Ashland Inc (ASH) Reports Decline in Q1 Fiscal 2024 Earnings Amid Market Challenges

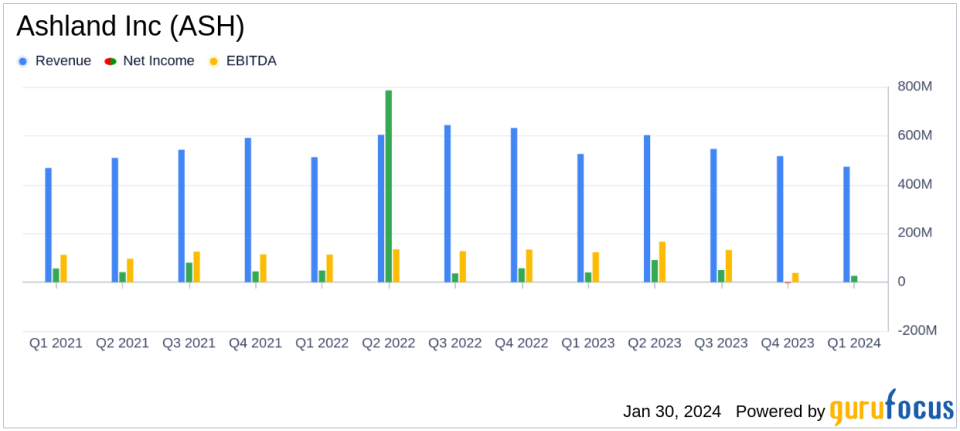

Sales: $473 million, a 10% decrease from the prior-year quarter.

Net Income: $26 million, down from $40 million in the prior-year quarter.

Adjusted EBITDA: $70 million, a 35% decline compared to the prior-year quarter.

Diluted Earnings Per Share (EPS): $0.54 from continuing operations, down from $0.76 year-over-year.

Free Cash Flow: Ongoing free cash flow of $66 million, a significant improvement from negative $21 million in the prior-year quarter.

Share Repurchase: 1.2 million shares repurchased in Q1, with $900 million remaining under the share repurchase authorization.

On January 30, 2024, Ashland Inc (NYSE:ASH) released its 8-K filing, detailing its financial results for the first quarter of fiscal year 2024. The global specialty materials company, known for its leadership in consumer-focused markets such as pharmaceuticals and personal care, reported a 10% decrease in sales, which totaled $473 million. This decline was attributed to market-demand dynamics and lower production volumes, which also led to a 35% drop in adjusted EBITDA to $70 million.

Company Overview and Performance

Ashland Inc operates in various industrial markets, with its life sciences segment generating the most revenue. The company's performance in Q1 reflects a stabilization in demand trends across most end markets, with favorable pricing within the Life Sciences and Personal Care segments. However, the overall decline in net income and adjusted EBITDA points to challenges in production volume and absorption compared to the previous year when production exceeded customer demand.

Despite these challenges, Ashland's management remains cautiously optimistic. CEO Guillermo Novo highlighted that customer demand was generally consistent with expectations and that the company continues to manage inventory levels and drive cash generation effectively. The company's disciplined pricing, coupled with deflationary raw material costs and prudent operating expense management, were overshadowed by lower sales volume and production absorption impacts during the quarter.

Financial Achievements and Outlook

Ashland's financial achievements in the quarter include a significant increase in operating cash flow, which totaled $201 million, up from a cash outflow of $29 million in the prior-year quarter. The company also improved its ongoing free cash flow to $66 million, compared to negative $21 million in the prior-year quarter. This reflects a focused reduction in inventory balances and a reduced incentive compensation payout.

Looking ahead, Ashland expects a partial return to more typical margins in the second quarter, forecasting an increase in sales and production volumes. For the second quarter, the company anticipates sales between $565 million and $585 million and adjusted EBITDA between $115 million and $125 million. For the full fiscal year, sales are expected to range from $2.15 billion to $2.25 billion, with adjusted EBITDA projected between $460 million and $500 million.

Strategic Focus and Capital Allocation

Ashland's strategic priorities include executing, globalizing, innovating, and acquiring to drive actions, investments, and profitable growth expectations. The company's portfolio optimization activities are underway to improve margin profiles and reduce earnings volatility. Ashland also continues to demonstrate its commitment to returning capital to shareholders through its share repurchase program.

Value investors may find Ashland's disciplined capital allocation approach and strategic initiatives to improve core business performance appealing. The company's focus on executing its business model and optimizing its portfolio, combined with a proactive approach to managing market challenges, positions it for potential recovery and long-term growth.

For more detailed information and analysis on Ashland Inc's financial results and strategic outlook, investors are encouraged to join the earnings call and webcast scheduled for tomorrow morning, as announced by CEO Guillermo Novo.

Explore the complete 8-K earnings release (here) from Ashland Inc for further details.

This article first appeared on GuruFocus.