ASX Favorite Energy Dividend Stocks

Given the energy industry’s dependence on commodity prices, the sector tends to be cyclical and profitability can be highly variable. However, after the 50% plunge in oil prices in 2014, energy companies are now benefiting from the recovery through higher cash flows. Subsequently, shareholders have growing expectations that dividend payments could increase as cash flow recovers at these companies. Here are my top dividend stocks in the energy industry that could be valuable additions to your current holdings.

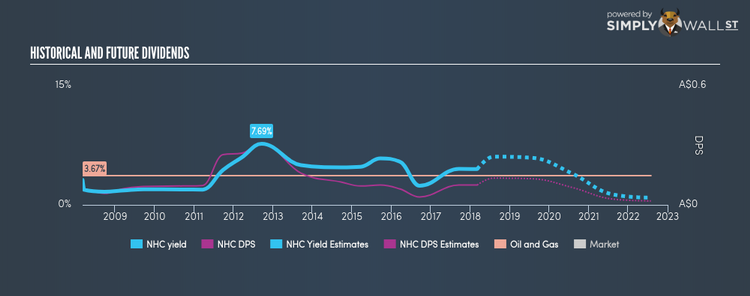

New Hope Corporation Limited (ASX:NHC)

NHC has a large dividend yield of 4.51% and is distributing 59.10% of earnings as dividends . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from AU$0.076 to AU$0.10. New Hope also looks promising for it’s growth over the next year, with analysts expecting a double digit earnings per share increase of 52.56%. More on New Hope here.

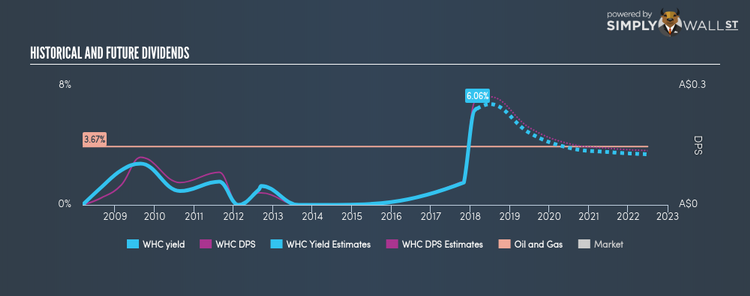

Whitehaven Coal Limited (ASX:WHC)

WHC has a great dividend yield of 6.06% and their current payout ratio is 36.99% , with analysts expecting a 45.77% payout in three years. While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from AU$0 to AU$0.26. The company’s latest earnings per share figure was A$0.17, up 200.65% from the previous year. Continue research on Whitehaven Coal here.

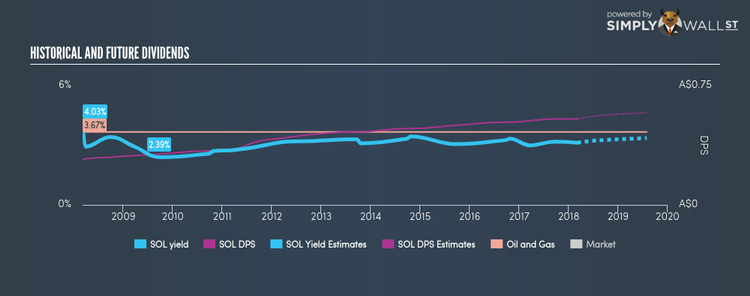

Washington H. Soul Pattinson and Company Limited (ASX:SOL)

SOL has a sizeable dividend yield of 3.13% and pays 38.75% of it’s earnings as dividends , and analysts are expecting the payout ratio in three years to hit 65.17%. The company’s DPS have increased from AU$0.28 to AU$0.54 over the last 10 years. Much to the delight of shareholders, the company has not missed a payment during this time. The company’s latest earnings per share figure was A$0.62, up 123.27% from the previous year. Dig deeper into Washington H. Soul Pattinson here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.