Assurant (AIZ) Q2 Earnings and Revenues Surpass Estimates

Assurant, Inc. AIZ reported second-quarter 2023 net operating income of $3.89 per share, which beat the Zacks Consensus Estimate by 49.6%. The bottom line increased 32% from the year-ago quarter.

The results reflected higher lender-placed net earned premiums, average insured values and premium rates and improved net investment income, offset by higher expenses.

Total revenues increased 6.4% year over year to $2.7 billion due to higher net earned premiums and net investment income. The top line beat the Zacks Consensus Estimate by 4.3%.

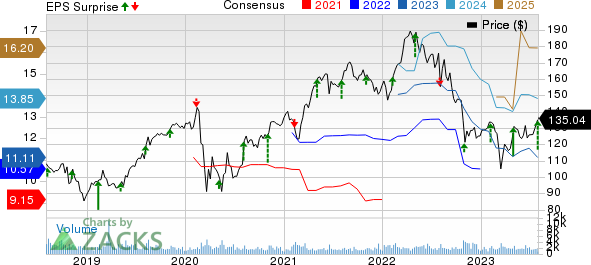

Assurant, Inc. Price, Consensus and EPS Surprise

Assurant, Inc. price-consensus-eps-surprise-chart | Assurant, Inc. Quote

Net investment income was up 22.7% year over year to $112.9 million and beat the Zacks Consensus Estimate of $110 million. The figure was higher than our estimate of $109.2 million.

Total benefits, loss and expenses increased 3.6% to $2.5 billion, mainly on account of an increase in policyholder benefits and underwriting, selling, general and administrative expenses. The figure was higher than our estimate of $2.4 billion.

Segmental Performance

Revenues at Global Housing increased 16% year over year at $561.8 million. The growth was driven by Homeowners from a rise in lender-placed policies in-force as well as higher average insured values and premium rates to address increased claims severity and higher net investment income. The figure beat the Zacks Consensus Estimate of $512 million and was higher than our estimate of $501.1 million.

Adjusted EBITDA of $154.6 million surged more than two-fold year over year due to significant growth in Homeowners from higher lender-placed net earned premiums and lower non-catastrophe loss experience, including a $40 million year-over-year decrease in prior period reserve development. The figure was higher than our estimate of $80.4 million.

Revenues at Global Lifestyle increased 5.3% year over year to $2.2 billion. The improvement was primarily driven by prior period sales in Global Automotive, increased Connected Living business as well as higher net investment income. The figure beat the Zacks Consensus Estimate of $2.1 billion and was higher than our estimate of $2 billion.

Adjusted EBITDA of $197 million decreased 11% year over year due to lower Global Automotive and Connected Living results, including the absence of a $12.9 million gain from the sale of a real estate joint venture partnership in the prior-year period.

Adjusted EBITDA loss at Corporate & Other was $28.5 million, wider than the year-ago quarter’s adjusted EBITDA loss of $24.9 million. The wider loss was due to lower net investment income from lower asset balances.

Financial Position

Liquidity was $495 million as of Jun 30, 2023, which was $270 million higher than the company’s current targeted minimum level of $225 million.

Total assets decreased 0.03% to $33.1 billion as of Jun 30, 2023 from 2022 end. The figure, however, was higher than our estimate of $32.3 billion.

Total shareholders’ equity came in at $4.5 billion, up 6% year over year. The figure was higher than our estimate of $4.2 billion.

Share Repurchase and Dividend Update

In the second quarter of 2023, Assurant repurchased 0.1 million shares for $20 million. From Jul 1 through Jul 28, 2023, AIZ repurchased additional shares for approximately $10 million. It now has $245 million remaining under the current repurchase authorization.

Assurant’s total dividends amounted to $40 million in the second quarter of 2023.

2023 Guidance

Assurant expects adjusted EBITDA, excluding reportable catastrophes, to increase by high single-digits, driven by significant growth in Global Housing, partially offset by a modest decline in Global Lifestyle.

The company expects Global Housing Adjusted EBITDA, excluding reportable catastrophes, to grow significantly, driven by strong performance in Homeowners reflecting higher lender-placed net earned premiums combined with improving non-catastrophe loss experience, including favorable prior period reserve development.

AIZ expects Global Lifestyle Adjusted EBITDA to decline modestly, largely driven by Global Automotive from elevated claims costs and less international contributions, including lower volumes and the impact of foreign exchange. The decline will be partially offset by higher investment income, expense savings to be realized over the course of the year and modest underlying Connected Living growth in North America.

Corporate and Other Adjusted EBITDA loss is expected to be approximately $105 million as the company continues to drive expense leverage.

Assurant expects Adjusted earnings, excluding reportable catastrophes, per diluted share growth rate to approximate Adjusted EBITDA, excluding reportable catastrophes.

AIZ expects depreciation expense of nearly $110 million, interest expense of approximately $110 million and an effective tax rate in the range of 22% to 24%.

Assurant expects business segment dividends to approximate 65% of segment Adjusted EBITDA, including reportable catastrophes, which takes into account the previously announced restructuring plan. This is subject to the business and investment portfolio performance and rating agency and regulatory capital requirements.

Capital deployment priorities is projected to focus on maintaining a strong financial position, supporting business growth by funding investments and M&A and returning capital to shareholders through common stock dividends and share repurchases.

Zacks Rank

Assurant currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Arch Capital Group Ltd. ACGL reported second-quarter 2023 operating income of $1.92 per share, beating the Zacks Consensus Estimate by 16.4%. The bottom line increased 43.3% year over year. Gross premiums written improved 25.2% year over year to $4.8 billion. Net premiums written climbed 27.7% year over year to $3.4 billion on higher premiums written across its Insurance and Reinsurance segments and beat our estimate of $3.1 billion.

Net investment income increased 128.3% year over year to $242 million and beat our estimate of $115.3 million. The Zacks Consensus Estimate was pegged at $185 million. Operating revenues of $3.2 billion rose 32.6% year over year. It beat the Zacks Consensus Estimate by 2.3%.

Pre-tax current accident year catastrophic losses, net of reinsurance and reinstatement premiums, were $119 million. Arch Capital’s underwriting income increased 13.1% year over year to $606 million. Our estimate was $686.8 million.

Cincinnati Financial Corporation CINF reported second-quarter 2023 operating income of $1.21 per share, which surpassed the Zacks Consensus Estimate by 68%. The bottom-line doubled year over year. Total operating revenues in the quarter under review were $2.1 billion, which improved 9.9% year over year. Also, the top line missed the consensus mark by 0.7%.

Net written premiums climbed 9% year over year to $2.1 billion and matched our estimate. Investment income, net of expenses, increased 13% year over year to $220 million and beat our estimate of $209.6 million. The Zacks Consensus Estimate was pegged at $213 million. Total benefits and expenses of Cincinnati Financial increased 3.5% year over year to $1.9 billion. Our estimate was $2.1 billion.

In its P&C insurance business, Cincinnati Financial witnessed an underwriting income of $47 million against an underwriting loss of $52 million in the year-earlier period. Our estimate was pegged at a loss of $67.4 million. The combined ratio — a measure of underwriting profitability — improved 560 basis points (bps) year over year to 97.6. Our estimate was 103.7. The Zacks Consensus Estimate was pegged at 101.

Kinsale Capital Group KNSL delivered second-quarter 2023 net operating earnings of $2.88 per share, which outpaced the Zacks Consensus Estimate by 14.7%. The bottom line improved 50% year over year. Total revenues rose about 60.8% year over year to about $295.7 million.

Gross written premiums of $438.2 million rose 58.2% year over year. Our estimate was $343.2 million. Net written premiums climbed 41% year over year to $242.3 million in the quarter. Our estimate for net written premiums was pegged at a loss of $282.2 million. Net investment income more than doubled year over year to $24.2 million in the quarter and beat our estimate of $14.9 million. The Zacks Consensus Estimate was pegged at $20.7 million.

Total expenses increased 35.8% year over year to $205.6 million due to a rise in losses and loss adjustment expenses, underwriting, acquisition and insurance expenses, interest expense and other expenses. Our estimate was pinned at $197.9 million. Kinsale Capital’s underwriting income of $61.5 million soared 39.3% year over year. Our estimate was $50.8 million. The combined ratio improved 70 bps to 76.7 in the quarter under review. While the expense ratio improved 150 bps to 21 in the quarter, the loss ratio deteriorated 80 bps to 55.7.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report