Assessing the Ownership Landscape of Horace Mann Educators Corp(HMN)

Horace Mann Educators Corp (NYSE:HMN) is a diversified insurance holding company that markets and underwrites personal lines of property and casualty insurance, retirement annuities, and life insurance. The company's property and casualty operations focus on automobile and homeowner insurance, while the retirement annuities are 403(b) tax-qualified products. Horace Mann Educators markets its products to kindergarten through 12th-grade teachers, administrators, and other employees of public schools and their families. The company uses several former teachers in its salesforce. Its segments include Property and Casualty, Supplemental & Group Benefits, Life & Retirement and Corporate and Other.

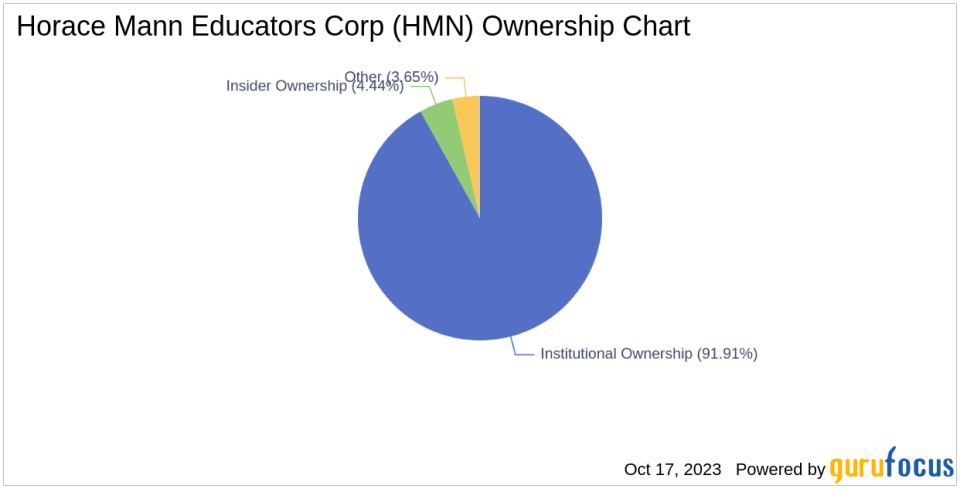

As of the latest available data, Horace Mann Educators Corp (NYSE:HMN) has an outstanding share count of 40.84 million. Institutional ownership stands at 37.54 million shares, constituting 91.91% of the total shares. Meanwhile, insiders hold 1.82 million shares, accounting for 4.44% of the total share count.

Recent Stock Performance

Horace Mann Educators Corp (NYSE:HMN) experienced a decline of about 7.4% in its stock value over the past week. As of Oct 17 2023, the stock rose by 0.73%, contrasting its three-month return of 12.43. A closer look reveals fluctuations in its market cap, which dropped to $1.21 billion in the most recent quarter from $1.37 billion in the preceding one. This volatility has sparked keen interest in the company's ownership trends.

Institutional Ownership and Key Players

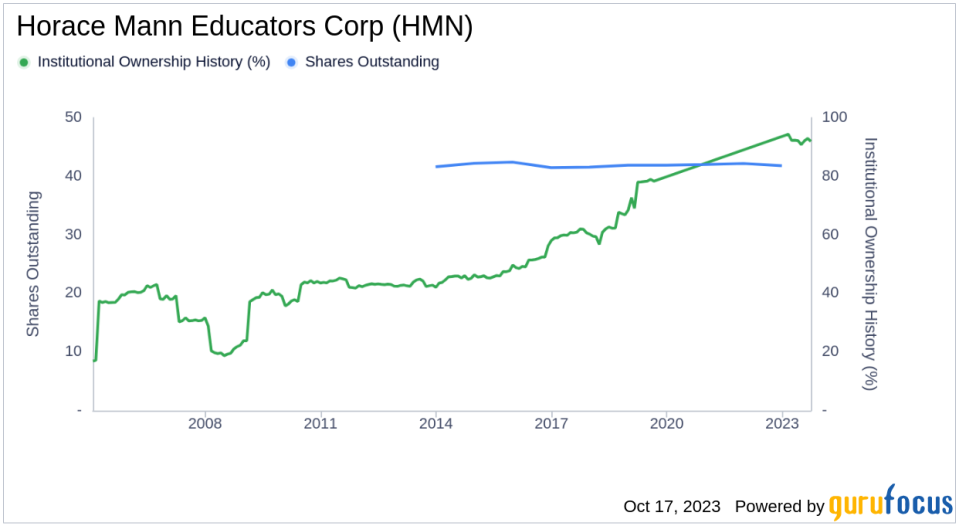

Horace Mann Educators Corp's institutional ownership history reveals the levels of trust and confidence that major players have in the company's future. As of 2023-09-30, Horace Mann Educators Corp's institutional ownership level is 91.91%, up from institutional ownership of 90.83% as of 2023-06-30 and up from institutional ownership of 78.08% from a year ago.

Among the most significant stakeholders , the top fund managers owning chunks of Horace Mann Educators Corp's stock are HOTCHKIS & WILEY (Trades, Portfolio), Steven Scruggs (Trades, Portfolio), and John Rogers (Trades, Portfolio), with 2.41%, 0.91%, and 0.83% of shares outstanding respectively.

Delving into Earnings: Past and Future

Over the past three years, Horace Mann Educators Corp's Ebitda growth averaged -49.1% per year, which is worse than 97.16% of 282 companies in the Insurance industry. This growth extends to the five-year marker, with a growth of -2.8%.

Looking forward, the estimated earnings growth for Horace Mann Educators Corp is 0% per year, higher than the earnings growth of 0% during the past three years. The EPS Growth Rate (Future 3Y to 5Y Estimate) is projected using a combination of historical data and industry trends, factoring in company-specific elements, broader economic conditions, and anticipated market dynamics.

Insider Ownership and Activities

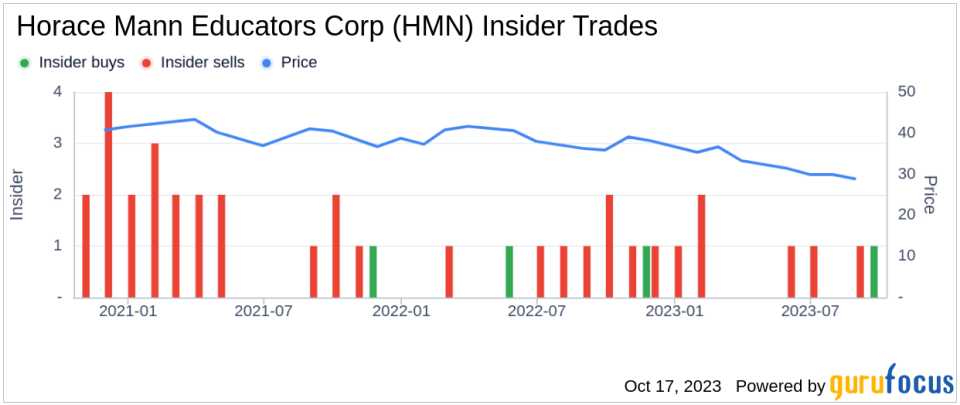

Insider ownership offers insights into the convictions of the company's board directors and C-level employees. Horace Mann Educators Corp's insider ownership is approximately 4.44% as of 2023-08-31, compared to insider ownership of 4.26% from a year ago, reflecting the increased faith of those intimately familiar with the company's operations.

During the past three months, Horace Mann Educators Corp had 1 insider sell transactions: Beverley J. Mcclure, Director sold 590 shares on 2023-08-21.

During the past three months, Horace Mann Educators Corp had 1 insider buy transactions: Victor Fetter, Director bought 3,500 shares on 2023-09-22.

Next Steps

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. Horace Mann Educators Corp's recent dip is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to sound investment decisions.

Screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.