Atrion Corp (ATRI): A Medical Device Stock with Good Outperformance Potential

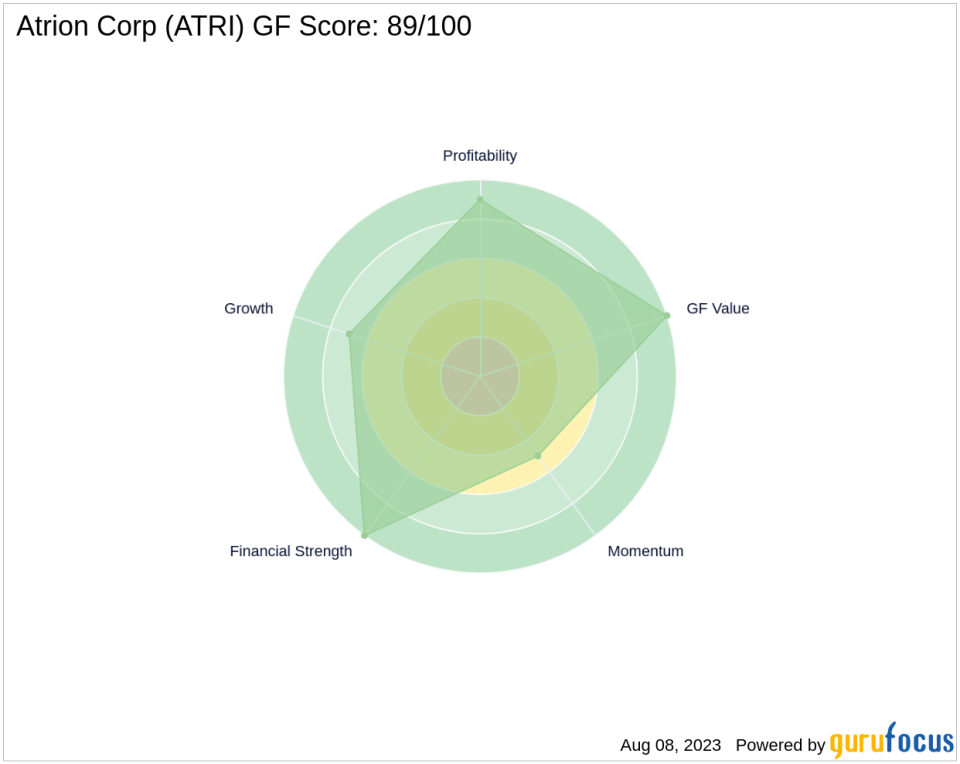

Atrion Corp (NASDAQ:ATRI), a leading player in the Medical Devices & Instruments industry, is currently trading at $557 per share. The company has a market capitalization of $980.596 million and has seen a stock price gain of 4.7% today. Over the past four weeks, the stock has gained 4.10%. According to GuruFocus, Atrion Corp has a GF Score of 89/100, indicating good outperformance potential. The GF Score is a stock performance ranking system developed by GuruFocus, which is closely correlated to the long-term performances of stocks.

Financial Strength Analysis

Atrion Corp's Financial Strength Rank is 10/10, indicating a strong financial situation. The company has a debt to revenue ratio of 0.00, suggesting that it is not burdened by debt. Furthermore, its Altman Z score of 28.67 indicates a low probability of bankruptcy.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, indicating high profitability and consistency. Atrion Corp has an operating margin of 19.23% and a Piotroski F-Score of 5. However, the trend of the Operating Margin over the past five years shows a decrease of -5.80%. Despite this, the company has been profitable for the past 10 years, demonstrating its ability to maintain profitability.

Growth Rank Analysis

Atrion Corp's Growth Rank is 7/10, indicating decent growth in terms of revenue and profitability. The company has a 5-year revenue growth rate of 4.60% and a 3-year revenue growth rate of 7.20%. Its 5-year EBITDA growth rate is 1.20%, suggesting a steady growth in the company's business operations.

GF Value Rank Analysis

The company's GF Value Rank is 10/10, indicating a high value based on historical multiples and future estimates. This suggests that the stock is undervalued, providing a good buying opportunity for value investors.

Momentum Rank Analysis

Atrion Corp's Momentum Rank is 5/10, indicating moderate momentum in the stock's performance. This suggests that the stock has the potential for future gains, although it may not be the top performer in the short term.

Competitor Analysis

When compared to its competitors in the same industry, Atrion Corp stands out with its high GF Score. BioLife Solutions Inc (NASDAQ:BLFS) has a GF Score of 76, Embecta Corp (NASDAQ:EMBC) has a GF Score of 25, and LeMaitre Vascular Inc (NASDAQ:LMAT) has a GF Score of 88. This suggests that Atrion Corp is a strong contender in the Medical Devices & Instruments industry. More details about the competitors can be found here.

Conclusion

In conclusion, Atrion Corp's overall GF Score of 89/100 indicates good outperformance potential. The company's strong financial situation, high profitability, decent growth, high value, and moderate momentum make it an attractive investment. However, investors should also consider the company's decreasing operating margin trend and moderate momentum rank when making investment decisions.

This article first appeared on GuruFocus.