Is Artisan Partners (APAM) Worth a Look for 6.6% Dividend Yield?

The financial sector is facing challenges amid the current operating backdrop, with expectations of an economic slowdown in the near term. Hence, solid dividend-yielding stocks should be on investors’ radar. Today, we are discussing one such stock, Artisan Partners Asset Management APAM.

This Milwaukee, WI-based company offers its clients high-value-added investment strategies that are diversified by asset class, market capital and investment style.

APAM has been paying quarterly dividends on a regular basis and raising the same. The last sequential hike of 22% to 61 cents per share was announced in August 2023. In the past five years, it increased dividends 12 times.

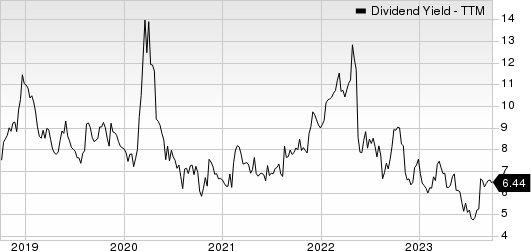

Considering the last day’s closing price of $37.89 per share, Artisan Partners’ dividend yield currently stands at 6.64%. This is impressive compared with the industry’s average of 2.95%, in turn, attracting investors as it indicates a steady income stream.

Artisan Partners Asset Management Inc. Dividend Yield (TTM)

Artisan Partners Asset Management Inc. dividend-yield-ttm | Artisan Partners Asset Management Inc. Quote

Is the Artisan Partners stock worth a look to earn a high dividend yield? Let’s check the company’s fundamentals to understand its risks and rewards for making a proper investment decision.

APAM pays a variable dividend, amounting to 80% of the cash generated each quarter. It also pays a special dividend. In January 2023, the company’s board of directors announced a special dividend of 35 cents per share.

Apart from regular quarterly dividend payouts, Artisan Partners’ total assets under management (AUM) have been witnessing improvements. The total AUM experienced a compound annual growth rate (CAGR) of 7.4% over the four-year period ended 2022, the upward trend continued in the first six months of 2023. Its efforts to improve and add investment strategies supported AUM growth.

Although AUM declined in 2022, as global equity and debt markets improve and the economy stabilizes, it is likely to rise, thus aiding top-line growth. Our estimates for total AUM suggest a CAGR of 32.6% by 2025.

APAM’s total revenues witnessed a CAGR of 4.6% over the last four years ended 2022, on the back of a solid AUM balance. Although revenues declined in 2022 and the first half of 2023, the company maintains decent funds for operations and new products. It also continues investing in new teams, and technological and operational capabilities. Such efforts are likely to boost revenues in the near term. We project total revenues to witness a CAGR of 20.2% by 2025.

Artisan Partners maintains a decent balance sheet. As of Jun 30, 2023, it had borrowings of around $200 million, which have been relatively stable over the past few quarters. Cash and cash equivalents, as of the same date, were $165 million and it had $100 million in its revolving credit facility. Given a decent liquidity position and modest leverage, Artisan Partners is less likely to fail to make interest and debt repayments if the economic situation worsens.

On the flip side, Artisan Partners’ bottom line continues to suffer from rising operating expenses. Also, volatile trends in net client cash flows pose a major concern.

Over the past six months, shares of APAM have gained 21.6% compared with the industry‘s upside of 7.3%.

Image Source: Zacks Investment Research

Therefore, income investors must watch this Zacks Rank #3 (Hold) stock as it will likely help generate robust returns over time.

Other Finance Stocks Worth Considering

A couple of other finance stocks like Invesco IVZ and Premier Financial PFC are worth a look, as these too have solid dividend yields.

Considering the last day’s closing price, Invesco’s dividend yield currently stands at 5.53%. In the past year, shares of IVZ have increased 5.6%. Currently, it carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Premier Financial carries a Zacks Rank #3 at present. Based on the last day’s closing price, its dividend yield currently stands at 7.27%. In the past year, shares of PFC have declined 33.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report

Premier Financial Corp. (PFC) : Free Stock Analysis Report