Assessing the Sustainability of Main Street Capital Corp's Dividend Performance

Examining the Dividend History, Yield, and Growth Rates of Main Street Capital Corp (NYSE:MAIN)

Main Street Capital Corp(NYSE:MAIN) recently announced a dividend of $0.24 per share, payable on 2023-10-13, with the ex-dividend date set for 2023-10-05. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Main Street Capital Corps dividend performance and assess its sustainability.

What Does Main Street Capital Corp Do?

Warning! GuruFocus has detected 4 Warning Sign with MAIN. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

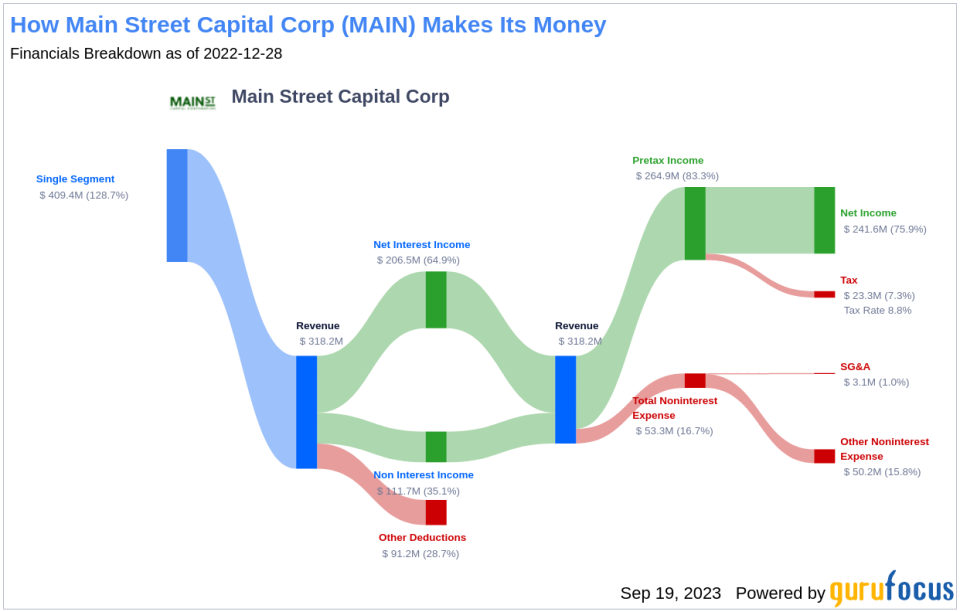

Main Street Capital Corp is an investment firm engaged in providing customized debt and equity financing to lower middle market companies and debt capital to middle market companies. The investment portfolio of the company is typically made to support management buyouts, recapitalizations, growth financings, refinancings, and acquisitions of companies that operate in diverse industry sectors. The group invests in secured debt investments, equity investments, warrants, and other securities of the lower middle market and middle market companies based in the US. Business functioned through the U.S. region and it derives the majority of its income from the source of fees, commission, and interest.

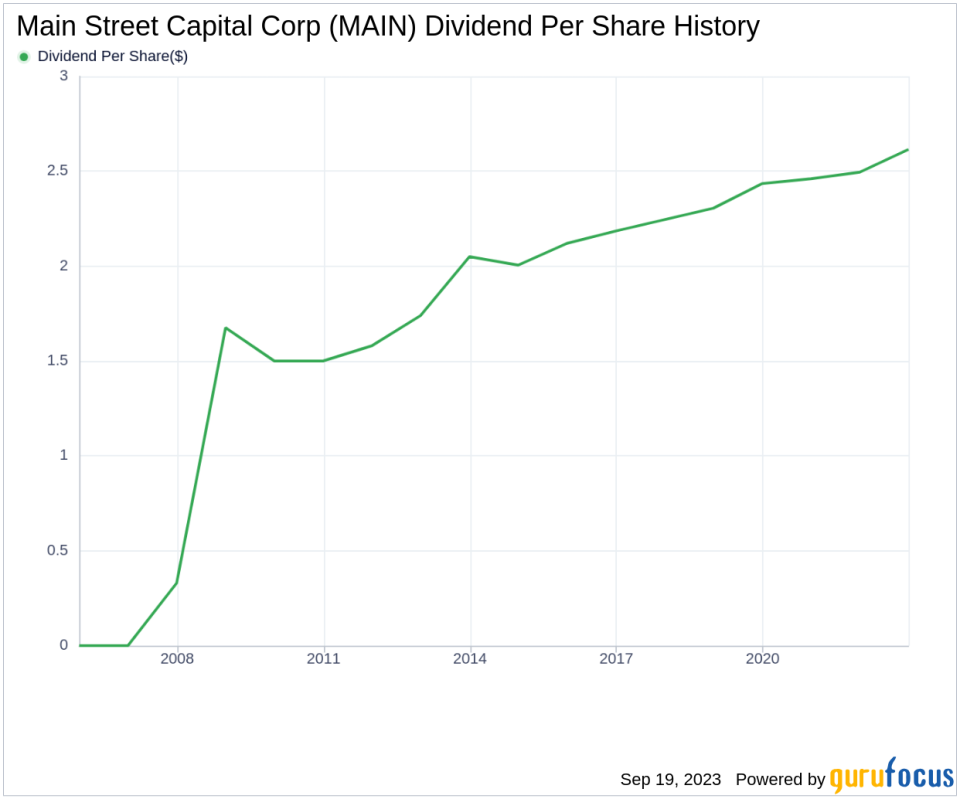

A Glimpse at Main Street Capital Corp's Dividend History

Main Street Capital Corp has maintained a consistent dividend payment record since 2007. Dividends are currently distributed on a monthly basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

Breaking Down Main Street Capital Corp's Dividend Yield and Growth

As of today, Main Street Capital Corp currently has a 12-month trailing dividend yield of 6.46% and a 12-month forward dividend yield of 6.86%. This suggests an expectation of increase dividend payments over the next 12 months.

Over the past three years, Main Street Capital Corp's annual dividend growth rate was 2.40%. Extended to a five-year horizon, this rate increased to 2.90% per year. And over the past decade, Main Street Capital Corp's annual dividends per share growth rate stands at 3.50%.

Based on Main Street Capital Corp's dividend yield and five-year growth rate, the 5-year yield on cost of Main Street Capital Corp stock as of today is approximately 7.42%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, Main Street Capital Corp's dividend payout ratio is 0.69.

Main Street Capital Corp's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks Main Street Capital Corp's profitability 5 out of 10 as of 2023-06-30, suggesting fair profitability. The company has reported positive net income for each of year over the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. Main Street Capital Corp's growth rank of 5 out of 10 suggests that the company has a fair growth outlook.

Revenue is the lifeblood of any company, and Main Street Capital Corp's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. Main Street Capital Corp's revenue has increased by approximately 17.00% per year on average, a rate that outperforms than approximately 67.63% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Main Street Capital Corp's earnings increased by approximately 16.30% per year on average, a rate that outperforms than approximately 60.35% of global competitors.

Lastly, the company's 5-year EBITDA growth rate of 1.30%, which outperforms than approximately 34.15% of global competitors.

Next Steps

In conclusion, Main Street Capital Corp's consistent dividend payments, reasonable growth rate, and sustainable payout ratio, combined with its profitability and growth metrics, indicate a promising outlook for the company's dividend sustainability. However, as always, investors should continue to monitor these key indicators for any significant changes. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.