ARWR: Broad-Based Pipeline Progress. Three Pivotal Studies, Value-Inflection Opportunities In View.

By Brian Marckx, CFA

NASDAQ:ARWR

READ THE FULL ARWR RESEARCH REPORT

Pipeline Highlights: APOC3/ANG3 Topline Data, Orphan Desig. JNJ-3989 in Ph2b, Cohort 12 Data Upcoming. And More…

Arrowhead (NASDAQ:ARWR) continues to make rapid progress across most of their pipeline. There has been no shortage of positive product development related events as of late – and, importantly, the progress continues to be broad-based with successes being experienced by nearly all the company’s programs. Additionally, ARWR remains committed to and is delivering on their prior guidance of expanding their TRiM clinical development pipeline. With another three clinical trial agreement (CTA) filings anticipated, the company could soon have eight TRiM clinical programs ongoing. ARO-HSD, targeting HSD17B13 for potential indications in alcohol and non-alcohol related liver diseases, is the most recent addition and which ARWR hopes to have in clinical studies next year.

The last few months has also been highly productive from an FDA regulatory standpoint with two Ph1 clinical candidates (ARO-APOC3 and ARO-ANG3) receiving Orphan Drug designation and a third, ARO-AAT, which recently commenced testing in the Ph2/3 SEQUOIA study, granted Fast Track status (ARO-AAT also has Orphan Drug designation).

Meanwhile, JNJ-3989 (targeting chronic HBV and the initial program under the Janssen collaboration) not only continues to progress through an ongoing Ph1/2 clinical study – which includes completion of enrollment of the (recently added) triple combination cohort (‘cohort 12’, 12 patients over 12 weeks) – but is also now being used in a large (n=450) Ph2b triple combination study which is evaluating different combination drug regimens in the treatment of chronic HBV for up to 48 weeks. ARWR received a $25M milestone payment upon initiation of this study. The development success to-date of JNJ-3989 may have other positive implications for the company, including bolstering the relationship with Janssen. Perhaps to that point, work just recently began on ‘JNJ1’ (discussed below) – which represents the first (of up to three) program that Janssen optioned to pursue under the duos’ October 2018 development collaboration agreement.

With APOC3, ANG3 and AAT all possibly entering pivotal studies in the near-term and JNJ-3989 now in what could prove to be a curative study (for HBV, which could draw massive appeal), we could soon have a lot more information to gauge the potential commercializability (and value) of Arrowhead’s development portfolio. This, by extension, also bolsters the potential likelihood of significant value-inflection events/announcements (over the same timeframes).

ARO-APOC3 / ARO-ANG3 Orphan Designation, Positive Ph1 Data: Pivotal Studies in 2020?

Arrowhead received orphan drug designation for ARO-APOC3 for the treatment of familial chylomicronemia syndrome (FCS) and for ARO-ANG3 for the treatment of homozygous familial hypercholesterolemia (HoFH) in June and July, respectively. FCS and HoFH are both rare metabolic disorders with high unmet needs and are associated with impaired quality of life and certain potentially serious health complications that, if left untreated, can result in death.

FCS is a genetic disorder characterized by inability to properly break down fats (as a result of dysfunctional lipoprotein lipase), which can result in severe hypertriglyceridemia (dangerously high levels of triglycerides), pancreatitis and even death. Worldwide prevalence of FCS is estimated at between 1 in 1M and 1 in 2M people.

HoFH is an inherited disorder which impairs the body’s ability to remove low-density lipoprotein. This can lead to severely elevated LDL, early and rapid narrowing / blockage of the arteries and eventually, death. It is estimated that HoFH affects between 1 in 160k to 1 in 1 million people around the world.

Orphan status, combined with the recently announced positive topline Ph1 data, sets the stage for what could be further acceleration of these programs through mid/late-stage development. In fact, ARWR expects to pursue respective orphan designated clinical programs immediately which, if all goes well, could potentially include pivotal trials for both APOC3 and ANG3 as soon as next year.

The most recent significant pipeline news came last week when ARWR announced positive topline data from Phase I studies of ARO-APOC3 and ARO-ANG3, the company’s two newest clinical RNAi TRiM candidates which target cardio metabolic diseases.

Presented at The Global Summit on Cardiology and Heart Diseases in Dubai, the data provided the first substantive look at safety and target activity in the clinical setting and results appear to have been exactly what had been hoped for – more specifically, that each candidate effectively reduced their respective targets and triglyceride levels and did so without any serious side effects. Perhaps just as encouraging, this initial topline data – which is from just a single dose (in healthy volunteers) - also suggests long duration of activity.

AROAPOC31001 is a Ph1 (n= ~80) single and multiple dose-escalating study evaluating the safety, tolerability, pharmacokinetics and pharmacodynamic effects of ARO-APOC3 in adult healthy volunteers, patients with hypertriglyceridemia and patients with FCS. AROANG1001 is a Ph1 (n= ~94) single and multiple dose study evaluating the safety, tolerability, pharmacokinetics and pharmacodynamic effects of ARO-ANG3 in adult healthy volunteers and patients with dyslipidemia.

As a reminder of the background of these programs and hypothesis behind their respective targets - large genetic studies discovered that certain rare mutations that disrupt the functioning of apolipoprotein C3 (i.e. APOC3) and angiopoietin-like 3 gene (i.e. ANGPTL3) are associated with lower levels of plasma triglycerides and, in the case of ANGPTL3, also decreased plasma levels of low-density lipoprotein (LDL)

cholesterol, and high-density lipoprotein (HDL) cholesterol. As these lipid fractions have been shown to be predictors of cardiovascular disease (CVD), targeted therapeutic antagonism of APOC3 and ANGPTL3 is hypothesized to reduce risk of CVD. This theory, already supported by laboratory and rodent models, just became much more compelling as a result of this positive initial human clinical trial data.

While we will wait for results of the larger data set to offer a more determined opinion, we would characterize these results – clean safety and initial signs of durability of effect - as about the best as could have been expected. Management anticipates additional data from both studies, including the complete treatment course of the single ascending dose (SAD) portions to be announced later this year and, subsequently, from the multiple ascending dose (MAD) portion (in various patient populations). And, as we also anticipate additional activity specific to each candidates’ respective orphan drug indications, there could be a regular amount of clinical news flow for APOC3 and ANG3 over the coming quarters - which we think further benefits the likelihood of potential value-inflection announcements.

The topline Ph1 data announced last week comes from the SAD portion which, for both studies (i.e. AROAPOC3001 and AROANG1001), included 4 cohorts of 10 adult healthy volunteers with (6 active / 4 placebo). AROAPOC3001 participants received a single dose of either placebo or ARO-APOC3 at dose levels of 10, 25, 50, or 100mg while AROANG1001 participants received a single dose of either placebo or ARO-ANG3 at dose levels of 35, 100, 200, or 300mg.

Of note, AROAPOC3001 was recently amended, eliminating what had originally included a 200mg as the highest dose. The amendment, which management stressed was based “solely on positive pharmacodynamic activity and not due to any concern or finding with respect to safety or tolerability”, also added a 10mg dose (25mg had initially been the lowest dose). Including this lower dose, management noted, should provide additional insight into dose response of APOC3.

Ph1 Topline Results showed:

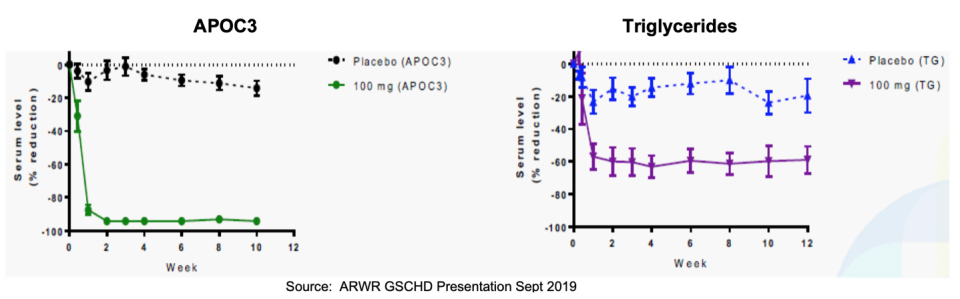

- 100mg of ARO-APOC3 was associated with 63% reduction in plasma triglycerides and 94% reduction in APOC3. Particularly noteworthy is the durability of this robust effect, which appears (see graphs below) to have remained at or near trough level through week 12.

These results also compare favorably to those of studies of other (non-ARWR associated) clinical stage apolipoprotein C-III-targeting candidates including AKCEA-APOCIII-LRx (Akcea Ther / Ionis Pharma), in Ph2 testing for the treatment of serious cardiometabolic diseases caused by lipid disorders (see table, below, from ARWR’s Ph1 topline results presentation)

View Exhibit I

- 200mg of ARO-ANG3 was associated with 66% reduction in plasma triglycerides and 79% reduction in ANGPTL3. Similar to the APOC3 data, ANG3 showed potent durability of effect with maximum reduction largely maintained through 12 weeks.

These results also compare favorably to those of studies of other (non-ARWR associated) clinical stage angiopoietin like protein 3-targeting candidates including AKCEA-ANGPTL3-LRx (Akcea Ther / Ionis Pharma) and Evinacumab (Regeneron) - see table, below. AKCEA-ANGPTL3-LRx is in Ph2 testing for patients with hypertriglyceridemia, type 2 diabetes and nonalcoholic fatty liver disease. Evinacumab is a monoclonal antibody in separate Ph2 trials for patients with severe hypertriglyceridemia as well as those with refractory hypercholesterolemia (also in Ph3 for patients with homozygous familial hypercholesterolemia).

View Exhibit II

- Clean safety profile: In both studies no drug-related serious or severe adverse events were observed

View Exhibit III

AROANG1001 and AROAPOC31001 current status and upcoming milestones…

As it relates to AROANG1001, the 200mg dose was chosen to use in the MAD portion, which commenced following recent receipt of requisite IRB and Drug Safety Committee approvals. Management noted on the Q3 earnings call (Aug 5th) that three of the MAD cohorts had been fully recruited and dosing started while recruiting of the fourth cohort was underway.

Of note, the MAD portion was initially designed to enroll up to 4 patient cohorts including those with non-alcoholic fatty liver disease (NAFLD), those on statin treatment with high LDL cholesterol and triglycerides, those with familial hypercholesterolemia and patients with severe hypertriglyceridemia. ARWR noted on the call that an amendment was in-process to add healthy subjects as well as patients with heterozygous or homozygous familial hypercholesterolemia.

As it relates to AROAPOC31001, management noted on the Q3 call that dosing had completed in all SAD cohorts, including the newly added 10mg. Screening for MAD cohorts had begun with dosing (as of the Q3 call in early August) expected to begin shortly.

ARWR anticipates the complete treatment course of the SAD portion of ANG3 (and APOC3) to be announced later this year – potentially including an abstract at the American Heart Association conference (November 16 – 18th). We could see initial MAD data sometime in 1H 2020. And, as we also anticipate additional activity specific to each candidates’ respective orphan drug indications, there could be a regular amount of clinical news flow for APOC3 and ANG3 over the coming quarters. As noted, we think this adds to the chances of potential value-inflection.

ARO-AAT: Fast Track Status Speeds Timeline of Ph2/3 SEQUOIA, Open Label On-Deck

Development of ARO-AAT, the company’s second generation subcutaneously administered RNAi therapeutic being developed as a treatment for a rare genetic liver disease associated with alpha-1 antitrypsin deficiency, also continues to rapidly progress. And with Fast Track status granted by FDA in mid-June (complementing Orphan Drug designation in the U.S. and E.U. which was granted in early 2018), we could see the development timeline further accelerate.

Encouragingly, SEQUOIA, a Ph2/3 trial which was just announced earlier this year and could serve as a pivotal U.S. registrational study (which would make it the first U.S. pivotal study of ARWR’s TRiM platform), appears to be moving quickly. IDE approval came in April and, as of the Q3 call in early August, multiple sites were enrolling and dosing had commenced. ARWR appears intent on leveraging the Fast Track status, noting that they have sped up clinical site activity including getting additional locations operational and enrolling. With U.S. sites now operational, management indicated that they will look to initiate locations in Europe and Canada. With some IRB approvals in-hand and others anticipated shortly, ARWR expects a number of additional OUS trial sites to come online and hopes to have a total of 40 locations (U.S. and OUS) operational in the months ahead.

Meanwhile, the timeline for ARO-AAT 2002, the parallel open label study, appears to be tracking prior expectations. The study will be conducted in Europe and per the Q3 call, was nearing commencement with trial sites opening and readying to begin enrolling patients.

JNJ-3989 (fka ARO-HBV): Ph1/2 Cohort 12 Completes Enrollment, New Ph2 Janssen Study

JNJ-3989 (targeting chronic HBV and the initial program under the Janssen collaboration) not only continues to progress through an ongoing Ph1/2 clinical study – which includes completion of enrollment of the (recently added) triple combination cohort (‘cohort 12’, 12 patients with chronic HBV over 12 weeks) – but is also now being used in REEF-1, Janssen’s Ph2b triple combination study (with targeted enrollment of 450) evaluating different combination drug regimens in the treatment of chronic HBV for up to 48 weeks.

All cohort 12 patients had completed dosing as of the Q3 call in early August. While possible that we could see initial data from these patients later this year, we think it is more likely to be a 2020 event. Safety has not been an issue with JNJ-3989 and Janssen’s use of it in REEF-1 implies additional confidence in that regard (in our opinion). So, while safety/tolerability may be the formal outcome of interest, we think that any indications of effectiveness and activity-oriented results will be the main attraction from this 12-week/12-patient triple combination cohort. The positive clinical data to-date coupled with the fact that this will be the first glimpse of JNJ-3989 as a triple combo therapy for chronic HBV (which has a great unmet need for finite curative therapies) means that AROHBV1001 cohort 12, while not designed to necessarily tell us anything definitive, could nonetheless be highly informative and value-additive.

Meanwhile, REEF-1, which will treat for up to 48 weeks, could inform on the curative potential of JNJ-3989 as part of a triple combination therapy. REEF-1 (NCT03982186) is a Phase 2b, multicenter, double-blind, active-controlled, randomized study to investigate the efficacy and safety of different combination regimens for the treatment of chronic hepatitis B virus infection. Regimens include JNJ-3989, and/or JNJ-6379, and a nucleos(t)ide analog (NA). REEF-1 is planned to include up to 450 patients who will be randomized to receive up to 48 weeks of treatment. (JNJ-6379 is Janssen’s investigational orally administered capsid assembly modulator of the class that forms normal capsid structures).

ARWR received $25M (in August) from Janssen, tied to their collaboration agreement, upon dosing of the fifth patient in REEF-1. This is the second (of two) development-related payments from Janssen (the first of which, also $25M, was received in April and associated with initiation of dosing of Ph1 cohort 12).

And, beyond the milestone payments (which, along with ~$250M upfront, including $175M in cash, have provided ARWR with a rich source of non-dilutive funding since the deal was penned in October 2018), we think inclusion of JNJ-3989 in REEF-1 represents a win in and of itself for ARWR given the potentiality implications (in regards to safety and utility in chronic HBV treatment) as well as it representing another shot on goal towards possible eventual commercialization of the compound (ARWR is eligible for royalties on any eventual sales of JNJ-3989).

In addition, any and all development successes of JNJ-3989 presumably bodes well for ARWR’s working relationship with Janssen and furthers the likelihood that they collaborate on additional TRIM-based RNAi targets (and, potentially, expanding their relationship outside of their current agreement). Their October 2018 agreement provides Janssen with the option to collaborate with ARWR on up to three additional RNAi therapeutics (for new targets to be selected by Janssen) – the first of which, ‘JNJ1’, was just recently announced. JNJ1, per ARWR, is being developed against an undisclosed liver-expressed target. As a reminder, ARWR is responsible for preclinical development (fully funded by Janssen) up to filing of an IND, at which point Jansen has the option to take an exclusivity license and continue development. Additional success of JNJ-3989 and initial progress with JNJ1 (which management indicated has moved swiftly) should further bolster the chances of a long-lasting relationship between ARWR and Janssen in our opinion.

ARO-HSD: latest pipeline addition, CTA filing anticipated this year…

ARO-HSD, targeting HSD17B13 for potential indications in alcohol and non-alcohol related liver diseases, is the most recent addition to ARWR’s pipeline. A CTA filing for ARO-HSD, which is currently in IND-enabling GLP-tox studies, is anticipated later this year. With human studies potentially kicking off early next year, ARO-HSD could soon represent ARWR’s sixth clinical TRiM program. Additional details about this program (likely including anticipated timelines) are expected to be discussed during Arrowhead’s ‘Analyst Day’ on October 18th.

17β-Hydroxysteroid dehydrogenase type 13 (17β-HSD type 13), an enzyme encoded by the HSD17B13 gene, is involved in lipid metabolism in the liver. Genetic studies have shown that loss-of-function mutations to HSD17B13 are associated with decreased risk of development of alcohol and non-alcohol related liver diseases. Specifically, a study conducted by Regeneron and published in March 2018 in the NEJM found that individuals with two copies of this loss-of-function variant of HSD17B13 had a 53% and 30% lower risk of alcoholic liver disease and nonalcoholic liver disease, respectively, as compared to individuals with two functioning copies of the gene. Non-functioning carriers were also found to have a 73% lower risk of alcoholic cirrhosis and 49% lower risk of nonalcoholic cirrhosis as compared to those with two working copies of the gene1.

Clinical Pipeline Could Soon Grow to 8 TriM Programs, Up From 5 Today…

In addition to ARO-HSD, ARWR is aiming for near-term CTA filings for ARO-HIF2 and ARO-ENaC as well. A CTA for ARO-HIF2, the company's candidate targeting renal cell carcinoma which achieved 85% target gene knockdown in a rodent tumor model, is still expected later this year. ARO-HIF2 would represent their seventh TRiM program.

Meanwhile IND-enabling studies of ARO-ENaC, Arrowhead’s candidate targeting the epithelial sodium channel (ENaC) alpha subunit for treatment of cystic fibrosis, have experienced delays which has pushed back the CTA filing timeline. Management’s most recent guidance is for GLP toxicology studies to commence later this year and, if all goes well, to file a CTA in 1H’20. ARO-ENaC could represent their eighth clinical program.

Amgen Collab: AMG 890 Ph1 Ongoing. Anticipate Initial Data, Development Milestone Pymt…

As a reminder, in August of last year Arrowhead announced that it earned a $10 million milestone payment from Amgen following the administration of the first dose of AMG 890 (fka ARO-LPA) in a Ph1 clinical study designed to assess safety in subjects with elevated levels of lipoprotein (a) [Lp(a)]. AMG 890 is an RNAi therapeutic designed to lower Lp(a) for the treatment of cardiovascular disease. Initial data from the study could be available later this year or early next. Management also noted that Amgen anticipates starting the next phase of development of AMG 890, which would trigger a development milestone payment to ARWR.

Meanwhile, in July 2019 Amgen notified ARWR that they would not be exercising their option to exclusively license ARO-AMG1. As a refresher, Arrowhead received $35M million in upfront payments and $21.5M in equity investments from Amgen related to the ARO-LPA and ARO-AMG1 agreements. ARWR was also eligible to receive up to $617 million in option payments, and development, regulatory and sales milestone payments related to these programs. The company is also eligible for up to low double-digit royalties for sales of products under the ARC-LPA agreement.

Valuation

With APOC3, ANG3 and AAT all possibly entering pivotal studies in the near-term and JNJ-3989 now in what could prove to be a curative study (for HBV, which could draw massive appeal), we could soon have a lot more information to gauge the potential commercializability (and value) of Arrowhead’s development portfolio. This, by extension, also bolsters the potential likelihood of significant value-inflection events/announcements (over the same timeframes).

We also remain highly encouraged by ARWR’s seeming determination to continue to deepen their development pipeline. With another three CTA filings anticipated, the company could soon have eight TRiM clinical programs ongoing. ARO-HSD, targeting HSD17B13 for potential indications in alcohol and non-alcohol related liver diseases, is the most recent addition and which ARWR hopes to have in clinical studies next year.

The rapid and largely error and delay-free progress of the existing clinical pipeline, coupled with the company continuing to deliver on its guidance related to increasing the number of high-potential TRiM candidates under development, has moved our targeted market capitalization from $2.8B to $3.4B, representing an increase to our per-share target price from approximately $30 to $36.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $30,000 annually for these services. Full Disclaimer HERE.

_____________________________

1. Noura S. Abul-Husn, M.D., Ph.D, et al. A Protein-Truncating HSD17B13 Variant and Protection from Chronic Liver Disease. N Engl J Med 2018; 378:1096-1106