Atomera Inc (ATOM) Reports Mixed Fiscal Year 2023 Results with Revenue Growth and Widened Net Loss

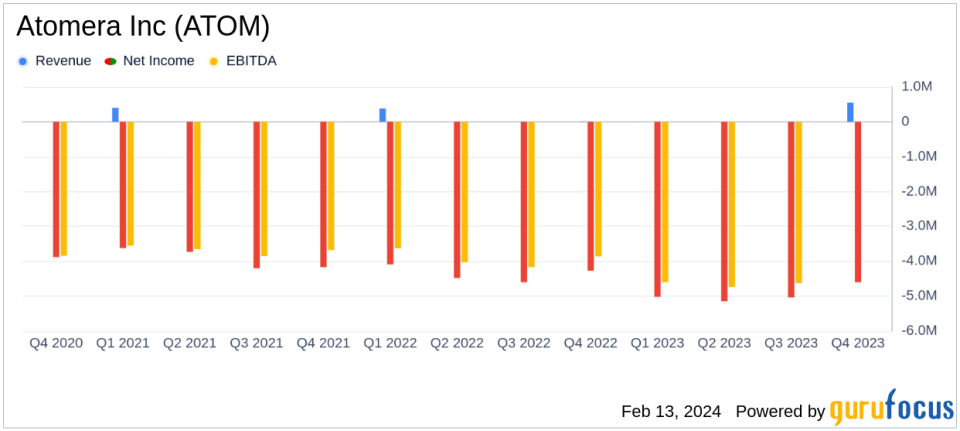

Revenue: Reported $550,000 for Q4 2023, marking a year-over-year increase.

Net Loss: Widened to ($19.8) million for fiscal year 2023, compared to ($17.4) million in the previous year.

Adjusted EBITDA: Loss increased to ($16.6) million for fiscal year 2023 from ($14.1) million in fiscal 2022.

Cash Position: Ended the year with $19.5 million in cash, cash equivalents, and short-term investments.

Shares Outstanding: Total number of shares outstanding was 26.1 million as of December 31, 2023.

Atomera Inc (NASDAQ:ATOM) released its 8-K filing on February 13, 2024, providing a detailed account of its financial performance for the fourth quarter and the fiscal year ended December 31, 2023. The company, known for its development, commercialization, and licensing of proprietary processes and technologies for the semiconductor industry, including the Mears Silicon Technology (MST), has reported a revenue of $550,000 for the fourth quarter. This revenue primarily stems from the installation of MST at a licensee's facility.

Despite the revenue growth, Atomera Inc faced a net loss of ($4.6) million, or ($0.18) per basic and diluted share in the fourth quarter of 2023, which is a slight increase from a net loss of ($4.3) million, or ($0.18) per basic and diluted share, for the same period in the previous year. For the full fiscal year 2023, the company's net loss expanded to ($19.8) million, or ($0.80) per basic and diluted share, from ($17.4) million, or ($0.75) per basic and diluted share in fiscal 2022. The adjusted EBITDA loss also grew to ($16.6) million for fiscal 2023, up from a loss of ($14.1) million in the previous fiscal year.

Atomera's cash reserves decreased slightly from $21.2 million as of December 31, 2022, to $19.5 million as of December 31, 2023. The company's total number of shares outstanding as of the end of the fiscal year was 26.1 million.

President and CEO Scott Bibaud commented on the company's progress, stating:

There is clear evidence the company is executing on its strategy to commercialize MST. With our technology now installed at two customer fabs, were focusing on moving additional customers along the engagement pipeline toward the royalty phase, said Scott Bibaud, President and CEO. The semiconductor industry is currently in an ideal state to adopt new technology and the performance improvements enabled by MST are compelling to fabs and foundries seeking to gain cost-effective advantages in highly competitive markets.

Atomera's financial achievements, particularly the revenue from commercial licensees, underscore the company's potential in the semiconductor industry. The adoption of MST technology by two customer fabs is a significant step towards broader commercialization and future royalty revenues. However, the increased net loss and adjusted EBITDA loss reflect the challenges faced by the company in a highly competitive and capital-intensive industry.

The company's balance sheet shows a solid position with $19.5 million in cash and short-term investments, providing Atomera with the financial flexibility to continue its operations and invest in further development and commercialization of its MST technology. The income statement reflects the company's current stage of growth, with revenue generation starting to materialize but with ongoing investments leading to net losses.

Atomera's performance in the fiscal year 2023 demonstrates a company at a critical juncture, with significant technological advancements and initial commercial success offset by the financial realities of scaling up in a competitive industry. Investors and stakeholders will be watching closely to see if the company can leverage its technological edge into sustainable financial growth in the coming years.

For more detailed financial tables and information on Atomera's fiscal year 2023 performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Atomera Inc for further details.

This article first appeared on GuruFocus.