Atlassian Corp (TEAM) Reports Strong Revenue Growth Amidst Strategic Expansion

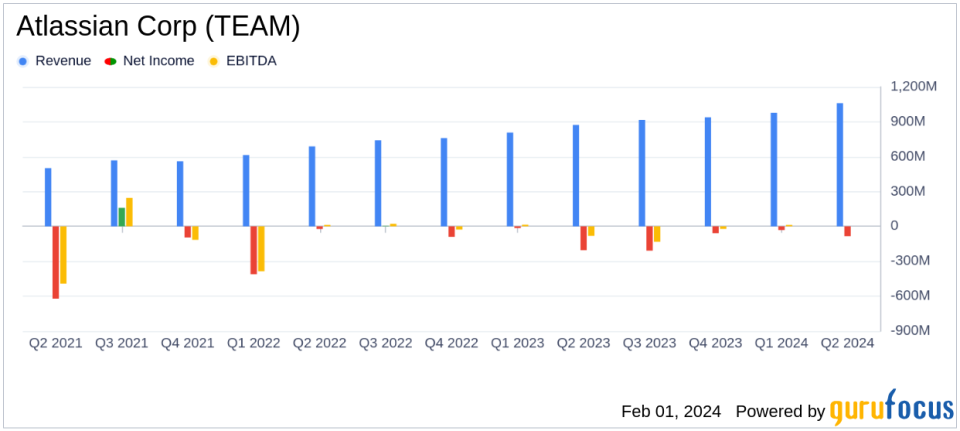

Revenue Growth: Atlassian Corp (NASDAQ:TEAM) reports a 21% year-over-year increase in quarterly revenue, reaching $1.06 billion.

Subscription Revenue: A significant 31% year-over-year growth in subscription revenue, totaling $932 million.

Operating Margins: GAAP operating margin improved to (5%), while non-GAAP operating margin increased to 24%.

Net Loss Improvement: Quarterly net loss narrowed to $84.5 million from $205 million year-over-year, with net loss per diluted share decreasing from $0.80 to $0.33.

Free Cash Flow: Strong free cash flow of $284.3 million, with a free cash flow margin of 27%.

Customer Growth: Surpassed 300,000 customers, with 42,864 customers generating more than $10,000 in Cloud ARR.

On February 1, 2024, Atlassian Corp (NASDAQ:TEAM) released its 8-K filing, announcing the financial results for its second quarter ended December 31, 2023. The company, known for its efficient team collaboration and productivity software, achieved a milestone with its first-ever $1 billion revenue quarter. Atlassian operates in four segments: subscriptions, maintenance, perpetual license, and other, which includes training, strategic consulting, and revenue from the Atlassian Marketplace app store.

Financial Performance and Strategic Focus

Atlassian's co-founder and co-CEO, Scott Farquhar, highlighted the company's significant milestones, including Jira Software surpassing $1 billion in Cloud Annual Recurring Revenue (ARR) and the customer base growing beyond 300,000. The company's focus remains on strategic priorities such as cloud migrations, serving enterprise customers, IT Service Management (ITSM), and Artificial Intelligence (AI).

Mike Cannon-Brookes, Atlassians co-founder and co-CEO, emphasized the company's innovation in AI through the Atlassian Intelligence capabilities, which are now generally available. The acquisition of Loom and its AI features is expected to enhance customer collaboration further.

Financial Highlights and Challenges

Atlassian's financial achievements are particularly noteworthy in the context of the software industry, where recurring revenue streams and cloud-based solutions are increasingly important. The 31% growth in subscription revenue underscores the company's successful transition to a cloud-based model. However, despite the strong revenue growth and improved operating margins, Atlassian still reported a GAAP operating loss, although it was significantly reduced from the previous year. This indicates ongoing investments in growth and potential challenges in managing expenses.

The balance sheet remains robust with $1.6 billion in cash and cash equivalents plus marketable securities. The company's ability to generate strong free cash flow is a critical indicator of financial health and provides the flexibility to invest in strategic initiatives.

"Q2 was full of incredible milestones as we recorded our first-ever $1 billion revenue quarter, Jira Software crossed $1 billion in Cloud ARR, and we surpassed 300,000 customers," said Scott Farquhar, Atlassians co-founder and co-CEO.

Looking Ahead

For the third quarter of fiscal year 2024, Atlassian expects total revenue to be in the range of $1,085 million to $1,105 million, with cloud revenue growth year-over-year expected to be between 30.0% to 32.0%. The company also anticipates a GAAP gross margin of approximately 81.0% and a non-GAAP gross margin of approximately 83.5%.

Atlassian's performance reflects its strong position in the software industry and its commitment to innovation and customer expansion. The company's strategic focus on cloud migrations and AI is expected to continue driving growth and improving operational efficiencies.

For more detailed information and analysis, investors and interested parties are encouraged to read the full 8-K filing and visit the Investor Relations section of Atlassians website.

Explore the complete 8-K earnings release (here) from Atlassian Corp for further details.

This article first appeared on GuruFocus.