Aurora Cannabis’ Q3 Loss Wider than Expected; Shares Plunge 10%

Shares of Aurora Cannabis (ACB) fell more than 10% in early trading Friday after the company posted a disappointing third quarter with lower-than-expected sales as COVID-19 lockdowns and increased competition outshined gains in its medical cannabis business. Aurora Cannabis is one of the world’s largest cannabis companies, serving both the recreational and the medical cannabis market.

Total net revenue for Q3 2021 came in at C$55.2 million, down 25% year-on-year. Sales in Aurora’s Canadian recreational business fell 53% to C$18 million. In contrast, medical business revenue increased 17% to C$36.4 million. Net selling price of cannabis rose to C$5.00 per gram in the third quarter, from C$4.64 in the prior-year quarter.

Meanwhile, net loss was C$164.7 million (C$-0.85 per share) in the quarter ended March 31, down from a net loss of C$139.3 million (C$1.40 per share) for the same quarter in fiscal 2020.

The Adjusted EBITDA loss was C$24 million in the three months ending March 31, compared to $49.6 million from the prior-year quarter.

Aurora Cannabis’ CEO Miguel Martin said, "Consistent with many of our peers, the quarter presented challenges in the Canadian adult-use segment. This reinforces the importance of Aurora's broadly diversified business model that balances domestic medical, international medical, and adult-use platforms. To that point, we delivered the strongest performance in domestic medical and the best results in international medical cannabis of any Canadian LP during the period."

Aurora revealed a plan to achieve an annualized C$60 million to C$80 million cost savings over the next 12 to 18 months. Selling, general and administrative expenses fell 42% to C$45.1 million in the quarter. (See Aurora Cannabis stock analysis on TipRanks)

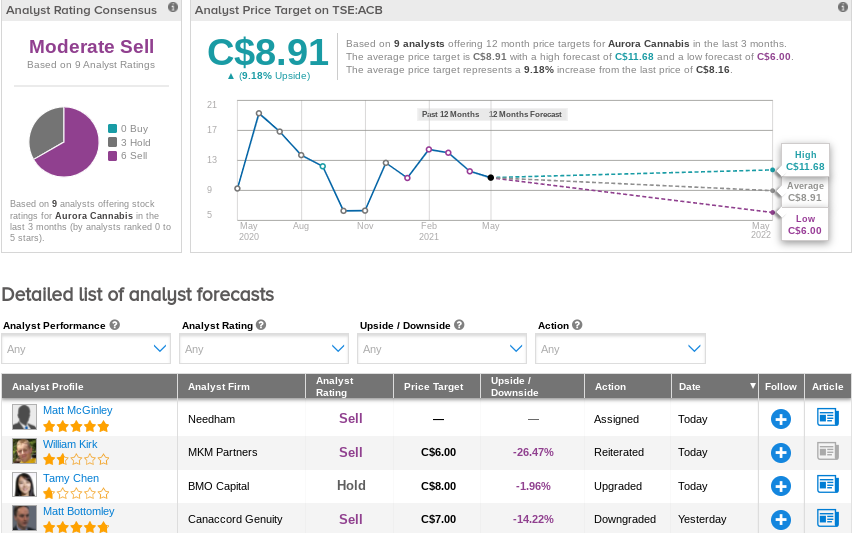

Yesterday, Canaccord Genuity analyst Matt Bottomley downgraded ACB to Sell from Hold and lowered its price target to C$7.00 (from C$14.00) for 14.2% downside potential.

Bottomley said in a research note that Aurora's Q3 financial results were significantly lower than estimates as the company's adult-use sales in Canada continue to fall fast.

The rest of the Street is cautiously pessimistic on ACB with a Moderate Sell consensus rating based on 3 Holds and 6 Sells. The average analyst price target of C$8.91 implies 9.2% upside potential to current levels.

Related News:

Trulieve Beats on Revenue, Misses on Earnings in Q1

Rritual Superfoods Teams Up With Ultimate Sales Canada

Village Farms Swings To A 1Q Loss; Shares Plunge 20%