Is Athersys Inc (ATHX) Significantly Overvalued?

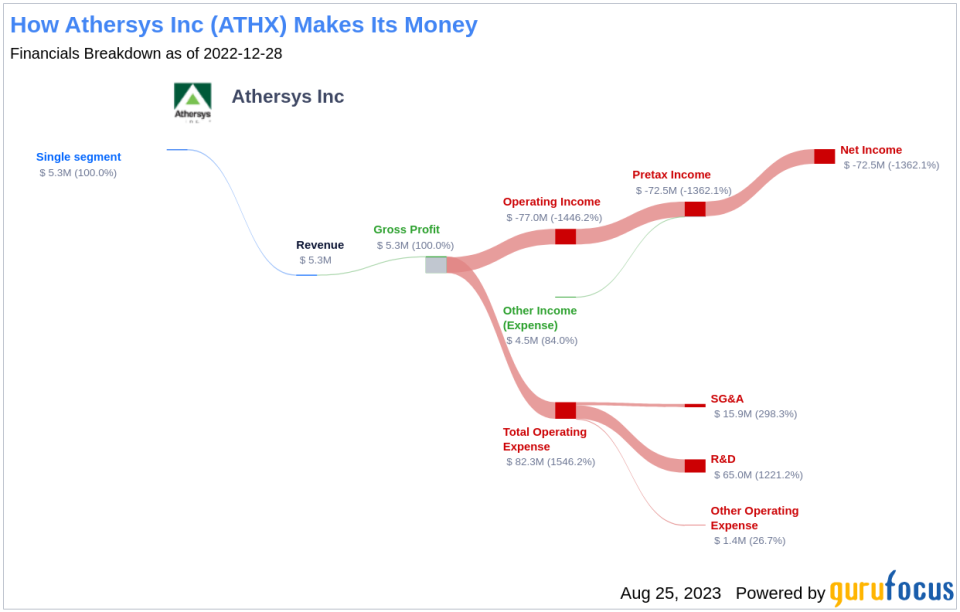

Today, we delve into the financials of Athersys Inc (NASDAQ:ATHX), a biotechnology company with a daily gain of 12.75%. Despite this gain, the company has suffered a 3-month loss of 46.82% and a Loss Per Share of 3.03. This analysis seeks to answer the critical question: Is Athersys significantly overvalued? We invite you to read on for an in-depth valuation analysis of Athersys.

Company Overview

Athersys Inc is a key player in the field of regenerative medicine, focusing on research, clinical development, manufacturing, and manufacturing process development activities. Athersys' primary product is the Multistem cell therapy, with clinical development programs aimed at treating neurological conditions, cardiovascular disease, inflammatory and immune disorders, and certain pulmonary conditions. The company's revenue is derived from corporate collaborations, license agreements, and government grants. Despite its current stock price of $0.52, Athersys' GF Value, an estimation of its fair value, stands at $0.24, suggesting a significant overvaluation.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line provides a snapshot of the stock's ideal fair trading value. If the stock price significantly exceeds the GF Value Line, the stock is likely overvalued and may offer poor future returns. Conversely, if the stock price is significantly below the GF Value Line, the stock may be undervalued and likely to offer higher future returns.

Athersys, with a market cap of $11.70 million, appears to be significantly overvalued. This overvaluation suggests that the long-term return of its stock is likely to be much lower than its future business growth.

These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

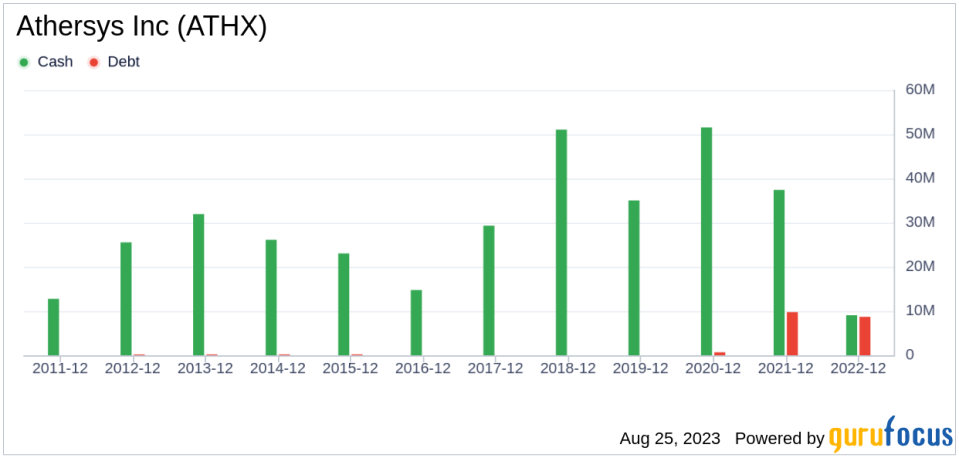

Investing in companies with poor financial strength carries a higher risk of permanent loss of capital. Hence, it's crucial to review a company's financial strength before investing. Athersys' cash-to-debt ratio stands at 0.08, ranking worse than 95.04% of companies in the Biotechnology industry. This poor financial strength rating indicates a potentially high investment risk.

Profitability and Growth

Investing in profitable companies generally carries less risk. Athersys has been profitable for 0 years over the past 10 years, and its operating margin of -34962.07% ranks worse than 95.72% of companies in the Biotechnology industry. These figures suggest Athersys' profitability is poor.

Growth is a crucial factor in company valuation. Athersys' 3-year average annual revenue growth rate stands at 131.4%, ranking better than 92.94% of companies in the Biotechnology industry. However, its 3-year average EBITDA growth rate is -177.9%, ranking worse than 98.5% of companies in the industry, suggesting poor growth.

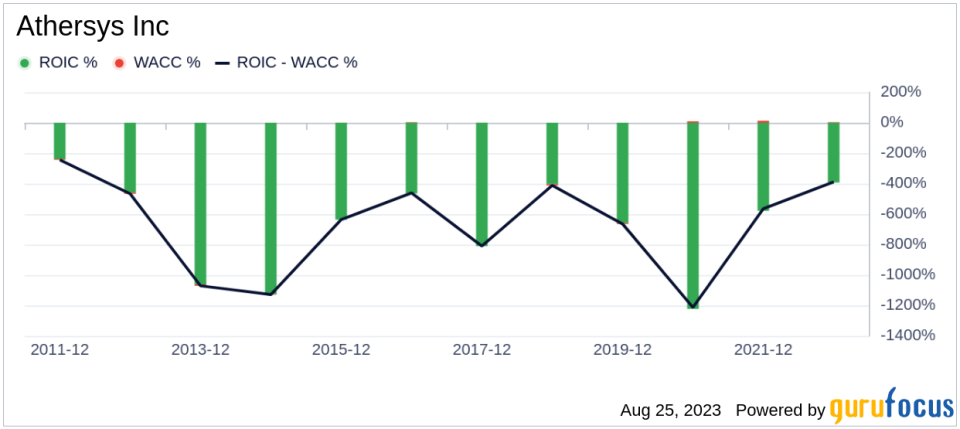

ROIC vs WACC

Another way to determine a company's profitability is by comparing its return on invested capital (ROIC) to the weighted average cost of capital (WACC). Athersys' ROIC stands at -233.67, and its WACC is 3.8, suggesting the company may not be creating value for shareholders.

Conclusion

In conclusion, Athersys appears to be significantly overvalued. Its financial condition and profitability are poor, and its growth ranks worse than 98.5% of companies in the Biotechnology industry. For more details about Athersys' financials, check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.