ASGN Inc (ASGN) Reports Solid Q4 and Full Year 2023 Financials, Surpassing $1 Billion in ...

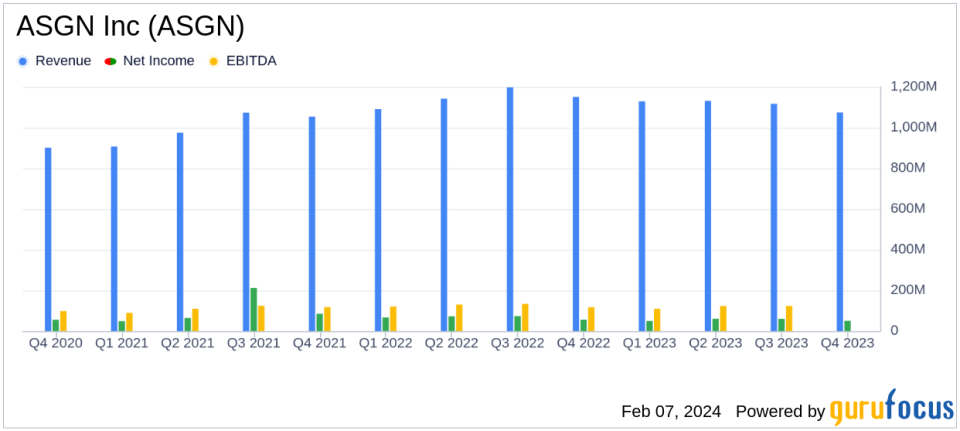

Revenue: Q4 revenues reached $1.1 billion, with full-year revenues totaling $4.5 billion.

Net Income: Q4 net income stood at $50.3 million, contributing to the full-year net income of $219.3 million.

Adjusted EBITDA: Q4 Adjusted EBITDA was $121.0 million, representing 11.3% of revenues, with full-year Adjusted EBITDA at $517.2 million or 11.6% of revenues.

Free Cash Flow: Generated $109.2 million in Q4 and $417.0 million for the full year.

Stock Repurchase: Repurchased approximately 0.9 million shares in Q4 and 3.4 million shares over the full year for $75.4 million and $273.1 million, respectively.

IT Consulting Revenues: Accounted for 55.3% of total Q4 revenues and 53.3% for the full year, with commercial consulting revenues exceeding $1.0 billion.

On February 7, 2024, ASGN Inc (NYSE:ASGN), a leading provider of IT services and solutions to the commercial and government sectors, announced its financial results for the fourth quarter and full year of 2023. The company's 8-K filing revealed that it achieved revenues at the top-end or above guidance ranges, with a notable milestone of commercial consulting revenues surpassing $1.0 billion.

ASGN operates through two segments, Commercial and Federal Government. The Commercial Segment, which is the larger of the two, offers consulting, creative digital marketing, and permanent placement services to Fortune 1000 clients and mid-market companies. The Federal Government Segment delivers mission-critical solutions to the Department of Defense, intelligence agencies, and civilian agencies.

Performance and Challenges

ASGN's fourth quarter saw revenues of $1.1 billion, a decrease of 6.6% over the same period in the previous year. The Federal Government Segment revenues increased by 9.2% year-over-year, while the Commercial Segment experienced a decline. The company's IT consulting services revenues grew by 5.6% year-over-year, indicating a strong demand for ASGN's specialized IT services.

Despite the overall revenue decline, ASGN maintained a solid Adjusted EBITDA margin of 11.3% for the quarter, reflecting the company's ability to manage costs effectively and sustain profitability. However, the company faced challenges such as a lower mix of certain high-margin assignment revenues and a higher mix of revenues from the Federal Government Segment, which have a lower gross margin than commercial revenues.

Financial Achievements and Importance

ASGN's financial achievements, particularly the surpassing of $1.0 billion in commercial consulting revenues, underscore the company's strength in its core consulting services. This milestone is significant as it demonstrates ASGN's competitive edge and growing influence in the IT consulting market. Additionally, the company's strong free cash flow generation highlights its operational efficiency and financial health, enabling strategic investments and shareholder returns through stock repurchases.

Key Financial Metrics

ASGN's net income for the fourth quarter was $50.3 million, with a diluted earnings per share of $1.06. For the full year, net income reached $219.3 million, translating to $4.50 per diluted share. The company's gross margin for the fourth quarter was 28.4%, a decrease from the previous year's 29.6%, mainly due to the aforementioned business mix changes.

Operating cash flows for the fourth quarter were robust at $116.4 million, contributing to the full-year operating cash flows of $456.9 million. The company's disciplined capital allocation strategy was evident in its share repurchase program, where it bought back shares worth $75.4 million in the fourth quarter and $273.1 million for the full year.

"ASGN achieved solid results for the fourth quarter, with revenues, gross margin, and Adjusted EBITDA margin at the top-end of, or above, our guidance ranges," said ASGN Chief Executive Officer, Ted Hanson. "This success in the final quarter of the year resulted in revenues of approximately $4.5 billion for 2023, of which $2.4 billion was in commercial and government IT consulting work. A highlight of our annual performance, commercial consulting revenues officially surpassed $1.0 billion. From a profitability perspective, Adjusted EBITDA margins remained solid and totaled 11.6 percent for 2023."

Analysis of Performance

ASGN's performance in the fourth quarter and full year of 2023 reflects the company's resilience in a challenging market environment. The company's strategic focus on IT consulting has paid off, as evidenced by the growth in this segment. The ability to maintain strong EBITDA margins despite revenue fluctuations indicates effective cost management and a robust business model that can withstand market cycles.

Looking ahead, ASGN is well-positioned to capitalize on the growing demand for IT consulting services. The company's focus on high-value projects and its strategic initiatives to strengthen IT consulting capabilities are expected to drive continued success in 2024 and beyond.

For more detailed financial information and future outlook, interested parties can access the full earnings release and join the conference call scheduled for today at 4:30 p.m. ET.

Explore the complete 8-K earnings release (here) from ASGN Inc for further details.

This article first appeared on GuruFocus.