ATO or MDU: Which Utility Gas Distribution Stock to Accumulate?

Natural gas distribution pipeline operators play a crucial role in delivering natural gas from intrastate and interstate transmission pipelines to consumers through small-diameter distribution pipelines. The natural gas network in the United States has nearly 3 million miles of pipeline. Increasing consumption of natural gas in the United States and internationally is driving demand for distribution pipelines.

Awareness about lower emissions as well as a higher volume of exports have boosted domestic natural gas production in the United States. Rising demand for natural gas from different customer groups will create demand for the addition of new distribution pipelines.

Major concerns for the industry are aging infrastructure and the increasing investment costs required to upgrade and maintain the vast network of pipelines due to the hike in interest rates. Per Playbook.AGA.org, natural gas utilities invest nearly $32 billion annually to improve the distribution network's safety. The stocks we are comparing below are also making planned capital expenditures to increase the resilience of operations.

In this article, we have run a comparative analysis on two Utility - Gas Distribution companies — Atmos Energy ATO and MDU Resource Group MDU — to decide which stock is worth retaining in your portfolio now.

Both stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Atmos Energy has a market capitalization of $16.3 billion, while the same for MDU Resources is $4.14 billion.

Growth Projections

The Zacks Consensus Estimate for Atmos Energy’s fiscal 2023 earnings is pegged at $6.05, indicating 0.3% growth in the past 60 days.

The Zacks Consensus Estimate for MDU Resources’ 2023 earnings is pegged at $1.36, which indicates 4.6% growth in the past 60 days.

Debt-to-Capital

The debt-to-capital is a vital indicator of the financial position of a company. The indicator shows how much debt is used to run the business. Atmos Energy and MDU Resources have a debt-to-capital of 38.52% and 45.35%, respectively compared with the industry’s 45.35%. Atmos Energy is currently using lower debt than its peers to manage its business operations.

Dividend Yield

Utility companies generally distribute dividends. Currently, the dividend yield for Atmos Energy is pegged at 2.55%, while that of MDU Resources is 4.37%, better than the Zacks S&P 500 Composite’s average yield of 1.65%.

Times Interest Earned Ratio

he Times interest earned ratio (TIE) measures a company's ability to pay short-term obligations or those due within one year. At present, the TIE of Atmos Energy is 8.1 and that of MDU Resources is 5.6. Having a ratio greater than 1 indicates ample liquidity to meet near-term obligations.

Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE for the trailing 12 months for Atmos Energy and MDU Resources is 8.38% and 11.5%, respectively, outperforming the industry’s ROE of 8.81%.

Price Performance

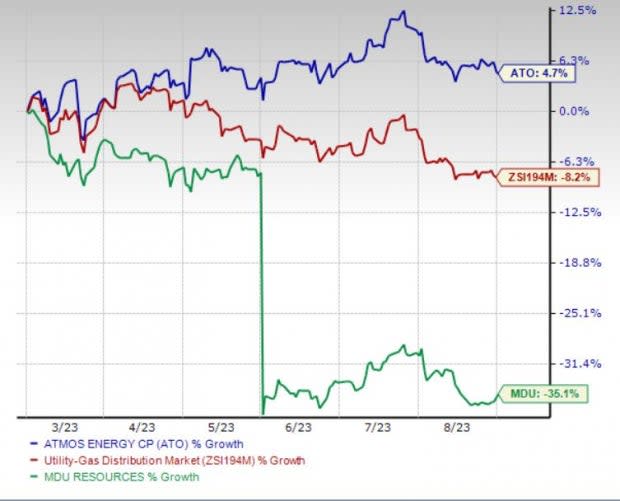

In the past six months, Atmos Energy’s shares have gained 4.7% against the industry's decline of 8.2%, whereas shares of MDU Resources have declined by 35.1%.

Image Source: Zacks Investment Research

Outcome

Even though both companies are efficiently providing services to customers and should be included in one’s portfolio, the above comparisons put Atmos Energy ahead of MDU Resources.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report