AstroNova Inc (ALOT) Posts Record Operating Income in Fiscal 2024

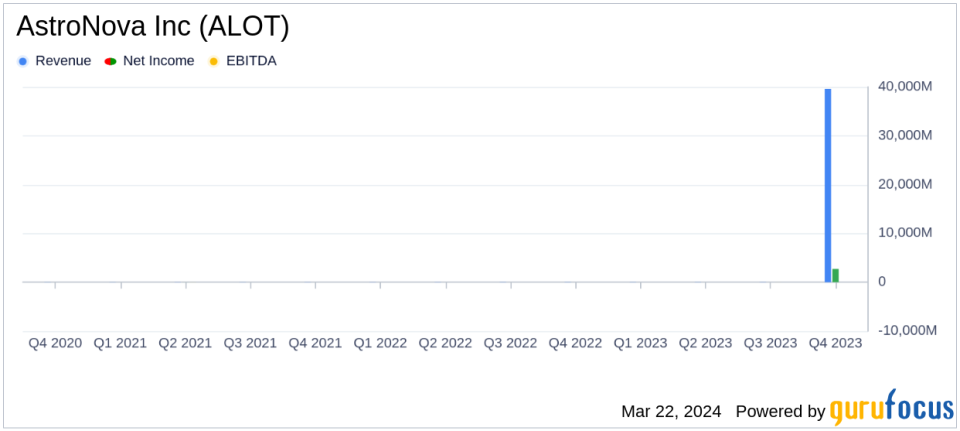

Full-Year GAAP Operating Income: Reached a company record of $8.8 million.

Non-GAAP Operating Income: Achieved $12.0 million for the full year.

GAAP Net Income: Reported at $4.7 million, or $0.63 per diluted share.

Non-GAAP Net Income: Totaled $7.2 million, or $0.97 per diluted share.

Adjusted EBITDA: Excluding restructuring and retrofit-related items, stood at $17.6 million.

AstroNova Inc (NASDAQ:ALOT), a global leader in data visualization technologies, announced its financial results for the fiscal fourth quarter and full year ended January 31, 2024. The company reported a record full-year GAAP operating income of $8.8 million and a non-GAAP operating income of $12.0 million. AstroNova's GAAP net income for the year was $4.7 million, or $0.63 per diluted share, with a non-GAAP net income of $7.2 million, or $0.97 per diluted share. The company also generated a full-year adjusted EBITDA of $14.4 million, which increases to $17.6 million when excluding restructuring and retrofit-related items. These results were disclosed in AstroNova's 8-K filing released on March 22, 2024.

AstroNova designs, develops, manufactures, and distributes a broad range of specialty printers and data acquisition and analysis systems. The company operates through two segments: Product Identification (PI) and Test & Measurement (T&M), serving markets such as aerospace, automotive, packaging, and transportation.

In fiscal 2024, AstroNova faced challenges including supply chain disruptions and the need for strategic realignment within its PI segment. Despite these hurdles, the company managed to achieve significant financial milestones, demonstrating resilience and adaptability. The successful completion of a retrofit program for certain PI printers and the launch of new digital printers under the QuickLabel and TrojanLabel brands were among the key achievements.

The company's financial performance is particularly noteworthy in the context of the hardware industry, where innovation and efficient cost management are critical for success. AstroNova's ability to improve margins while continuing to invest in future growth exemplifies a balanced approach to navigating market challenges and seizing opportunities.

Looking ahead, AstroNova has set ambitious targets for fiscal 2025, aiming for mid-single-digit organic revenue growth and an adjusted EBITDA margin of 13% to 14%. These goals reflect the company's confidence in its operational improvements and the demand dynamics across its end markets.

AstroNova's strong fiscal 2024 performance and optimistic outlook for the coming year underscore the company's strategic focus and operational efficiency. As AstroNova continues to innovate and expand its market presence, investors and stakeholders have much to look forward to.

Explore the complete 8-K earnings release (here) from AstroNova Inc for further details.

This article first appeared on GuruFocus.