Astec (ASTE) Stock Gains 13% in Six Months: More Room to Run?

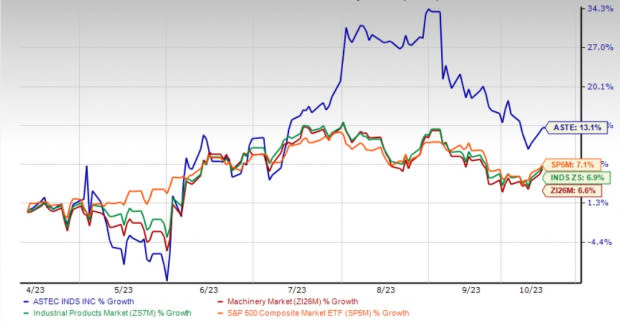

Shares of Astec Industries ASTE have gained 13.1% in the past six months, faring better than the industry’s 6.6% growth. The Industrial Products sector and the S&P 500 have gained 6.9% and 7.1%, respectively, in the same timeframe.

Astec has a market capitalization of $1.05 billion and a Zacks Rank #1 (Strong Buy), currently.

Solid Results Year to Date

Astec reported record revenues of $350 million in the second quarter of 2023, which were up 10% year over year. In the first two quarters of 2023, the company’s revenues increased 14.5% to $697.9 million. Astec has been benefiting from the favorable changes in volume, pricing and mix. Infrastructure Solutions and Material Solutions revenues increased 10% and 21%, respectively, in the first six months of 2023, thus indicating strong demand. The company has witnessed improvement in both equipment and parts sales.

Image Source: Zacks Investment Research

Despite cost inflation and supply chain-related issues, Astec has delivered solid earnings growth this year as its pricing actions have helped to combat these headwinds. Adjusted earnings per share in the second quarter of 2023 were 87 cents, which marked substantial year-over-year growth of 358%. In the first quarter, the company’s adjusted earnings per share had improved 119.5% year over year to 90 cents.

Earnings estimates for ASTE have moved up over the past 60 days. The Zacks Consensus Estimate for the ongoing quarter’s bottom line has moved up 7%. The consensus mark for 2023 has been revised upward by 4% and for 2024, by 6%. The favorable estimate revisions instill investors’ confidence in the stock.

The consensus estimate for Astec’s earnings per share for fiscal 2023 is $3.23, which indicates year-over-year growth of 163%. The earnings per share estimate of $3.63 for 2024 projects year-over-year growth of 12.2%.

Strategic Initiatives Bode Well

The company is making solid progress in terms of its OneASTEC business model, which includes the strategic pillars of Simplify, Focus and Grow. Per the Simplify aspect, it continues to reduce organizational structure complexity and consolidate and rationalize its footprint and product portfolio. The Focus strategy strives to deliver operational excellence. Through the Grow aspect, the company continues to focus on innovation, developing aftermarket sales, global expansion and growing digital connectivity, among others.

This model is designed to better set strategic direction, define priorities and improve the overall operating performance. The company will continue to gain traction from this model. Astec maintains its long-term targets of more than 12% EBITDA margin, earnings per share growth of more than 10% and greater than 14% return on invested capital.

Solid Balance Sheet Bodes Well

As of Jun 30, 2023, Astec had a total liquidity of $227 million. Its total debt-to-total capital ratio was 0.09, much lower than the industry’s 0.70. The times interest earned ratio was 7.6.

The company’s strong balance sheet enables it to continue to invest in boosting capacity to meet the strong demand levels, pursue strategic acquisitions and continue to return value to shareholders.

Other Stocks to Consider

Some other top-ranked stocks from the Industrial Products sector are Applied Industrial Technologies AIT, Caterpillar Inc. CAT and EnerSys ENS. AXON sports a Zacks Rank of 1, while CAT and ENS have a Zacks Rank #2 (Buy) each, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial Technologies has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings is pegged at $9.13 per share, suggesting 4% year-over-year growth. The consensus estimate for fiscal 2024 earnings has moved 2% north in the past 60 days. AIT’s shares have gained 17% in the last six months.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.87 per share, indicating year-over-year growth of 43.6%. The consensus estimate for 2023 earnings has moved up 1.3% in the past 60 days. Its shares have gained 24% in six months’ time.

The Zacks Consensus Estimate for EnerSys’ 2023 earnings per share is pegged at $7.78. The figure projects 45.7% growth from 2022. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 10.3%. Shares of ENS have rallied 17% in six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report