Atlassian Corp CFO Joseph Binz Sells Shares: An Insider Sell Analysis

Joseph Binz, the Chief Financial Officer of Atlassian Corporation, has recently sold 894 shares of the company's stock on November 14, 2023. This transaction has caught the attention of investors and market analysts, as insider activity, particularly from high-ranking executives, can often provide valuable insights into a company's financial health and future prospects.

Who is Joseph Binz of Atlassian Corp?

Joseph Binz serves as the CFO of Atlassian Corp, a position that places him in charge of the company's financial operations, including strategic planning, risk management, record-keeping, and financial reporting. His role is crucial in ensuring that Atlassian maintains its financial integrity and continues to deliver value to its shareholders. Binz's decisions and insights are instrumental in shaping the company's financial strategy, making his trading activities particularly noteworthy to investors.

Atlassian Corp's Business Description

Atlassian Corporation is a leading provider of team collaboration and productivity software. The company is known for its innovative solutions that help teams organize, discuss, and complete shared work. Atlassian's suite of products includes Jira for project and issue tracking, Confluence for team collaboration, Trello for organizing and prioritizing projects, and Bitbucket for code sharing and management. These tools are widely used by software developers, project managers, and content creators, making Atlassian a staple in many tech-driven businesses.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, such as the recent sale by Joseph Binz, can provide investors with clues about a company's internal perspective on its stock's value. Over the past year, Binz has sold a total of 6,977 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as favorable for selling rather than buying.

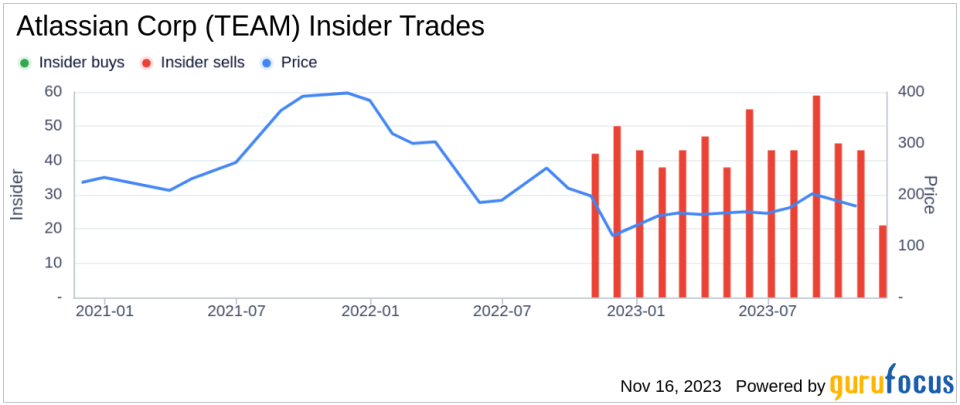

When examining the broader insider transaction history for Atlassian Corp, we observe that there have been no insider buys and 544 insider sells over the past year. This trend might indicate a consensus among insiders that the stock's price has been at a level that encourages profit-taking rather than accumulation.

On the day of Binz's recent sale, Atlassian Corp's shares were trading at $184.97, giving the company a market cap of $48.344 billion. This valuation is significant as it reflects the market's confidence in the company's future growth and profitability.

However, when we consider the GF Value, which is an intrinsic value estimate developed by GuruFocus, we find that Atlassian Corp has a price-to-GF-Value ratio of 0.53. This suggests that the stock is significantly undervalued based on its GF Value of $351.74. The GF Value takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

Despite the insider selling trend, the GF Value indicates that the stock may have considerable upside potential. This discrepancy between insider behavior and the GF Value could be due to various factors, including personal financial planning, diversification of assets, or other non-company-specific reasons.

The insider trend image above provides a visual representation of the selling pattern among Atlassian Corp insiders. This consistent selling could be interpreted in multiple ways, but without additional context, it is challenging to draw definitive conclusions about the company's outlook based solely on these transactions.

The GF Value image further illustrates the perceived undervaluation of Atlassian Corp's stock. If the company continues to perform well and deliver on its growth promises, the current stock price could represent an attractive entry point for long-term investors.

Conclusion

Joseph Binz's recent sale of Atlassian Corp shares is part of a broader pattern of insider selling at the company. While this activity might raise questions about the insiders' confidence in the stock's future performance, the GF Value suggests that the stock is significantly undervalued. Investors should consider both insider trading patterns and valuation metrics when making investment decisions. As always, it is essential to look at the full picture, including company performance, market conditions, and individual financial goals, before drawing conclusions from insider trading activities.

Atlassian Corp's position as a leader in collaboration and productivity software, combined with its current valuation, may still present a compelling case for potential investors, despite the recent insider sell-off. As with any investment, due diligence and a balanced approach to interpreting insider transactions are key to making informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.