Assessing the Ownership Landscape of Conagra Brands Inc(CAG)

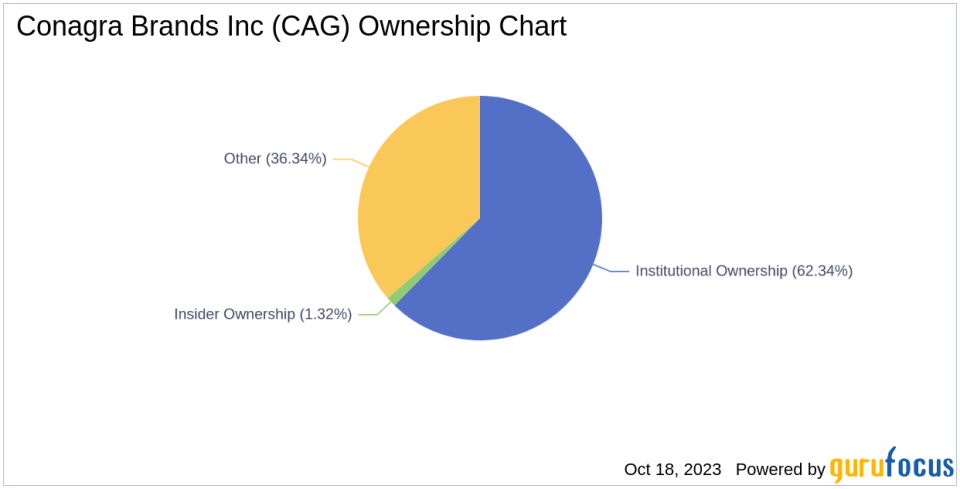

Conagra Brands Inc (NYSE:CAG), a leading packaged food company primarily operating in the United States, has been experiencing significant market volatility. As of October 18, 2023, the company's stock value has seen a week-over-week decline of 1.88%, contrasting with its three-month return of -12.48%. With an outstanding share count of 477.97 million, institutional ownership stands at 297.92 million shares (62.34%), while insiders hold 6.29 million shares (1.32%).

Market Performance and Capitalization

Conagra Brands Inc's recent performance has sparked keen interest in its ownership trends. The company's market cap dropped to $14.28 billion in the most recent quarter from $16.63 billion in the preceding one, reflecting the market's reaction to its performance.

Institutional Ownership and Key Players

Conagra Brands Inc's institutional ownership history reveals the levels of trust and confidence that major players have in the company's future. As of 2005-01-31, Conagra Brands Inc's institutional ownership level is 3.76%, down from 23.07% as of 2005-04-30 and 29.27% from a year ago.

Notably, the top fund managers owning significant portions of Conagra Brands Inc's stock are T Rowe Price Equity Income Fund (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio), with 1.37%, 0.03%, and 0.02% of shares outstanding respectively.

Earnings Analysis: Past and Future

Over the past three years, Conagra Brands Inc's Ebitda growth averaged -6.8% per year, underperforming 71.61% of 1525 companies in the Consumer Packaged Goods industry. However, the company's estimated earnings growth for the future is 8.36% per year, indicating a potential turnaround in its performance.

Insider Ownership and Activities

Conagra Brands Inc's insider ownership is approximately 1.32% as of 2023-08-31, up from 1.23% a year ago, reflecting the increased faith of those intimately familiar with the company's operations. Recent insider trades also provide a nuanced view of this sentiment.

Conclusion

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. Conagra Brands Inc's recent dip is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to sound investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.