AUD Breakout Points to Topside Targets- Looking for Lower High

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10655.15 | 10687.98 | 10653.48 | -0.24 | 51.24% |

Chart - Created Using FXCM Marketscope 2.0

Release | Expected | Actual |

Wholesale Inventories (MoM) (JUN) | 0.4% | -0.2% |

Wholesale Sales (MoM) (JUN) | 0.7% | 0.4% |

Although the Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) remains 0.24 percent lower from the open, the greenback appears to be finding soft support around the 38.2 percent Fibonacci expansion around the 10,650 region, but the greenback may continue to threaten the key level amid the batch of dismal developments coming out of the world’s largest economy.

Indeed, the 0.2 percent contraction in Wholesale Inventories along with the slowdown in Wholesale Sales spurred a bearish reaction in the USD, but we may see a more meaningful rebound in the week ahead as the index holds above the monthly low (10,650). At the same time, we will be keeping a close eye on the 30-minute relative strength index as a bullish divergence appears to be taking shape, and we may see the greenback threaten the bearish trend from earlier this month as it carves a short-term base.

The economic docket for the following week may help to prop up the greenback as U.S. Retail Sales are projected to increase another 0.3 percent in July, while the headline reading for inflation is expected to grow an annualized 2.0 percent, and a slew of positive developments may pave the way for a near-term rally as it raises the Fed’s scope to start tapering the asset-purchase program at the September 17-18 meeting.

Should the 38.2 percent Fib (10,652) mark a higher low, we will revert back to our game plan of buying dips in the USD, but the 78.6 percent retracement (10,585) may come up on our radar should the fundamental developments coming out of the U.S. economy fall short of market expectations.

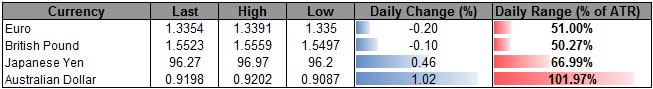

Two of the four components rallied against the dollar, led by a 1.02 percent advance in the Australia dollar, and the near-term correction may gather pace in the days ahead as it breaks out of the downward trending channel carried over from the previous week.

In light of recent price developments, the 61.8 percent retracement (0.9210-20) may provide interim resistance, and we will look for a lower high in the exchange rate as the higher-yielding currency remains poised to face additional headwinds over the near to medium-term.

According to Credit Suisse overnight index swaps, market participants still see the Reserve Bank of Australia (RBA) delivering another 25bp rate cut over the next 12-months, and the bearish trend in the AUDUSD should continue to take shape amid the deviation in the policy outlook.--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.