that are diversified by asset class, market cap and investment style.

On May 2, Artisan Partners announced a cash dividend of 50 cents per share. The dividend was paid on May 31, 2023, to shareholders of record as of May 17, 2023.

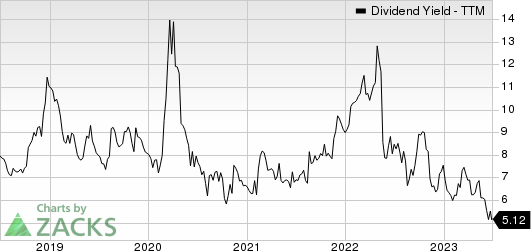

Considering the last day’s closing price of $39.07, the company’s dividend yield currently stands at 5.12%. This is impressive compared with the industry average of 2.86% and attractive for income investors as it represents a steady income stream.

Artisan Partners Asset Management Inc. Dividend Yield (TTM)

Artisan Partners Asset Management Inc. dividend-yield-ttm | Artisan Partners Asset Management Inc. Quote

Markedly, the company pays a variable dividend amounting to 80% of the cash generated each quarter. It also pays a special dividend. In January 2023, APAM announced a special dividend of 35 cents per share.

Artisan Partners has been increasing its quarterly dividend on a regular basis. Over the past five years, the company increased its dividend ten times, with an annualized dividend growth rate of 5.93%.

Dividends aside, should you add Artisan Partners to your portfolio to earn a high dividend yield? Let’s check out the company’s fundamentals to understand the risks and rewards. This will help us make a proper investment decision.

Artisan Partners has a decent balance sheet. As of Mar 31, 2023, the company had borrowings of around $200 million, cash and cash equivalents of $150.6 million and a revolving credit facility of $100 million. Given a decent liquidity position, strong cash generation ability and modest leverage, its capital deployment activities seem sustainable and are likely to boost investors’ confidence in the stock.

Artisan Partners also has a decent earning surprise history. Its earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, with the average surprise being 1.5%. In the last three to five years, the company witnessed earnings per share growth of 9.6%, higher than the industry’s rise of 7.8%. While its earnings are projected to decline 11.6% in 2023, the same is expected to rebound and grow 7.8% in 2024.

Artisan Partners’ total assets under management (AUM) have been witnessing improvement. Total AUM saw a four-year (2018-2022) compounded annual growth rate (CAGR) of 7.4%, with the rising trend continuing in the first quarter of 2023. The company’s efforts to improve and add investment strategies supported AUM growth. Hence, as markets improve and the economy stabilizes, AUM will rise, thus aiding top-line growth.

Artisan Partners’ revenues witnessed a CAGR of 4.6% over the last four years (ended 2022) with some volatility. The company's diverse product offerings and investment strategies continue to attract investors. It maintains decent funds for operations and new products and continues investing in new teams, and technological and operational capabilities. Such efforts are likely to boost revenues in the upcoming period.

Artisan Partners’ return on equity (ROE) of 86.38% is higher than the industry average of 12.69%. This shows that it reinvests its cash more efficiently than its peers.

Despite near-term headwinds like rising expenses and macroeconomic uncertainties, APAM is fundamentally solid. In the past three months, shares of Artisan Partners have gained 25.3% compared with the industry's rise of 5.3%.

Image Source: Zacks Investment Research

Therefore, income investors should add this Zacks Rank #2 (Buy) stock to their portfolio as it will help generate robust returns over time. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Other Finance Stocks With Solid Dividends

A couple of other finance stocks like Ares Capital Corporation ARCC and Capital Southwest CSWC are worth a look as these too have robust dividend yields.

Considering the last day’s closing price, Ares Capital’s dividend yield currently stands at 10%. Over the past three months, shares of ARCC have gained 2.5%.

Based on the last day’s closing price, Capital Southwest’s dividend yield currently stands at 10.98%. Over the past three months, shares of CSWC have gained 12.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report

Capital Southwest Corporation (CSWC) : Free Stock Analysis Report