Atlanta Braves Holdings Inc (BATRA) Posts Mixed Financial Results for Q4 and Full Year 2023

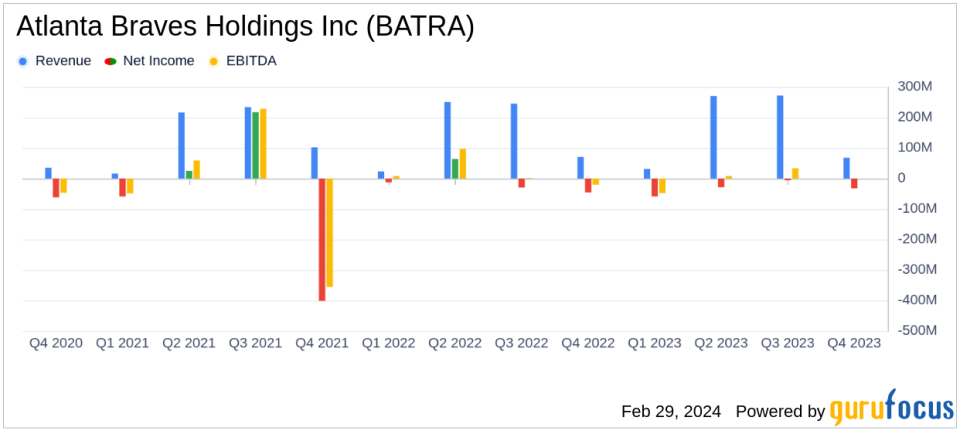

Revenue: Full-year revenue increased by 9% to $640.7 million, while Q4 saw a 5% decrease to $67.7 million.

Operating Income: Operating loss widened by 349% in Q4 to $(32.4) million and by 52% for the full year to $(46.4) million.

Adjusted OIBDA: Full-year Adjusted OIBDA declined by 35% to $38.3 million, with Q4 posting a negative $(13.0) million.

Net Earnings: Net loss for the year was $(125.3) million, with Q4 contributing a $(32.4) million loss.

Debt and Cash: Total debt increased to $572.9 million, while cash and cash equivalents rose to $125.1 million as of December 31, 2023.

On February 28, 2024, Atlanta Braves Holdings Inc (NASDAQ:BATRA) released its 8-K filing, disclosing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, which operates through its wholly-owned subsidiary, the Atlanta Braves Major League Baseball Club, and its mixed-use real estate development, The Battery Atlanta, reported a year of financial contrasts with revenue growth offset by increased operating costs and a widened operating loss.

Financial Performance Overview

For the full year, Atlanta Braves Holdings Inc saw a 9% increase in revenue, reaching $640.7 million, driven by robust ticket demand and attendance at regular season home games, new advertising sponsorships, and contractual rate increases in broadcasting revenue. However, the fourth quarter experienced a 5% decrease in total revenue to $67.7 million, primarily due to fewer home games played.

Despite the revenue growth, operating income and Adjusted OIBDA both saw significant declines. The operating loss for the full year expanded by 52% to $(46.4) million, and Adjusted OIBDA decreased by 35% to $38.3 million. The fourth quarter was particularly challenging, with an operating loss of $(32.4) million and a negative Adjusted OIBDA of $(13.0) million.

Baseball operating costs increased for the full year due to higher player salaries and increases under MLBs revenue sharing plan. Selling, general and administrative expenses also rose, largely due to costs related to the company's split-off from Liberty Media and higher personnel costs.

Balance Sheet and Cash Flow

Atlanta Braves Holdings Inc ended the year with $125.1 million in cash and cash equivalents, an increase from the previous quarter. The company's total debt rose to $572.9 million, attributed to borrowing for current capital projects. The balance sheet reflects the company's ongoing investments in its operations and the mixed-use development.

Management Commentary

"The Braves are a unique and valuable sports property with leading on-field and off-field business performance. Congrats to the team on capping off the 2023 season with their sixth consecutive NL East title and unprecedented player accolades," said Greg Maffei, Chairman and CEO of ABH. "Strong on-field performance yielded robust revenue growth for the full year, and early indicators for the 2024 season show increased demand."

"We are thrilled with both the team and financial performance at the Braves in 2023," said Terry McGuirk, Chairman and CEO of Braves Holdings, LLC. "Our management continues to focus on optimizing the ballpark, with upgrades planned for 2024 to drive more commercial opportunities and an improved fan experience. Season tickets, including premium seats, are already sold out in anticipation of another exciting season. The Battery benefitted from increased foot traffic and strong sales across the development and we expect another strong year ahead."

Looking Ahead

While Atlanta Braves Holdings Inc faced challenges in 2023, the management's outlook for 2024 is optimistic, with increased demand for the upcoming season and planned upgrades to enhance the fan experience. The company's focus on optimizing its assets and driving commercial opportunities suggests a proactive approach to overcoming the operational and financial hurdles experienced in the past year.

Investors and stakeholders will be watching closely to see if the company's strategic initiatives can translate into improved financial metrics and a stronger balance sheet in the year ahead.

For more detailed financial information and to participate in the earnings conference call, interested parties can access the webcast on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Atlanta Braves Holdings Inc for further details.

This article first appeared on GuruFocus.