Assurant Inc (AIZ) Reports Substantial Growth in 2023 Earnings, Expects Continued Profitable ...

GAAP Net Income: Increased by 132% to $642.5 million in 2023.

Adjusted EBITDA: Grew by 32% to $1,257.5 million in 2023, excluding reportable catastrophes.

Adjusted Earnings Per Share: Increased by 39% to $15.49 in 2023, excluding reportable catastrophes.

Global Housing Segment: Adjusted EBITDA soared by 133% in 2023.

Global Lifestyle Segment: Adjusted EBITDA saw a 12% increase in Q4'23, driven by Connected Living growth.

2024 Outlook: Mid-single-digit growth expected in Adjusted EBITDA, excluding reportable catastrophes.

Shareholder Returns: $352 million returned via share repurchases and dividends in 2023.

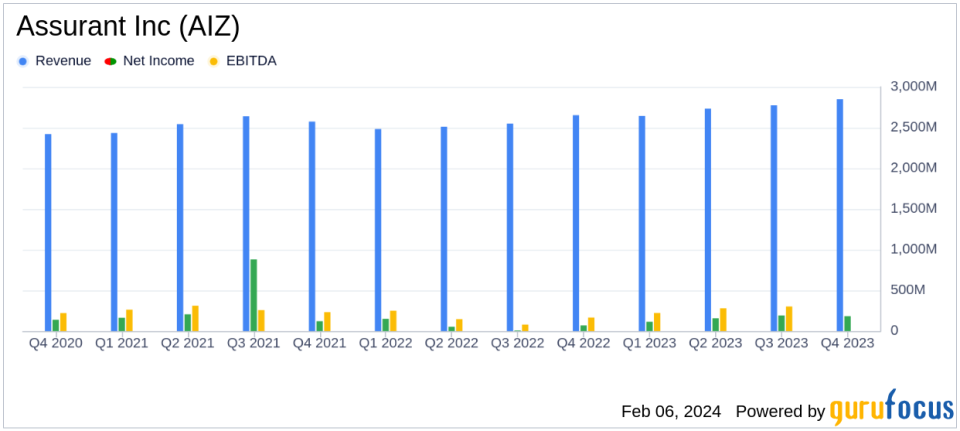

On February 6, 2024, Assurant Inc (NYSE:AIZ) released its 8-K filing, announcing its fourth quarter and full-year financial results for 2023. The company, a global provider of risk management solutions in the housing and lifestyle sectors, reported a significant increase in earnings, driven by strong performance in its Global Housing segment and strategic investments in technology and product innovation.

Assurant Inc (NYSE:AIZ) operates through segments such as Global Housing and Global Lifestyle, offering insurance products and services that cater to a diverse clientele. The Global Housing segment, which includes lender-placed insurance and renters insurance, was a key driver of the company's earnings growth in 2023. Meanwhile, the Global Lifestyle segment, which covers mobile device protection and vehicle protection services, also contributed to the company's robust financial performance.

Financial Performance Highlights

Assurant Inc's GAAP net income surged by 132% to $642.5 million in 2023, with net income per diluted share increasing by 137% to $11.95. Adjusted EBITDA, excluding reportable catastrophes, grew by 21% to $1,369.3 million. Adjusted earnings per diluted share, also excluding reportable catastrophes, rose by 26% to $17.13. These figures underscore the company's ability to generate profitable growth and enhance shareholder value.

The company's Global Housing segment reported a 133% increase in Adjusted EBITDA, while the Global Lifestyle segment's Adjusted EBITDA grew by 12% in the fourth quarter of 2023, driven by growth in Connected Living. Net earned premiums, fees, and other income from these segments totaled $10.70 billion, marking an 8% increase from the previous year.

2024 Outlook and Strategic Focus

Looking ahead to 2024, Assurant Inc expects mid-single-digit growth in Adjusted EBITDA, excluding reportable catastrophes, driven by both the Global Lifestyle and Global Housing segments. The company anticipates that the growth rate in Adjusted earnings per diluted share will be modestly lower than the growth rate in Adjusted EBITDA, primarily due to an increase in depreciation expense from strategic technology investments.

Assurant Inc's President and CEO, Keith Demmings, expressed confidence in the company's continued earnings growth and competitive positioning.

We are pleased with our exceptionally strong results in 2023, representing Assurants seventh consecutive year of profitable growth. Our success was driven by our intense focus on strategic, financial and operational outperformance, allowing us to strengthen our competitive positioning across our global businesses and ultimately create meaningful shareholder value,"

Demmings stated.

Shareholder Returns and Liquidity Position

In 2023, Assurant Inc returned $352 million to shareholders through share repurchases and common stock dividends. The company's holding company liquidity stood at $606 million as of December 31, 2023, well above the targeted minimum level. This strong liquidity position supports the company's capital deployment priorities, which include maintaining a robust financial position, funding investments, and returning capital to shareholders.

Assurant Inc's solid financial performance and optimistic outlook for 2024 reflect its strategic focus on operational excellence and innovation. The company's ability to adapt to market conditions and invest in growth areas positions it well for continued success in the insurance industry.

For more detailed information on Assurant Inc's financial results and outlook, investors are encouraged to review the full earnings release and financial statements available on the company's Investor Relations website.

Assurant Inc will hold its fourth quarter 2023 earnings conference call on February 7, 2024, where management will discuss the results and provide further insights into the company's performance and strategies.

Explore the complete 8-K earnings release (here) from Assurant Inc for further details.

This article first appeared on GuruFocus.