AUDUSD Scalp Looks to Sell Rallies- Bearish below 9570

Talking Points

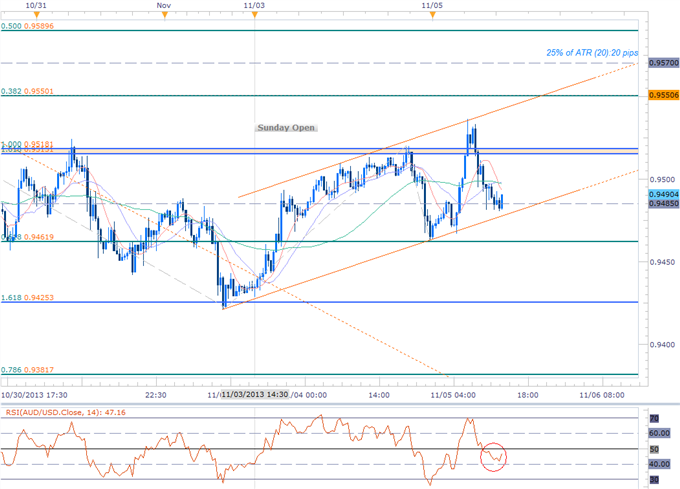

AUDUSD reversal off October highs halts at Fibonacci support- Key Event Risk Ahead

Near-term price action & RSI shifts focus higher to open the week

Bearish below 9570- Short scalp conviction below 9425

AUDUSD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

AUDUSD November opening range in focus post RBA

Advance off the August lows seems to have completed 5-waves up- Expect correction

Channel support break late last month now being tested as resistance

Near-term resistance range 9510-9552, Key resistance 9673-79714

Support 9426, 9324, Key support 9220

Daily RSI struggling to hold above 50- Cautiously bearish below 50- conviction below 40

Key Events Ahead: Australian Trade Balance Wednesday, Employment Report on Thursday

AUDUSD Scalp Chart

Notes: The AUDUSD broke below channel support late last month before rebounding off the 38.2% retracement taken from the advance off the late-August lows at 9426. Note that the rally off this mark was halted today at former channel support, currently around 9535. The broader ascent off the yearly lows looks to have completed a 5-wave advance and as such, we look for a near-term correction lower after reversing off key resistance at 9673- 9714.

Although the initial weekly opening range looks constructive, it’s important to remain prudent as we head into key event risk this week with Australian trade balance and employment data on tap ahead of US GDP and Non-Farm Payrolls. The November opening range is now in focus with price action into the close of the week likely to offer further conviction on a medium-term directional bias. That said, we will look to sell rallies / breaks of support with only a breach above 9570 invalidating our near-term scalp bias. A move sub 9426 warrants short exposure into subsequent support targets with traders advised to reduce exposure as we head into key US event risk later in the week.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

Entry/Exit Targets | Timeframe | Level | Significance |

Resistance Target 1 | Daily / 30min | 9515/18 | 1.618% & 100% Fib Extensions |

Resistance Target 2 | Daily / 30min | 9550 | 23.6% & 38.2% Retracement |

Bearish Invalidation | Daily / 30min | 9570 | October 24th Low / Soft Resistance |

Break Target 1 | 30min | 9590 | 50% Retracement |

Break Target 2 | 30min | 9621/30 | 1.618% Fib Extension / 61.8% Retrace |

Break Target 3 | Daily / 30min | 9671/85 | 61.8% Fib Extension / 78.6% Retrace |

Break Target 4 | Daily / 30min | 9711/19 | 50% Retrace / 2.618% Fib Ext |

Support Target 1 | 30min | ~9485 | Soft Channel Support / Pivot |

Support Target 2 | 30min | 9460 | 61.8% Retracement |

Bullish Invalidation | Daily / 30min | 9425 | 1.618% Fib Ext / 38.2% Retrace |

Break Target 1 | 30min | 9382 | 78.6% Retracement / 2011 Low |

Break Target 2 | Daily / 30min | 9320/24 | 50% Retrace / July High |

Break Target 3 | 30min | 9275/86 | 100% & 2.618 Fib Exts / Oct Range Low |

Break Target 4 | Daily / 30min | 9219/22 | 61.8% Retrace(s) / August High |

Daily | 79 | Profit Targets 18-20pips | |

Other Setups in Play:

USD Setups Heading into November- NZD, JPY Scalp Biases at Risk

AUDJPY Scalp Setup Eyes Key Support- Bias Bearish Below 93.80

USD Setups Heading into FOMC- EUR, GBP & Cross at Resistance

Trade these setups and more alongside the DailyFX research team everyday with DailyFX on Demand

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for a Live Scalping Webinar on Monday on DailyFX and Tuesday, Wednesday and Thursday mornings on DailyFX Plus (Exclusive of Live Clients) at 1230 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.