Assessing the Ownership Landscape of Old Republic International Corp(ORI)

Old Republic International Corp (NYSE:ORI) is a renowned provider of specialized insurance products to individuals and institutions. The company operates through three segments: General Insurance, Title Insurance, and Republic Financial Indemnity Group (RFIG) Run-off. With its primary revenue sourced from the United States, the company offers a diverse range of products, including Automobile Extended Warranty Insurance, Aviation, Commercial Automobile Insurance, Inland Marine, Travel Accident, Workers' Compensation, Financial Indemnity, and more.

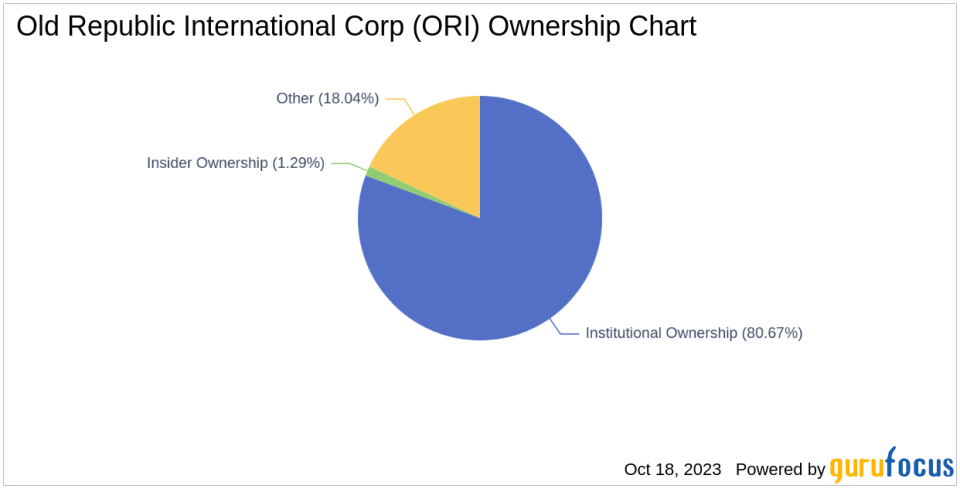

As of the latest data, Old Republic International Corp has an outstanding share count of 284.64 million. Institutional ownership is recorded at 248.15 million shares, making up 80.67% of total shares. On the other hand, insiders hold 3.67 million shares, representing 1.29% of the total share count. A recent decline of about 2.94% in its stock value over the past week has sparked keen interest in the company's ownership trends.

Institutional Ownership and Key Players

Old Republic International Corp's institutional ownership history provides insights into the trust and confidence that major players hold in the company's future. As of 2022-02-28, the institutional ownership level is 80.67%, a drop from 83.24% as of 2021-11-30 and down from 96.38% from a year ago.

Notable stakeholders include top fund managers such as Charles Brandes (Trades, Portfolio), Third Avenue Management (Trades, Portfolio), and Third Avenue Value Fund (Trades, Portfolio), owning 0.58%, 0.29%, and 0.25% of shares outstanding respectively. Recent institutional trading activity provides a clear picture of the market sentiment surrounding Old Republic International Corp.

Delving into Earnings: Past and Future

Over the past three years, Old Republic International Corp's Ebitda growth averaged -12.3% per year, placing it below 80.07% of 281 companies in the Insurance industry. However, the estimated earnings growth for the company is projected at 0% per year, a promising improvement from the -13.6% earnings growth over the past three years.

Insider Ownership and Activities

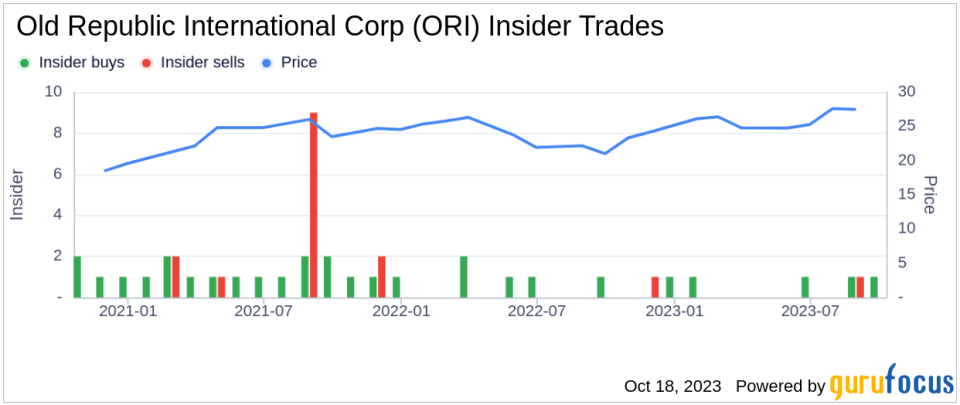

Insider ownership at Old Republic International Corp stands at approximately 1.29% as of 2023-08-31, a rise from 1.09% from a year ago. This increase reflects the growing confidence among the company's board directors and C-level employees. Recent insider trades offer a nuanced view of this sentiment, with 1 sell transaction and 2 buy transactions in the past three months.

Final Thoughts

In the dynamic world of stocks, understanding the intricacies of ownership and earnings is vital. Old Republic International Corp's recent performance serves as a case study in how major players react to market shifts, offering valuable insights for potential investors. As always, a comprehensive view combining past performance and future projections remains the key to sound investment decisions.

Screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.