ASE Technology (ASX) to Post Q2 Earnings: What's in the Offing?

ASE Technology Holding ASX is scheduled to report its second-quarter 2023 results on July 27.

The company reported first-quarter 2023 earnings of 8.6 cents per American Depositary Share (NT$1.3).

ASE expects ATM segment’s revenues to be in line with first-quarter 2023 levels.

Factors to Note

The ATM segment’s second-quarter revenues are likely to reflect sluggishness across certain product categories. Its second-quarter 2023 gross margin is expected to have remained flat from its first-quarter 2023 gross margin.

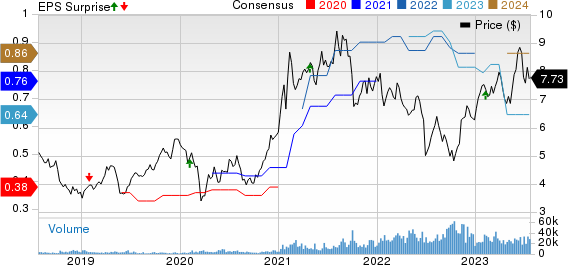

ASE Technology Holding Co., Ltd. Price, Consensus and EPS Surprise

ASE Technology Holding Co., Ltd. price-consensus-eps-surprise-chart | ASE Technology Holding Co., Ltd. Quote

ASE’s revenues in the to-be-reported quarter are likely to have faced slower inventory depletion due to weak end market demand. Continued macroeconomic constraints and a shift in consumer spending are anticipated to have acted as headwinds in the to-be-reported quarter.

The company has been actively pursuing various routes to reduce costs, including expanding its automation efforts. Due to the higher utility rates brought up by the Taiwan government, its utility costs are expected to have risen sequentially in the to-be-reported quarter.

ASE is expected to have benefited from a strong momentum in its automotive business with slight improvement in its consumer and computing segments. This is anticipated to have driven the company’s performance in the to-be-reported quarter.

Further, ASE’s pricing resiliency and the minimization of irrational competition is likely to have contributed to the company in the to-be-reported quarter.

ASE’s continued infrastructure expansion and smart manufacturing is expected to have given it a competitive advantage in the form of lower manufacturing costs in the quarter under review.

Insight Into Upcoming Earnings Announcements

ASE Technology has underperformed the Zacks Electronics- Semiconductors segment on a year-to-date basis. While this Zacks Rank #3 (Hold) stock has rallied 23.3%, the industry has surged 50%.

Investors interested in the industry are eagerly awaiting earnings releases from players like Lattice Semiconductor LSCC, Advanced Micro Devices AMD and Rambus RMBS.

Lattice Semiconductor currently sports a Zacks Rank #1 (Strong Buy). The company is scheduled to release second-quarter 2023 results on Jul 31. The Zacks Consensus Estimate for the company’s quarterly earnings is pegged at 51 cents per share, unchanged in the past 30 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Advanced Micro Devices is set to report second-quarter 2023 results on Aug 1. The Zacks Consensus Estimate for earnings for this Zacks Rank #3 stock is pegged at 57 cents per share, unchanged in the past 30 days.

Rambus is scheduled to report second-quarter 2023 results on July 31. The Zacks Consensus Estimate for earnings is pegged at 39 cents per share, unchanged in the past 30 days. RMBS carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Rambus, Inc. (RMBS) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

ASE Technology Holding Co., Ltd. (ASX) : Free Stock Analysis Report