Atlantic Union Bankshares Corp Reports Solid Earnings Amidst Industry Challenges

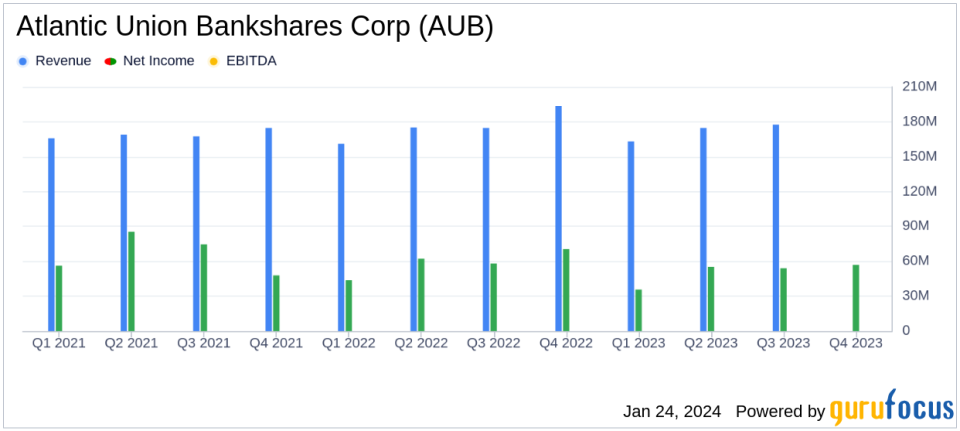

Net Income: Q4 net income available to common shareholders at $53.9 million; $190.0 million for full year.

Earnings Per Share: Q4 EPS at $0.72; adjusted diluted operating EPS at $0.78.

Net Interest Income: Increased to $153.5 million in Q4, up from $151.9 million in Q3.

Asset Quality: Nonperforming assets at 0.24% of total loans held for investment.

Balance Sheet Growth: Total assets reached $21.2 billion, marking a 3.4% increase from the previous year.

Capital Ratios: Common equity Tier 1 capital ratio at 9.84%.

Dividends: Declared and paid quarterly dividends of $0.32 per common share, a 6.7% increase from the previous year.

On January 23, 2024, Atlantic Union Bankshares Corp (NYSE:AUB) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The report showcases a company that has navigated the complexities of the financial sector while maintaining a trajectory of growth and profitability.

Atlantic Union Bankshares Corp, a financial holding company, operates through its community bank subsidiary, offering a comprehensive suite of banking, trust, and wealth management services. The bank's revenue primarily stems from service fees and is concentrated in the United States. With a focus on traditional full-service community banking, Atlantic Union has one reportable segment that encompasses its core business operations.

Financial Performance and Challenges

Atlantic Union's Q4 earnings report reflects a company that has adeptly managed the headwinds facing the banking industry. The bank reported a net income available to common shareholders of $53.9 million for Q4 and $190.0 million for the year. The adjusted operating earnings available to common shareholders were $58.9 million for Q4 and $221.2 million for the full year, with corresponding EPS figures of $0.78 and $2.95, respectively. These results are indicative of the bank's ability to generate robust earnings, a critical factor for investor confidence and the company's ability to reinvest in its operations.

Despite the positive earnings, the bank faced challenges, including competitive pressures for deposits leading to higher deposit costs and a slight decrease in net interest margin. Nonperforming assets increased to 0.24% of total loans held for investment, primarily due to new nonaccrual loans within the commercial real estate and industrial portfolios. These challenges underscore the importance of vigilant risk management and the potential impact of economic fluctuations on asset quality.

Strategic Actions and Financial Achievements

Throughout 2023, Atlantic Union undertook strategic actions aimed at positioning the bank for future success. These included a reduction in structural expenses, the pending acquisition of American National Bank, and balance sheet restructuring. The bank's diversified business model, stable deposit base, and strong asset quality were highlighted as key factors that have helped navigate a demanding operating environment.

Net interest income saw a modest increase, driven by higher yields on securities and the loan portfolio, as well as loan growth. The bank's capital ratios remained strong, with a common equity Tier 1 capital ratio of 9.84%, reflecting a well-capitalized position that supports growth and provides a buffer against potential losses.

Key Financial Metrics

Important financial metrics from the report include:

"Net interest income was $153.5 million, an increase of $1.6 million from the third quarter of 2023... The Company's net interest margin decreased 1 basis point from the prior quarter to 3.26% for the quarter ended December 31, 2023."

This marginal increase in net interest income and the slight decrease in net interest margin are critical as they directly affect the bank's profitability. The bank's ability to manage interest income and expenses is vital for sustaining earnings growth.

The balance sheet growth is another significant aspect, with total assets increasing by approximately 3.4% from the previous year to $21.2 billion. This growth is primarily attributed to a $1.2 billion increase in loans held for investment, signaling the bank's expanding loan portfolio and potential for increased interest income.

Conclusion and Outlook

Atlantic Union Bankshares Corp's financial results for Q4 and the full year of 2023 reflect a company that has effectively managed industry challenges while executing strategic initiatives to foster growth. The bank's solid financial position, coupled with its commitment to sustainable, profitable growth, positions it well to continue building value for shareholders in the evolving banking landscape.

For a more detailed analysis of Atlantic Union Bankshares Corp's financial results, including the full earnings release and financial statements, please visit the 8-K filing.

Explore the complete 8-K earnings release (here) from Atlantic Union Bankshares Corp for further details.

This article first appeared on GuruFocus.