Asbury (ABG) Q3 Earnings & Revenues Miss Estimates, Fall Y/Y

Asbury Automotive Group ABG reported third-quarter 2023 adjusted earnings of $8.12 per share, which decreased 12% year over year and missed the Zacks Consensus Estimate of $8.44 per share on lower-than-anticipated sales across new-vehicle, finance and insurance business and parts and service business segments.

In the reported quarter, revenues amounted to $3,666.2 million, down 5% year over year. The top line also missed the Zacks Consensus Estimate of $3,722 million.

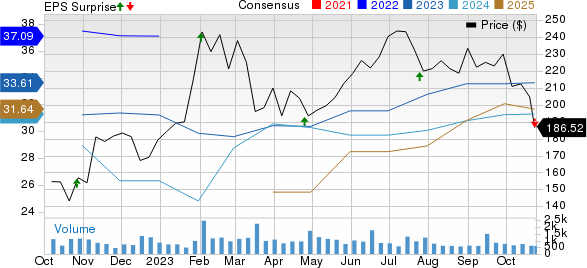

Asbury Automotive Group, Inc. Price, Consensus and EPS Surprise

Asbury Automotive Group, Inc. price-consensus-eps-surprise-chart | Asbury Automotive Group, Inc. Quote

Segment Details

In the quarter, new-vehicle revenues rose 3% year over year to $1,861.9 million, missing the Zacks Consensus Estimate of $1,897 million. Gross profit from the segment came in at $168 million, contracting 16.4% from the prior-year quarter and lagging the Zacks Consensus Estimate of $171 million.

Used-vehicle revenues slid 16% from the year-ago figure to $1,111.7 million, surpassing the Zacks Consensus Estimate of $1,097 million. Gross profit from the segment came in at $62 million, which fell 24.4% and missed the Zacks Consensus Estimate of $69 million.

Net revenues in the finance and insurance business amounted to $166.1 million, down 17% from the year-ago quarter and lagging the Zacks Consensus Estimate of $169 million. Gross profit was $152 million, declining 18.7% year over year but outpacing the Zacks Consensus Estimate of $142 million.

Revenues from the parts and service business fell 2% from the prior-year quarter to $526.5 million and missed the Zacks Consensus Estimate of $551 million. Gross profit from this segment came in at $291 million, falling 2.3% year over year and missing the Zacks Consensus Estimate of $304 million.

Other Tidbits

Adjusted selling, general & administrative (SG&A) expenses as a percentage of gross profit rose to 58.4%, marking an increase of 136 basis points year over year. Asbury sold over 11,600 vehicles, an all-time record high, through the “end-to-end” online sales platform Clicklane.

As of Sep 30, 2023, the company had cash and cash equivalents of $41.6 million, down from $235.3 million on Dec 31, 2022. It had a long-term debt of $3,222.3 million as of Sep 30, 2023, down from $3,301.2 million on Dec 31, 2022.

During the quarter under review, Asbury did not repurchase shares. On Sep 30, 2023, ABG had $250 million in share repurchase authorization remaining.

Zacks Rank & Key Picks

ABG currently carries a Zacks Rank #2 (Buy).

Some other top-ranked players in the auto space are Toyota Motor TM, Allison Transmission Holdings ALSN and Honda Motor HMC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s 2023 sales and earnings implies year-over-year growth of 10.6% and 27.6%, respectively. The EPS estimates for 2023 and 2024 have moved up by 18 cents and 37 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for ALSN’s 2023 sales and earnings indicates year-over-year rises of 9.4% and 26.8%, respectively. The EPS estimate for 2023 increased by a penny in the past seven days. The EPS estimate for 2024 increased by 32 cents in the past 30 days.

The Zacks Consensus Estimate for HMC’s 2023 sales and earnings suggests year-over-year improvements of 7.7% and 29.4%, respectively. The EPS estimates for 2023 and 2024 have moved up by 4 cents each in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report