Auto Parts Retailer Stocks Q3 Highlights: Genuine Parts (NYSE:GPC)

Let's dig into the relative performance of Genuine Parts (NYSE:GPC) and its peers as we unravel the now-completed Q3 auto parts retailer earnings season.

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

The 5 auto parts retailer stocks we track reported a mixed Q3; on average, revenues were in line with analyst consensus estimates Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but auto parts retailer stocks held their ground better than others, with the share prices up 3.8% on average since the previous earnings results.

Genuine Parts (NYSE:GPC)

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

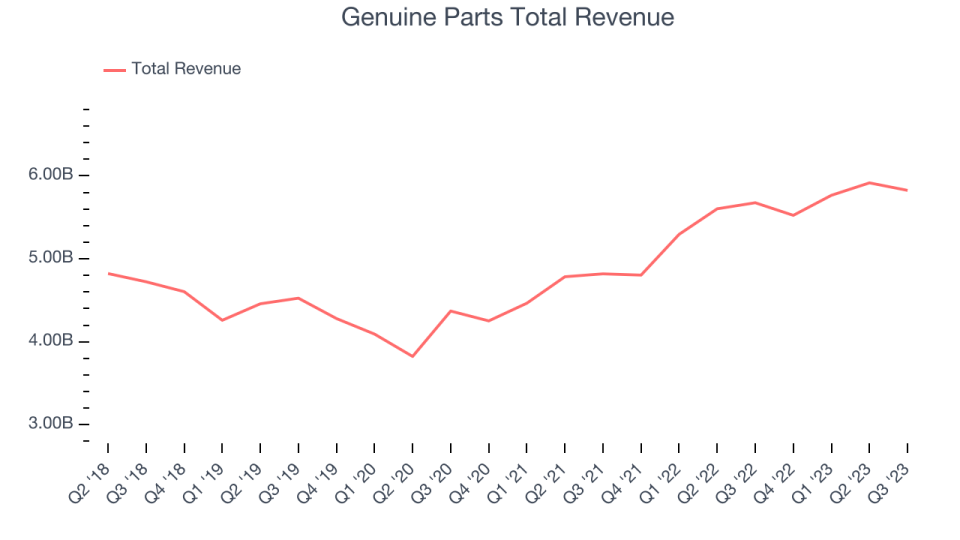

Genuine Parts reported revenues of $5.82 billion, up 2.6% year on year, falling short of analyst expectations by 1.5%. It was a mixed quarter for the company, with a decent beat of analysts' gross margin estimates but a miss of analysts' revenue estimates.

"Our third quarter performance was highlighted by double digit earnings growth, driven by benefits from the mix and geographic diversity of our businesses as well continued progress on our strategic initiatives," said Paul Donahue, Chairman and Chief Executive Officer.

The stock is down 6.9% since the results and currently trades at $138.43.

Is now the time to buy Genuine Parts? Access our full analysis of the earnings results here, it's free.

Best Q3: O'Reilly (NASDAQ:ORLY)

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ:ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

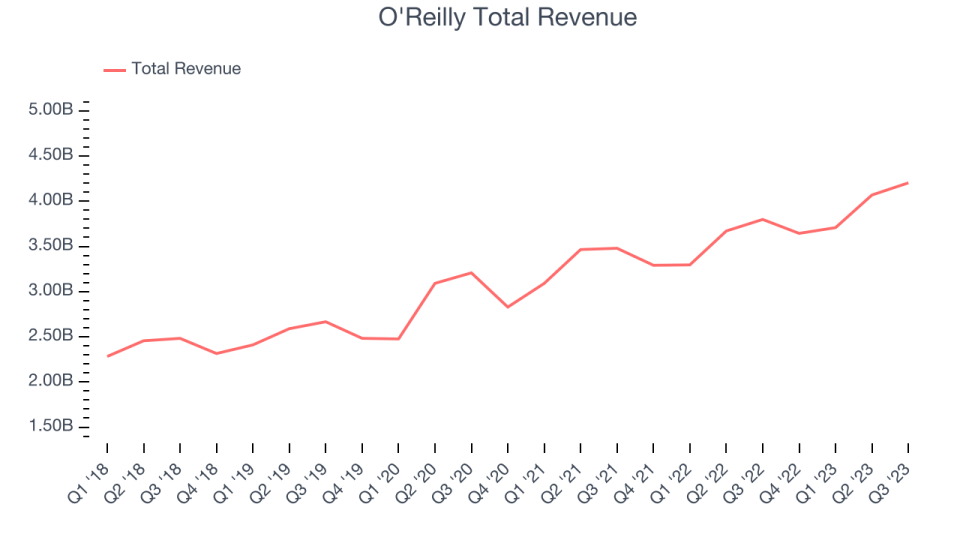

O'Reilly reported revenues of $4.20 billion, up 10.7% year on year, outperforming analyst expectations by 2.9%. It was a strong quarter for the company, with a solid beat of analysts' revenue estimates.

O'Reilly delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is up 7.8% since the results and currently trades at $944.99.

Is now the time to buy O'Reilly? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Advance Auto Parts (NYSE:AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Advance Auto Parts reported revenues of $2.72 billion, up 2.9% year on year, exceeding analyst expectations by 1.6%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year.

Advance Auto Parts had the weakest full-year guidance update in the group. The stock is up 6.8% since the results and currently trades at $62.43.

Read our full analysis of Advance Auto Parts's results here.

Monro (NASDAQ:MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $322.1 million, down 2.3% year on year, falling short of analyst expectations by 2.8%. It was a slower quarter for the company, with a miss of analysts' revenue estimates.

Monro had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 15.6% since the results and currently trades at $28.56.

Read our full, actionable report on Monro here, it's free.

AutoZone (NYSE:AZO)

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE:AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

AutoZone reported revenues of $4.19 billion, up 5.1% year on year, inline with analyst expectations. It was a decent quarter for the company, with a beat of analysts' EPS estimates.

The stock is down 4.3% since the results and currently trades at $2,546.65.

Read our full, actionable report on AutoZone here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned