Aspen Aerogels Inc Reports Significant Year-Over-Year Revenue Growth and Margin Improvement in ...

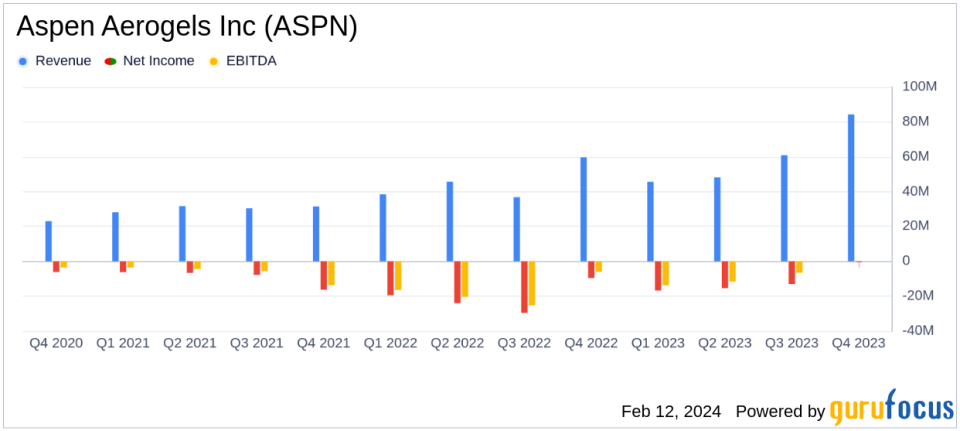

Revenue Growth: Full-year revenue surged by 32% to $238.7 million, with Q4 revenue up 41% YoY to $84.2 million.

Gross Margin Expansion: Gross margins improved to 35% in Q4, marking a significant increase from the previous year.

Net Loss Reduction: Annual net loss narrowed to $45.8 million from $82.7 million in the prior year.

Adjusted EBITDA: Q4 Adjusted EBITDA turned positive at $9.1 million, a substantial improvement from a negative $4.4 million in Q4 2022.

Capital Expenditure: CAPEX decreased to $175.5 million, down from the previous year's $178 million.

Liquidity Position: Ended the year with a strong cash and equivalents balance of $139.7 million.

Aspen Aerogels Inc (NYSE:ASPN) released its 8-K filing on February 12, 2024, announcing its financial results for the fourth quarter and full fiscal year 2023. The company, a leader in aerogel technology for sustainability and electrification solutions, reported a significant increase in revenue and a substantial reduction in net loss compared to the previous year. Aspen Aerogels Inc operates primarily in the U.S. and serves international markets, offering high-performance aerogel insulation used across various industries, including energy infrastructure and electric vehicles.

The company's financial achievements in 2023 are particularly noteworthy given the challenges faced in the energy industrial sector, which was supply constrained, leading to a 9% YoY reduction in revenue. Despite this, the thermal barriers segment saw a remarkable 110% YoY increase in revenue, highlighting the company's successful diversification and growth in the electric vehicle market.

Aspen Aerogels Inc's improved financial performance is crucial for the company's long-term strategy, which focuses on scaling to profitability and capitalizing on the growing demand for its products in the electrification and sustainability sectors. The company's ability to improve gross margins and reduce net loss significantly positions it well for future growth and operational efficiency.

Financial Performance Highlights

Aspen Aerogels Inc's financial results for the fourth quarter and full year of 2023 reflect a robust improvement in its operational and financial metrics:

Metric | Q4 2023 | Q4 2022 | FY 2023 | FY 2022 |

|---|---|---|---|---|

Revenue | $84.2 million | $59.6 million | $238.7 million | $180.4 million |

Net Loss | $0.5 million | $9.6 million | $45.8 million | $82.7 million |

Gross Margin | 35% | 23% | 24% | 3% |

Adjusted EBITDA | $9.1 million | ($4.4 million) | ($22.9 million) | ($60.6 million) |

The company's net loss per share improved from $2.10 in 2022 to $0.66 in 2023, reflecting a more stable financial position. The capital expenditures were significantly reduced, and the company ended the year with a healthy cash balance, providing a solid foundation for future investments and growth.

Management Commentary and Outlook

Don Young, Aspens President and CEO, expressed confidence in the company's trajectory, stating:

Our team has effectively delivered on the main execution milestones that we targeted for 2023 while building a company that can rapidly scale to profitability. We believe that further diversifying our EV Thermal Barrier customer base will drive our growth beyond 2024 and validate our recent investments in this segment."

For 2024, Aspen Aerogels Inc anticipates revenues to exceed $350 million, with Adjusted EBITDA expected to be at least $30 million. The company projects a net loss under $23 million and a net loss per share under $0.30, with capital expenditures, excluding investments in Plant II, to be around $50 million.

Ricardo C. Rodriguez, Chief Financial Officer and Treasurer, highlighted the company's focus on sustained profitability, emphasizing the importance of managing fixed costs and capital investments efficiently.

Aspen Aerogels Inc's performance in 2023 demonstrates its resilience and strategic focus on high-growth areas. With a solid financial foundation and a clear vision for the future, the company is well-positioned to capitalize on the opportunities presented by the global shift towards sustainability and electrification.

Investors and stakeholders are encouraged to review the full 8-K filing for a comprehensive understanding of Aspen Aerogels Inc's financial results and future outlook.

Explore the complete 8-K earnings release (here) from Aspen Aerogels Inc for further details.

This article first appeared on GuruFocus.