Australian Dollar Sensitive to RBA Decision and Risk Trend

Australian Dollar Sensitive to RBA Decision and Risk Trend

Fundamental Forecast for Australian Dollar: Neutral

Profits Booked on Australian Dollar Long Position Before FOMC Meeting

Aussie Vulnerable if Key US Economic Data Points to Sooner QE “Taper”

DailyFXSSI Speculative Sentiment Gauge Argues for AUD/USD Weakness

We’ve argued in favor of a significant Australian Dollar recovery since early August. We thought improving economic news-flow will help arrest the slide Chinese economic growth expectations, boosting the outlook for Australia’s mining sector exports and prompting an Aussie-supportive shift in RBA policy bets. The case for an upside scenario seemed all the more compelling against a backdrop of highly over-extended speculative net-short positioning, and we proceeded to enter long AUD/USD after an attractive technical setup presented itself.

Prices turned higher as expected, with COT positioning data over recent weeks pointing to swift short-covering. The back-story behind the move has reflected our baseline scenario. Chinese economic growth expectations not only stopped falling, but the median 2013 forecast was upgraded for the first time in over a year in September. Meanwhile, the priced-in RBA policy outlook no longer sees any interest rate cuts over the coming 12 months (according to data compiled by Credit Suisse).

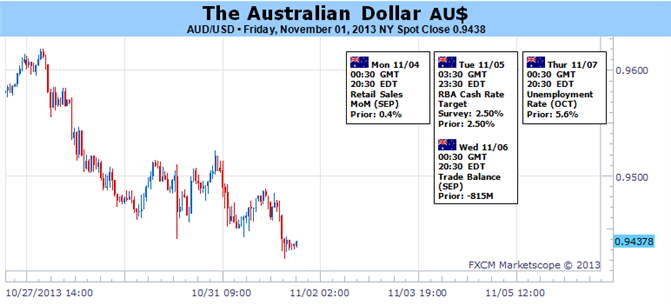

Looking ahead, the domestic landscape remains supportive. Last week’s upbeat Chinese PMI data supported our baseline scenario. Meanwhile, China’s benchmark SHIBOR lending rate – a recently prominent sore spot for investors – turned lower anew, easing fears of a debilitating credit squeeze. Traders are pricing in a meager 4 percent probability of further easing at the upcoming RBA policy meeting while October’s jobs data is forecast to print in line with established trends, offering little impetus to dislodge status-quo expectations.

A lingering sensitivity to risk appetite trends remains a threat however. AUD/USD shows a notable correlation the MSCI World Stock Index, a proxy measure of broad-based market sentiment. That makes for a vulnerability to the outbreak of risk aversion as investors attempt to nail down the timing of the first move to “taper” Fed QE asset purchases. In fact, we noted last week that the Aussie may fall as markets primed for a dovish turn in FOMC rhetoric are disappointed and booked profits on our long trade accordingly.

The US economic calendar is brimming with top-tier event risk in the days ahead. The service-sector ISM gauge, third-quarter GDP figures, and October’s Employment report are all on tap. With Ben Bernanke and company still in data-dependent mode, each one of these outcomes will be looked at as an important piece of the overall Fed policy outlook puzzle. Needless to say, that is likely to generate considerable gyrations in sentiment trends, and thereby the Aussie. Signs of resilience akin to last week’s impressive manufacturing ISM print may feed fears of a sooner move to reduce QE, eroding risk appetite and pushing the Australian unit lower. -IS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.