Auto Roundup: ABG's $1.2B Buyout Deal, MGA's Revised 2025 View & More

Last week, the China Passenger Car Association released vehicle sales data. China's passenger vehicle sales rebounded on a year-over-year basis in August, driven by increased discounts and tax incentives for eco-friendly vehicles. Despite a sluggish economic backdrop, consumer sentiment surged, resulting in 2.2% year-over-year growth in car sales, reaching 1.94 million units. This marks the first year-over-year increase since May, with a notable 8.5% rise from July. In the eight months of the year, total sales reached 13.38 million units, reflecting a 1.8% increase.

As we know, Detroit 3 automakers — General Motors, Ford and Stellantis — face a strike threat if they don't reach an agreement with the United Auto Workers (“UAW”) before the current four-year contract expires at midnight on Sep 14, 2023. The UAW is determined to negotiate better terms, conditions and benefits for its members this year. To this end, Ford presented a contract offer to the UAW last to last week after the union called Detroit Three automakers to come up with counterproposals. However, Ford’s proposal fell short of UAW’s expectations. Last week, General Motors came up with a counterproposal, offering a wage hike of 10% to roughly 46,000 of its UAW-represented workers. However, Shawn Fain, the president of the UAW, called the offer “insulting.”

On the news front, Asbury Automotive ABG is set to acquire Jim Koons Automotive Companies, marking the largest auto retail acquisition since 2021. Cummins CMI, PACCAR PCAR and Daimler announced a collaboration for battery cell production in the United States. Magna MGA unveiled its Gen5 front camera module system and also lifted its 2025 sales view. Allison Transmission ALSN received a $13 million contract from the U.S. Army for the production of the M10 Booker Combat Vehicle.

ALSN sports a Zacks Rank #1 (Strong Buy). PCAR carries a Zacks Rank #2 (Buy), while ABG, MGA and CMI are currently Zacks #3 Ranked (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Last Week’s Top Stories

Asbury inked a deal to acquire Jim Koons for around $1.2 billion. This significant deal includes 20 dealerships, 29 franchises, six collision centers and one of the highest-volume Toyota and Stellantis dealerships in the United States, with more than $3 billion in revenues in 2022. Subject to satisfactory closing conditions, the acquisition is expected to close in late 2023 or early 2024 and will be funded through Asbury's cash reserves, credit facility and existing liquidity. The auto retailer sees this acquisition as transformative, allowing it to expand into a rapidly growing Mid-Atlantic region.

This buyout is a testament to the strength of the U.S. auto retail market in 2023. Asbury's president and CEO, David Hult, expressed confidence in the profitability of Koons dealerships and emphasized the shared values of both companies in prioritizing people, employees and the community. This acquisition represents a significant step forward for Asbury, solidifying its position as a major player in the U.S. automotive retail landscape.

Magna unveiled its Gen5 front camera module system during the IAA Mobility 2023 event. Designed for a European original equipment manufacturer, this one-box camera module boasts an impressive 120-degree horizontal and 48-degree vertical field of view. The production of the same is set to commence in late September 2023. It can perceive obstacles up to 160 meters ahead and detect side objects like traffic lights, emergency vehicles and merging cars. With eight megapixels, a 36-frames-per-second frame rate and color imaging, the system can also fuse data from up to five radars. Notable features include Trained Park Assist, Environmental Condition Recognition, Monocular Scene Reconstruction and Hazard Detection, emphasizing road safety and driver assistance.

Magna also updated its 2025 outlook to take into account the benefits of the Veoneer Active Safety buyout. It now expects full-year sales in the band of $46.7-$49.2 billion, up from the prior guidance of $44.7-$47.2 billion, due to the upward revision of the sales forecast of the Power & Vision segment. Revenues from the segment are projected in the $16.8-$17.4 billion range, up from the previous forecast of $14.8-$15.4 billion. Sales expectations from the Body Exteriors & Structures, Seating Systems and Complete Vehicles units remain unchanged in the band of $20-$21 billion, $6.2-$6.6 billion and $4-$4.5 billion, respectively. The adjusted EBIT margin is envisioned at 6.7-7.8%, same as the prior guidance.

Allison was awarded a contract for the second phase of the U.S. Army’s Low-Rate Initial Production. The contract is worth nearly $13 million and is for producing the M10 Booker Combat Vehicle, formerly known as Mobile Protected Firepower. The M10 Booker, a modernization initiative by the U.S. Army, seeks to strengthen the combat power of the Army’s Infantry Brigade Combat Teams. The vehicle has reached the second phase of low-rate production with Allison’s 3040 MX cross-drive transmission.

Allison has a knack for providing its customers with propulsion solutions required for armored combat vehicles. The U.S. Army is likely to buy 500 MPF vehicles by 2035, contributing approximately $250 million in revenues for Allison’s Defense end market. The 3040 MX transmission is one of the many cross-drive propulsion solutions from Allison. The variants of the X200 Series, X1100 Series, 2000 SP Series, 3000 SP Series, 4000 SP Series and the new eGen Force are additional defense product offerings by Allison that are applied throughout the organization.

Cummins, PACCAR and Daimler have formed a joint venture (JV) to accelerate and localize battery cell production and the battery supply chain in the United States. Through this JV, the companies plan to manufacture battery cells for electric commercial vehicles and industrial applications. For the 21-gigawatt-hour factory, total investment is estimated to be in the range of $2 billion to $3 billion. Each of the three companies will own 30% of the JV. The initial focus of the JV will be the lithium-iron-phosphate (LFP) battery technology family for commercial battery-electric trucks.

Cummins, PACCAR and Daimler expect the demand for battery technology to boom this decade, and a state-of-the-art dedicated battery cell factory is expected to benefit U.S. customers. EVE Energy, a Chinese battery cell manufacturer, will hold a 10% stake in the JV and serve as a technology partner. The joint venture not only advances critical technology solutions but also accelerates the U.S. energy transition. It seeks to localize top-quality battery production to support customer operational and environmental objectives. This collaboration aligns Cummins, PACCAR and Daimler with the Paris Climate Agreement, reducing carbon emissions.

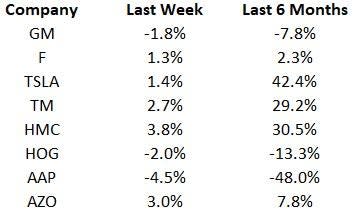

Price Performance

The following table shows the price movement of some of the major auto players over the last week and the six-month period.

Image Source: Zacks Investment Research

What's Next in the Auto Space?

Stay tuned for updates on the UAW-Detroit 3 contract talks and the looming strike. Investors will keep track of the quarterly release of Copart, scheduled for Sep 14.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report