Asbury (ABG) Q4 Earnings Miss Expectations, Decline Y/Y

Asbury Automotive Group ABG reported fourth-quarter 2023 adjusted earnings of $7.12 per share, which decreased 21.9% year over year and missed the Zacks Consensus Estimate of $7.74 on lower-than-expected sales from used-vehicle and parts and service segments.

In the reported quarter, revenues amounted to $3.81 billion, which increased 3% year over year. The top line surpassed the Zacks Consensus Estimate of $3.77 billion.

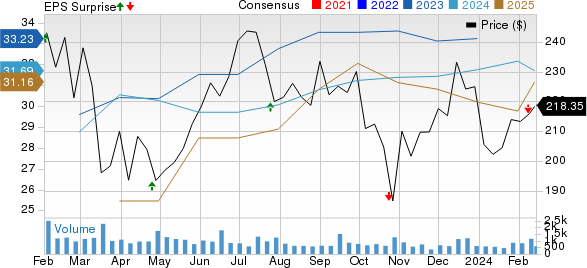

Asbury Automotive Group, Inc. Price, Consensus and EPS Surprise

Asbury Automotive Group, Inc. price-consensus-eps-surprise-chart | Asbury Automotive Group, Inc. Quote

Segment Details

In the quarter, new-vehicle revenues rose 11% year over year to $2.06 billion, surpassing the Zacks Consensus Estimate of $1.96 billion. Gross profit from the segment came in at $171 million, decreasing 13.6% from the prior-year quarter and surpassing the Zacks Consensus Estimate of $161 million.

Used-vehicle revenues declined 7% from the year-ago figure to $1.07 billion, missing the Zacks Consensus Estimate of $1.09 billion. Gross profit from the segment came in at $54 million, which fell 20.6% and missed the Zacks Consensus Estimate of $62 million.

Net revenues in the finance and insurance business amounted to $171.2 million, down 10% from the year-ago quarter but surpassed the Zacks Consensus Estimate of $157 million. Gross profit was $163 million, which rose 5.8% year over year and beat the Zacks Consensus Estimate of $153 million.

Revenues from the parts and service business dipped 1% from the prior-year quarter to $513.4 million and missed the Zacks Consensus Estimate of $556 million. Gross profit from this segment came in at $285 million, falling 2.1% year over year and missing the Zacks Consensus Estimate of $301 million.

Other Tidbits

Adjusted selling, general & administrative expenses as a percentage of gross profit rose to 61.5%, marking an increase of 442 basis points year over year.

As of Dec 31, 2023, the company had cash and cash equivalents of $45.7 million, down from $235.3 million as of Dec 31, 2022. It had a long-term debt of $3.21 billion as of Dec 31, 2023, down from $3.3 billion as of Dec 31, 2022.

During the quarter under review, Asbury repurchased 246,000 shares for $47 million. On Dec 31, 2023, ABG had $203 million remaining under its share repurchase authorization.

Zacks Rank & Key Picks

ABG currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Modine Manufacturing Company MOD, NIO Inc. NIO and Oshkosh Corporation OSK. MOD sports a Zacks Rank #1 (Strong Buy), while NIO & OSK carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings suggests year-over-year growth of 4% and 67.2%, respectively. The earnings per share (EPS) estimates for 2024 and 2025 have improved 22 cents each in the past 30 days.

The Zacks Consensus Estimate for NIO’s 2023 sales implies year-over-year growth of 10.4%. The EPS estimates for 2024 have improved 7 cents in the past 30 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 6.7% and 4%, respectively. The EPS estimates for 2024 and 2025 have improved 16 cents and 29 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report