Auto Roundup: AZO's Q4 Results, CZOO's Debt Restructuring Deal & More

The U.S. auto industry faces growing turmoil with the escalation of the UAW strike against the Detroit 3 automakers. The strike began on Sep 15 at three plants.A week has passed without a new labor contract in place, prompting UAW to extend strikes to 38 parts and distribution centers across 20 states, primarily focusing on General Motors and Stellantis.

Targeting these centers may not immediately disrupt vehicle production but could cause significant delays in repairs, aggravating supply chain issues. Ford appears closer to resolution, with positive statements suggesting an agreement. It is likely to address wage tiers, cost-of-living adjustments and profit-sharing and position the company favorably compared to its competitors.

Last week, the European Automobile Manufacturers Association released data on new car registrations for August 2023. The European Union (“EU”) car market rose 21% last month to 787,626 units, marking the 13th straight month of growth. Most EU markets witnessed robust growth. Registrations in Germany, France and Italy rose 37.3%, 24.3% and 11.9%, respectively, on a year-over-year basis. Spain saw an increase of 7.8% in registrations last month. In the first eight months of 2023, EU market vehicle registrations reached 7.1 million units, up 17.9% year over year. During January-August, the majority of markets recorded substantial double-digit percentage growth, with the top four being Spain (20.5%), Italy (20.2%), France (16.6%) and Germany (16.5%).

On the news front, auto retailer Lithia Motors LAD signed a deal to partner with Pinewood Technologies and acquire the U.K. motor and fleet management divisions of Pendragon plc. Auto parts retailer AutoZone AZO released fiscal fourth-quarter 2023 results, wherein it topped both earnings and sales estimates. Online car retailer Cazoo Group CZOO inked a debt restructuring agreement with its noteholders, entailing the elimination of convertible notes in exchange for fresh senior secured debt and new equity.

U.S. auto giant General Motors GM announced that it would temporarily shut down the CAMI Assembly Plant in Ontario from October until spring 2024. Auto equipment supplier Autoliv ALV also made to the top stories as it joined forces with Great Wall Motor to improve safety solutions and redefine the driving experience.

LAD, AZO, CZOO, GM and ALV carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Last Week’s Top Stories

AutoZone reported earnings of $46.46 per share for fourth-quarter fiscal 2023 (ended Aug 26, 2023), up 14.7% year over year. Earnings surpassed the Zacks Consensus Estimate of $44.51. Net sales grew 6.4% year over year to $5,690.6 million. The top line also surpassed the Zacks Consensus Estimate of $5,581 million. In the reported quarter, domestic commercial sales totaled $1,499 million, up from $1,442.3 million recorded in the year-ago period. Domestic same-store sales (sales at stores open at least for a year) rose 1.7%.

During the quarter, AutoZone opened 53 new stores in the United States, 27 in Mexico and 17 in Brazil. It exited the quarter with 6,300 stores in the United States, 740 in Mexico and 100 in Brazil. The total store count was 7,140 as of Aug 26, 2023. AutoZone had cash and cash equivalents of $277.1 million as of Aug 26, 2023, up from $264.4 million as of Aug 27, 2022. The total debt amounted to $7,668.5 million as of Aug 26, marking an increase from $6,122.1 million as of Aug 27, 2022.

Lithia signs a deal to partner with Pinewood Technologies and acquire the U.K. motor and fleet management divisions of Pendragon. The acquisition will help Lithia expand its presence in the U.K. market and is estimated to generate more than $4.5 billion in annual revenues. Using Pinewood’s technology platform, Lithia will enhance its digital capabilities in its U.K. operations. Lithia and Pinewood Technologies will form a joint venture to co-develop automotive technology solutions to reap the benefits of the opportunities that the North American market has to offer. Lithia will own 16.7% of the remaining Pinewood business after the transaction.

Pendragon’s UK motor and fleet management divisions complement Lithia's existing U.K. brand and geographic footprint and the combined platform represents 3.6% of the new vehicle market share. After completion, the combined business will report to Neil Williamson, president of Lithia U.K. Bryan DeBoer, president and CEO of Lithia & Driveway, said that the partnership with Pinewood Technologies and Pendragon's U.K. motor and vehicle management division buyout is a crucial step toward the company’s long-term growth strategy. This transaction underpins Lithia’s previously stated goal of making $2.00 of EPS for every $1 billion in revenues in the future.

Cazoo announced a debt restructuring agreement with its noteholders. The company will be swapping $630 million of its existing debt for $200 million in new senior-secured debt due in February 2027. Additionally, this agreement entails an equity component. Class A ordinary shares issued to the current debt holders will account for 92% of the company's total outstanding Class A Shares following this transaction. Existing shareholders will retain an 8% stake in the post-transaction Class A shares. Furthermore, they are positioned to benefit from three tranches of new warrants, contingent upon the company hitting equity valuation benchmarks ranging from $525 million to $1.5 billion.

The reduction of debt is key to the company's growth prospects. The current capital structure has exerted considerable weight on the company's equity. Alex Chesterman, Cazoo's founder and executive chairman, encapsulated the company's sentiment, expressing that the agreement was a cornerstone in "deleveraging Cazoo’s capital structure." Cazoo also received a notice from the NYSE on Sep 19 about non-compliance with certain listing standards. The company's average global market capitalization had dipped below the requisite benchmark. Cazoo is now on the clock to craft a plan to address these deficiencies and ensure its ongoing presence on the NYSE.

General Motors will halt the production of BrightDrop commercial vans in its Ontario plant from October until next spring due to delayed delivery of battery modules. These modules power the BrightDrop Zevo 600 and Zevo 410 electric vans produced at the facility. GM spokesperson Maria Violette cited "previously announced delays in battery-module supply" as the reason for the production halt. The CAMI plant also suspended operation in July for two weeks due to the unavailability of parts after two weeks of summer downtime. The CAMI Assembly Plant employs around 1,500 people, with approximately 1,200 belonging to the Unifor union.

The production of commercial vans in CAMI Assembly will resume in the spring of 2024, underpinned by the launch of CAMI’s new battery module line. The line will produce enough battery modules to fully support the production of BrightDrop vans and supplement electric vehicle (EV) production at other General Motors plants. The 400,000-square-foot plant, which will begin battery module production in the second quarter of 2024, is dedicated to producing BrightDrop Zevo and other EVs.

Autoliv announced a collaboration with Great Wall Motor, a Chinese automobile manufacturer. Through this partnership, Autoliv wants to consolidate its position with Chinese OEMs. Autoliv and Great Wall Motor have been working together since 2003. During its first collaboration, Autoliv developed and started supplying seatbelts for Haval sport utility vehicles. In 2019, both companies signed a joint research statement for road safety evaluation studies in North America to improve safety and product support for Great Wall Motor’s globalization strategy.

The latest collaboration focuses on innovation by enhancing the driving experience, such as an overhead passenger airbag that deploys from the car’s ceiling. It also includes an integrated safety system solution for autonomous vehicles. Autoliv’s zero-gravity seat includes airbags and an integrated seatbelt. The safety system is adaptable to the needs of different drivers and passengers. Autoliv and Great Wall Motor share a common commitment to create low-carbon solutions and plan to develop new products with sustainable materials. These products will use bio-PET in airbag cushions and bio-leather wrapping on steering wheels.

Price Performance

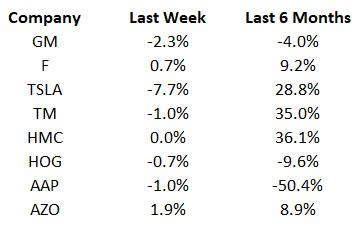

The following table shows the price movement of some of the major auto players over the last week and the six-month period.

Image Source: Zacks Investment Research

What's Next in the Auto Space?

Stay tuned for updates on the UAW strike against the Detroit 3 automakers. Industry watchers will keep a tab on auto biggies releasing third-quarter 2023 U.S. vehicle deliveries data.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Cazoo Group Ltd. (CZOO) : Free Stock Analysis Report