AstraZeneca (AZN) Q1 Earnings and Revenues Beat Estimates

AstraZeneca’s AZN first-quarter 2022 core earnings of 95 cents per American depositary share (ADS) beat the Zacks Consensus Estimate of 85 cents. Core earnings of $1.89 per share rose 16% year over year on a reported basis and 20% at constant exchange rates (CER).

Total revenues, including sales of the rare disease drugmaker Alexion acquired in July 2021, were up 56% on a reported basis and 60% at CER to $11.39 billion in the quarter, driven by higher product sales and a contribution from AstraZeneca’s COVID-19 vaccine. Revenues beat the Zacks Consensus Estimate of $11.14 billion.

All growth rates mentioned below are on a year-over-year basis and at CER.

Product Sales Rise

Product sales rose 56% at CER to $10.98 billion. Collaboration revenues were $410 million. Collaboration revenues included a $175-million sales milestone payment for Lynparza, $75 million for Enhertu (from partner Daiichi Sankyo) and $70 million for tralokinumab (as part of the license agreement with Leo Pharma).

Among AstraZeneca’s various therapeutic areas, Oncology product sales were up 25%. CVRM product sales were up 18%, while the Respiratory & Immunology segment gained 4%. Rare disease product sales were up 7%. Sales of other medicines declined 15%.

Sales in Detail

In Vaccines & Immune Therapies (V&I), AstraZeneca’s COVID-19 vaccine Vaxzevria, generated $1.09 billion of revenues. AZN’s new COVID-19 antibody cocktail medicine Evusheld generated $469 million worth of sales, of which $307 million came from the United States, $89 million from the Emerging Markets and $66 million from Europe.

In Oncology, Lynparza product revenues rose 17% year over year to $617 million owing to its higher adoption in ovarian, breast and prostate cancer treatments in the United States. Additional reimbursements, increasing BRCAm-testing rates and a successful launch for addressing the first-line ovarian cancer in Europe also boosted sales. The drug is the leading PARP-inhibitor in the United States.

AstraZeneca markets Lynparza in partnership with Merck MRK. The profit-sharing deal between AstraZeneca and Merck was inked in 2017. In addition to Lynparza, the deal included Koselugo.

AstraZeneca & Merck’s Lynparza is approved for four cancer types, namely ovarian, breast, prostate and pancreatic. Lynparza is also being evaluated in an earlier-line setting for the approved cancer indications as well as some other cancer types.

Tagrisso recorded sales of $1.30 billion, up 17% year over year on strong demand for use as a first-line and adjuvant treatment, partially offset by lower rates of new patient diagnosis due to the new wave of Omicron-related infections in the United States.

Imfinzi generated sales of $599 million in the quarter, up 11% year over year, driven by increased demand for an extensive stage non-small cell lung cancer (ES-SCLC) indication. COVID-19 continued to hurt lung cancer diagnosis rates, mainly in the United States.

Calquence generated $414 million in the quarter, up 100% year over year, benefiting from the new patients initiating treatment.

Sales of AstraZeneca’s legacy cancer drugs, such as Iressa, Arimidex, Faslodex and Casodex declined during the quarter. However, sales of Zoladex were up 12%.

In CVRM, Brilinta/Brilique sales were $325 million in the reported quarter, down 10% year over year, primarily due to the impact of COVID-19 (reflecting fewer elective procedures) in the United States and the EU and pricing pressures from the VBP (volume-based procurement) program in China.

Farxiga recorded product sales of $1.0 billion in the quarter, up 67% year over year, reflecting volume growth across all regions and growth of the SGLT2 inhibitor class in general. The recent label expansion approvals for heart failure with a reduced ejection fraction (HFrEF) and chronic kidney disease (CKD) indications contributed to Farxiga’s sales growth in the United States and Europe. The inclusion of Farxiga in the NRDL in China boosted sales in the Emerging Markets.

Bydureon sales declined 33% to $68 million. Sales of older CVRM medicine Crestor were flat year over year while product sales of another old CVRM drug Seloken/Toprol-XL declined 1% in the quarter.

In Respiratory & Immunology, Symbicort sales were flat in the quarter at $674 million. Pulmicort sales declined 34% to $217 million.

Fasenra recorded sales of $308 million in the quarter, up 22% year over year, driven by sustainable growth in volume in the United States and an increased volume from sustained leadership in new to brand prescriptions in Europe.

AstraZeneca’s new triple combo COPD treatment Breztri recorded sales of $87 million in the quarter compared with $73 million in the previous quarter.

In the Rare Disease portfolio, which added with Alexion post acquisition, Soliris recorded sales of $990 million, in line with the year-ago quarter’s figure. The performance in the United States was driven by its growing uptake in neurology indications, generalized myasthenia gravis (gMG) and neuromyelitis optica spectrum disorder (NMOSD), offset by the patient conversion to Ultomiris for paroxysmalnocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS) indications. Ultomiris and Strensiq sales were $419 million and $208 million each, up 25% and 7%, respectively. Koselugo, a new drug which was recently moved to AstraZeneca’s Rare Disease Portfolio, generated sales of $39 million in the quarter.

Profit Discussion

AstraZeneca’s core gross margin of 79.3% was up 4 percentage points at CER. Core selling, general and administrative (SG&A) expenses increased 25% to $2.95 billion.

Core research and development (R&D) expenses rose 36% to $2.19 billion. Core operating profit rose 60% to $3.96 billion in the quarter. The core operating margin was 34.8% in the quarter, which was stable year over year.

2022 Guidance Intact

AstraZeneca reiterated its financial guidance for 2022. AZN expects total revenues to increase in high-teens percentage in 2022. The guidance includes the full-year contribution from the COVID-19 vaccine.

Management expects a decline in total revenues from COVID-19 medicines in 2022 by a low-to-mid-twenties percentage, with an expected decline in the sales of COVID-19 vaccine being partially offset by growth in Evusheld sales. Shares of AstraZeneca were down 1.2% in pre-market trading on Apr 29, attributable to this factor most likely.

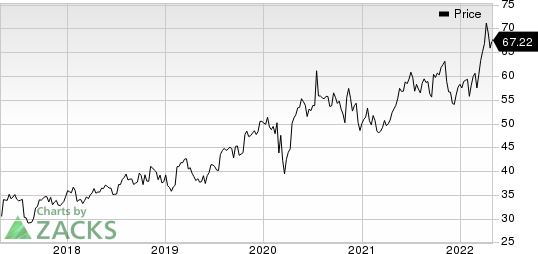

So far this year, the stock has gained 15.4% compared with an increase of 5.1% for the industry.

Image Source: Zacks Investment Research

Core earnings are expected to increase in mid-to-high twenties’ percentage in 2022.

Our Take

AstraZeneca’s first-quarter results were encouraging as it beat on both earnings and sales Product sales growth was driven by its V&I unit, COVID products and higher sales of key medicines across the Oncology and CVRM units like Tagrisso and Farxiga, which offset some negative impacts from the pandemic. The rare disease drugs were added to AZN’s portfolio following the Alexion acquisition, which in turn, aided sales growth.

On a region-wise analysis, AstraZeneca witnessed double-digit growth in all major regions, including the Emerging Markets except China. Sales in China were hurt by pricing pressure associated with the National Reimbursement Drug List (NRDL) and VBP programs.

AstraZeneca PLC Price

AstraZeneca PLC price | AstraZeneca PLC Quote

Zacks Rank & Stocks to Consider

Currently, AstraZeneca has a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include Deciphera Pharmaceuticals DCPH and Vertex Pharmaceuticals VRTX, each of which has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Deciphera Pharmaceuticals’ loss per share estimates for 2022 have narrowed from $2.94 to $2.84 in the past 30 days. The same for 2023 has narrowed from $2.38 to $2.27 in the past 30 days. DCPH has risen 10.9% in the year-to-date period.

Earnings of Deciphera Pharmaceuticals missed estimates in three of the last four quarters and beat the mark once, the average surprise being 2.7%.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $14.52 to $14.56 in the past 30 days. The same for 2023 has risen from $15.31 to $15.35 in the past 30 days. VRTX has risen 22.3% in the year so far.

Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, the average being 10%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Deciphera Pharmaceuticals, Inc. (DCPH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research