Aspen Technology Inc (AZPN) Reports Mixed Q2 Fiscal 2024 Results Amidst Operational Challenges

Annual Contract Value (ACV): Grew to $914.1 million, up 9.6% year-over-year.

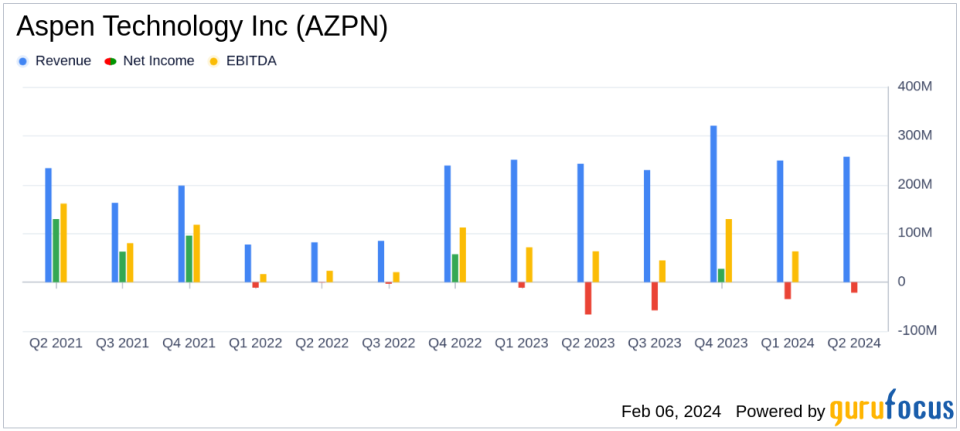

Revenue: Increased to $257.2 million, with gains in license, maintenance, and services revenue.

Operating Loss: Decreased to $49.2 million from $59.4 million in the prior year.

Net Loss: Improved to $21.5 million, or $0.34 per diluted share, from $66.2 million, or $1.02 per diluted share year-over-year.

Non-GAAP Net Income: Rose significantly to $87.8 million, or $1.37 per diluted share.

Cash Flow: Operating cash flow and free cash flow decreased to $29.8 million and $29.2 million, respectively.

Share Repurchase: AspenTech repurchased 375,041 shares for $72.1 million under its share repurchase authorization.

On February 6, 2024, Aspen Technology Inc (NASDAQ:AZPN) released its 8-K filing, announcing financial results for the second quarter of fiscal 2024, which ended December 31, 2023. The company, a global leader in industrial software, reported a solid quarter with strong demand for its products and solutions, particularly in asset-intensive industries focusing on efficiencies and sustainability use cases.

Financial Performance and Challenges

Aspen Technology's total revenue for the quarter was $257.2 million, with license and solutions revenue at $152.5 million, maintenance revenue at $85.1 million, and services and other revenue at $19.6 million. Despite the revenue growth, the company faced a loss from operations of $49.2 million, an improvement from the $59.4 million loss in the same quarter of the previous fiscal year. The net loss also narrowed to $21.5 million, or $0.34 per diluted share, compared to $66.2 million, or $1.02 per diluted share, in the second quarter of fiscal 2023.

Aspen Technology's performance is critical as it reflects the company's ability to navigate operational challenges while capitalizing on growth opportunities in a transitioning energy sector. The reported challenges, such as the delay of a customer agreement renewal, could pose risks to future revenue streams and ACV growth.

Financial Achievements and Importance

The company's non-GAAP net income saw a significant increase to $87.8 million, or $1.37 per diluted share, mainly due to changes in the approach to computing AspenTechs tax provision. This financial achievement is important as it indicates the company's underlying profitability and operational efficiency, excluding one-time charges and non-cash expenses.

However, cash flow from operations and free cash flow both decreased compared to the second quarter of fiscal 2023, which the company attributes to the variability of contract cycle renewals and billings between quarters, as well as higher expenses and cash tax in the second quarter of fiscal 2024.

Key Financial Metrics and Commentary

Aspen Technology's financial health can be further understood through key metrics such as ACV, which increased by 9.6% year-over-year to $914.1 million. This metric is important as it represents the value of the company's portfolio of term license and software maintenance and support contracts, indicating the company's recurring revenue strength.

"We continue to see resilient demand and meaningful pipeline growth across most end markets as we move into the second half of our fiscal year. We remain confident in our outlook for fiscal 2024, and we are reaffirming our ACV growth target of at least 11.5 percent," said Antonio Pietri, President and CEO of AspenTech.

Aspen Technology's balance sheet shows cash and cash equivalents of $130.8 million as of December 31, 2023, a decrease from $241.2 million as of June 30, 2023, due in part to share repurchase activity.

Analysis and Outlook

Aspen Technology's reaffirmation of its fiscal 2024 guidance, including ACV growth of at least 11.5%, GAAP operating cash flow of at least $378 million, and free cash flow of at least $360 million, suggests confidence in the company's strategic direction and market position. The company also increased its Non-GAAP net income per share guidance by $0.02 to reflect the impact of share repurchase activity.

The company's focus on asset optimization software for capital-intensive industries positions it well to benefit from the ongoing digital transformation in these sectors. However, investors should be mindful of the operational challenges and the potential impact of delayed customer agreements on future performance.

For a detailed analysis of Aspen Technology Inc's financial results and outlook, investors are encouraged to review the full earnings presentation and listen to the conference call hosted by the company.

Explore the complete 8-K earnings release (here) from Aspen Technology Inc for further details.

This article first appeared on GuruFocus.