ATI's Q3 Earnings & Sales Top on Aerospace and Defense Strength

ATI Inc. ATI recorded third-quarter 2023 profit of $75.7 million or 52 cents per share, up from the year-ago quarter's profit of $61.1 million or 42 cents per share.

ATI logged adjusted earnings of 55 cents per share, up from the year-ago quarter’s figure of 53 cents. It topped the Zacks Consensus Estimate of 52 cents.

The company’s net sales fell around 1% year over year in the third quarter to $1,025.6 million. It beat the Zacks Consensus Estimate of $1,024.6 million.

The company saw continued momentum in aerospace and defense in the quarter. Higher aerospace and defense content drove year-over-year earnings growth in the third quarter.

ATI Inc. Price, Consensus and EPS Surprise

ATI Inc. price-consensus-eps-surprise-chart | ATI Inc. Quote

Segment Highlights

The High Performance Materials & Components (HPMC) segment recorded sales of $539.5 million in the third quarter, representing an 18% increase from the year-ago quarter. It also surpassed the consensus estimate of $513 million. Total aerospace and defense sales rose 22% compared to the year-ago quarter.

In the reported quarter, the Advanced Alloys & Solutions (AA&S) segment reported sales of $486.1 million, around 15% lower than the year-ago quarter. The figure lagged the consensus estimate of $512 million. The decline in sales was due to the recessionary weakness in general industrial end markets and planned outages.

Financials

Cash and cash equivalents were $432.9 million at the end of the third quarter, up around 32% year over year. The company’s long-term debt was $2,147.7 million, up around 26% year over year.

For the third quarter, cash used in operating activities was $114.2 million.

ATI repurchased $45 million of common stock during the third quarter.

Outlook

Moving ahead, ATI sees sequential and year-over-year earnings growth in the fourth quarter, driven by the HPMC segment.

For HPMC, the company expects EBITDA margins to continue to improve year-over-year in the fourth quarter as backlogs remain strong across aerospace and defense. It continues to optimize operations and resolve bottlenecks that come with rising demand. ATI also expects sustained process optimization to positively impact future growth and performance.

The company anticipates stable performance in the AA&S segment in the fourth quarter due to continued growth in the aerospace and defense related markets, which is likely to help offset the recessionary impacts.

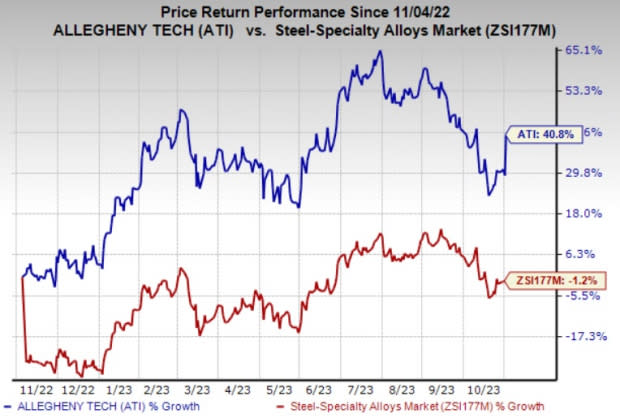

Price Performance

ATI’s shares are up 40.8% over a year compared with a 1.2% decline recorded by the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

ATI currently has a Zacks Rank #4 (Sell).

Better-ranked stocks worth a look in the basic materials space include Koppers Holdings Inc. KOP, WestRock Company WRK and The Andersons Inc. ANDE.

Koppers has a projected earnings growth rate of 7.5% for the current year. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Koppers has a trailing four-quarter earnings surprise of roughly 21.7%, on average. KOP shares have rallied around 35% in a year.

In the past 60 days, the Zacks Consensus Estimate for WestRock’s current fiscal year has been revised upward by 5.2%. WRK, carrying a Zacks Rank #2, beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have gained 3% in the past year. The company’s shares have gained 7% in the past year.

Andersons currently carries a Zacks Rank #1. The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days.

Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 39% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report