Asbury Automotive Group Inc (ABG) Faces Headwinds Despite Revenue Growth in Q4

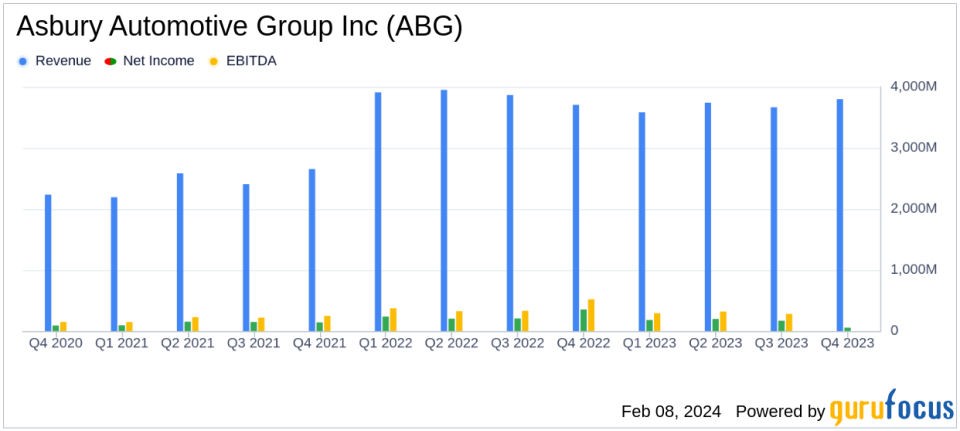

Revenue: Reported a 3% increase to $3.8 billion in Q4.

Net Income: Experienced an 84% decrease to $55.5 million in Q4.

Adjusted Net Income: Adjusted figures show a 28% year-over-year decrease to $146 million.

Earnings Per Share (EPS): Q4 EPS dropped significantly to $2.70 from $15.95 in the previous year.

Gross Profit: Saw a 9% decrease to $673 million in Q4.

Acquisitions: Completed the acquisition of Jim Koons Automotive Companies.

Share Repurchases: Repurchased 246,000 shares for $47 million during Q4.

On February 8, 2024, Asbury Automotive Group Inc (NYSE:ABG) released its 8-K filing, revealing a mixed financial performance for the fourth quarter of 2023. The company, a leading automotive retail and service company in the U.S., reported a 3% increase in revenue to $3.8 billion. However, net income saw a significant decline, falling 84% to $55.5 million compared to the same period last year. Adjusted net income, which excludes certain non-recurring items, also decreased by 28% year-over-year to $146 million.

Asbury Automotive Group operates 158 new vehicle dealerships and 37 collision repair centers, offering a range of automotive products and services. The company's revenue growth is attributed to its strategic acquisitions, including the recent addition of Jim Koons Automotive Companies. Despite this expansion, Asbury faced challenges in the fourth quarter, including non-cash asset impairments amounting to $117.2 million, which significantly impacted earnings per share (EPS), bringing it down to $2.70 from $15.95 in the prior year's quarter.

Financial Performance Analysis

The company's gross profit decreased by 9% to $673 million, with a gross margin decrease of 226 basis points to 17.7%. The automotive group also saw a decrease in finance and insurance (F&I) per vehicle retailed (PVR) by 11%, and parts and service revenue decreased by 1%. Selling, general, and administrative expenses (SG&A) as a percentage of gross profit increased to 61.5%, reflecting higher operational costs.

Asbury's adjusted operating margin, a non-GAAP measure, decreased by 180 basis points to 6.4%. The company's liquidity remained strong with $460 million in total, including cash and floorplan offset accounts, and availability under the revolver. The adjusted net leverage ratio was reported at 2.5x at quarter end.

"2023 was a year of building for the future, including continued integration of acquired businesses, rolling out TCA to 72% of our stores and closing the largest industry acquisition of 2023 in December. None of this would have been possible without the hard work and dedication of our 15,000 team members, including the 2,300 exceptional team members who are now a part of the Asbury family following our recent acquisition of Koons Automotive," said David Hult, Asburys President and Chief Executive Officer.

Despite the challenges faced in the fourth quarter, Asbury Automotive Group remains focused on its strategic plan to grow its business scale and enhance operational efficiency. The company's share repurchase program continued with the repurchase of approximately 246,000 shares for $47 million during the quarter, signaling confidence in its stock value and commitment to shareholder returns.

Investors and analysts looking for more detailed insights into Asbury Automotive Group Inc's financial performance can access the earnings conference call and supplemental materials on the company's investor relations website.

Value investors interested in the automotive retail and service industry may find Asbury's strategic acquisitions and focus on operational efficiency compelling, despite the current headwinds. The company's journey towards its 2025 revenue target of approximately $32 billion, along with its technological investments, could position it for future growth in the evolving automotive market.

For a comprehensive understanding of Asbury Automotive Group Inc's financial health and strategic direction, readers are encouraged to review the full 8-K filing and consider the implications of the company's latest financial results.

Explore the complete 8-K earnings release (here) from Asbury Automotive Group Inc for further details.

This article first appeared on GuruFocus.