Assurant (AIZ) Rallies 35% YTD: Can it Retain the Momentum?

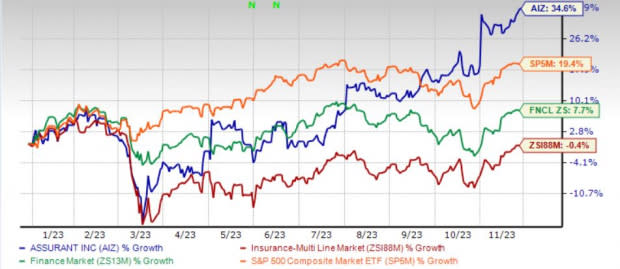

Shares of Assurant Inc. AIZ have increased by 34.6% year to date against the industry’s decline of 0.4%. The Finance sector and the Zacks S&P 500 composite have gained 7.9% and 19.6%, respectively, in the same time frame. With a market capitalization of $8.9 billion, the average volume of shares traded in the last three months was 0.4 million.

The well-performing Global Lifestyle business, growth in fee-based capital-light businesses and solid capital management continue to drive Assurant. The Zacks Consensus Estimate for 2023 and 2024 earnings moved north by 15.8% and 7%, respectively, in the past 30 days, reflecting analysts’ optimism.

Assurant, sporting a Zacks Rank #1 (Strong Buy), has a decent earnings surprise history of surpassing expectations in the last five quarters. The company’s earnings increased by 18.3% in the past five years, better than the industry average of 4.5%. It has a VGM Score of B.

Image Source: Zacks Investment Research

Can AIZ Retain the Momentum?

The Zacks Consensus Estimate for 2023 earnings is pegged at $14.56, indicating an increase of 30.8% on 5.4% higher revenues of $10.9 billion. The consensus estimate for 2024 earnings is pegged at $15.09, indicating an increase of 3.7% on 4% higher revenues of $11.4 billion.

The long-term earnings growth rate is currently pegged at 14.6%, better than the industry average of 12.5%. It has a Growth Score of B.

Assurant is also focusing on growing fee-based capital-light businesses that presently constitute 52% of segmental revenues. Management estimates that the contribution from the same will continue to grow in double digits over the longer term.

While improved performance in Homeowners reflecting higher lender-placed net earned premiums should fuel growth in Global Housing, growth across Connected Living and Global Automotive should drive Global Lifestyle.

Assurant remains focused on ramping up the Connected Living platform, deploying innovative products and services and adding new partnerships. These initiatives are expected to double the margins in Connected Living to 8% over the long term.

Investment income has been witnessing an increase in net investment income over the past few years. In an improved rate environment, investment income should benefit from higher yields on fixed-maturity securities.

AIZ has a robust capital management policy in place. While it has been increasing dividends for the last 19 straight years, the company has $174 million remaining under its current share buyback authorization.

Upbeat Guidance

Assurant expects adjusted EBITDA, excluding reportable catastrophes, to increase by mid- to high-teens and adjusted earnings, excluding reportable catastrophes, per diluted share growth rate to exceed adjusted EBITDA growth.

AIZ expects Global Housing adjusted EBITDA, excluding reportable catastrophes, to grow significantly.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are Enact Holdings ACT, Everest Group, Ltd. EG and Old Republic International ORI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enact’s earnings delivered a four-quarter average earnings surprise of 21.82%. Year-to-date, ACT’s shares gained 14.9%. The Zacks Consensus Estimate for ACT’s 2023 and 2024 earnings increased by 4.9% and 1.1%, respectively, in the past 30 days.

The Zacks Consensus Estimate for Everest Group 2022 and 2023 earnings has moved 5.5% and 4.9% north, respectively, in the past 30 days. EG’s delivered a four-quarter average earnings surprise of 24.50%. Its year-to-date shares gained 24.6%.

Old Republic delivered a four-quarter average earnings surprise of 28.59%. Year-to-date, ORI’s shares gained 19.9%. The Zacks Consensus Estimate for JRVR’s 2022 and 2023 earnings moved north by 2.6% and 3%, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report

Everest Group, Ltd. (EG) : Free Stock Analysis Report