Auto Roundup: GM's Deal With Unifor, UAW's Strike at F's Kentucky Plant & More

Per the China Passenger Car Association (CPCA), passenger car sales in China witnessed a 4.7% year-over-year increase to reach 2.04 million units, primarily driven by sales promotions and increased holiday purchases. Remarkably, this marked the highest monthly sales for 2023. September typically stands out as a peak month for car sales in China due to the enthusiasm surrounding the Mid-Autumn Festival and National Day holidays. New energy vehicle sales saw a substantial 22.1% rise, totaling 746,000 units and accounting for 36.6% of all car sales. Notably, battery electric vehicle (BEV) sales contributed 500,000 units. Over the first nine months of 2023, China's car market increased 2.1% to reach 15.41 million units.

Meanwhile, United Auto Workers (UAW) president Shawn Fain notified on Friday that the ongoing strike against the Detroit 3 automakers won’t be expanded immediately but kept the possibility open. Fain referred to this as a "new phase" in the strike, which is now in its fifth week. In the past few weeks, on Fridays, Fain had either advocated for additional walkouts or announced progress in talks. But in a shift from its previous approach, the UAW initiated a strike at Ford's F Kentucky Truck Plant last Wednesday. Fain stated that the UAW won't adhere to a set pattern and will act as necessary.

The standoff between the UAW and Detroit 3 persists as automakers' offers still do not align with the union's demands, despite the companies putting forth substantial proposals, including wage increases of over 20% in four years, cost of living allowances, faster wage progression, and more paid holidays.

Ford’s crosstown rival, General Motors GM, struck a deal with Canadian union, Unifor. Also, GM announced a collaboration with Anduril to deliver autonomy solutions, battery electrification and other new propulsion technologies. Stellantis STLA and Samsung SDI revealed plans to invest more than $3.2 billion in an Indiana EV battery plant. Japan’s auto giant Toyota TM teamed up with Idemitsu to achieve mass production of solid-state batteries for EVs. Also, the global supplier of advanced alternative fuel systems, Westport Fuel Systems WPRT made it to the top stories as it pioneered hydrogen-driven transport in Madrid.

While WPRT and GM carry a Zacks Rank #4 (Sell) each, F, TM and STLA are currently #3 Ranked (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Last Week’s Top Stories

1. Stellantis and Samsung announced building an EV battery manufacturing plant in Kokomo, IN, as part of the StarPlus Energy joint venture (JV). This will be their second EV battery facility in the United States. Globally, this will be Stellantis’ sixth battery plant. The JV will invest more than $3.2 billion in the new battery plant, bringing the total investment in both Kokomo-located facilities to more than $6.3 billion. The second StarPlus Energy plant will have an annual capacity of 34 gigawatt hours (GWh) and is expected to start production in early 2027. The first StarPlus Energy plant with an annual production capacity of 33 GWh is already under construction and on track to begin production by the first quarter of 2025.

As part of the Dare Forward 2030 plan, Stellantis aims to achieve a 100% EV sales mix in Europe and a 50% passenger car and light-duty truck BEV sales mix in the United States by the end of the decade. Stellantis is securing approximately 400 GWh of battery capacity to achieve these targets, underpinned by six battery manufacturing plants in North America and Europe. All these investments will help the automotive manufacturer reduce its carbon footprint to half by 2030 compared with 2021 and achieve carbon net zero by 2038.

2. Toyota announced a collaboration with Idemitsu, a Japanese petroleum company, for mass production of solid-state batteries for BEVs. The company aims to commercialize these BEVs by 2027-2028. The first-generation solid-state batteries will enable a driving range of 621 miles on a full charge. High stability at extreme temperatures, fast energy transfer and low footprint give solid-state batteries an edge over traditional lithium-ion batteries. The partnership will have three phases. In the first phase, both companies will work together on developing better sulfide solid electrolytes with a focus on quality, cost and lead times.

In the second phase, a large pilot factory will be constructed where Idemitsu will obtain mass production technology for solid electrolyte-based batteries. Toyota will integrate all solid-state batteries into its next-gen EVs and ensure market launch of vehicles in 2027-2028. In the last phase, depending on the result of the second phase, both companies will search for solutions for future full-scale mass production and commercialization of EVs equipped with solid-state batteries.

3. The UAW union escalated tensions with Ford by calling a strike at the Kentucky Truck Plant after talks between the two parties collapsed. Ford's offer included a 23% wage increase over four years, wage adjustments in line with inflation and a reduced timeframe for new hires to attain top wages. The UAW entered the latest negotiation session, anticipating Ford to enhance its proposition. However, the differences between the two parties became evident quickly, leading Fain to instruct Kentucky plant workers to strike.

This is a major escalation in the ongoing strike as the Kentucky Truck Plant, located in Louisville, is pivotal for Ford, producing $25 billion in annual revenues. It manufactures the Super Duty versions of Ford’s F-Series trucks, the Ford Expedition and the Lincoln Navigator SUVs. The plant accounts for about 16% of Ford's total revenues, with a new vehicle being produced every 37 seconds. Given its scale, any extended halt in its operations could cause a ripple across up to 13 other Ford plants, leading to potential disruptions in the production of engines, transmissions and axles.

4. The Canadian labor union Unifor has ratified General Motors’ new three-year agreement. The deal promises significant wage hikes —approximately 20% for production workers and an impressive 25% for skilled tradespeople over the three-year contract. Moreover, the agreement includes other benefits, such as reactivating cost-of-living adjustments and reducing the period for workers to achieve top pay. Last Tuesday, Unifor had initiated a national strike at three GM facilities—Oshawa Assembly Plant, St. Catharines Powertrain Plant, and the Woodstock Parts Distribution Centre. A day later, GM secured a tentative agreement with Unifor, following which the union kept the strike on hold to allow union members to cast their votes. The pact, covering over 4,300 GM workers in Canada, saw 80.5% of the participating workers voting in favor of it.

In another development, GM’s Defense unit announced a partnership with Anduril Industries to collaborate on a defense program, which will focus on delivering autonomy solutions, battery electrification and other new propulsion technologies, and integrating the full range of Anduril technologies into GM Defense mobility solutions. Both companies are showcasing variations of the proven and fielded Infantry Squad Vehicle (“ISV”) at the Association of the U.S. Army tradeshow. At the GM Defense booth, a four-seat ISV was equipped with Anduril-made loitering munitions, while at Anduril’s booth, a nine-seat ISV was equipped with the company’s Lattice platform.

5. To usher in a new era of sustainable transport, Westport has successfully executed a groundbreaking heavy transport demonstration in Madrid, Spain. This achievement, featuring the H2 HPDI fuel system-equipped prototype truck, marks the maiden venture of its kind in Spain and is a testament to the nation's commitment to decarbonizing its heavy transport sector. The demonstration witnessed the prototype truck, equipped with the H2 HPDI system, transporting refrigerated goods in Madrid. This operation was enabled through a collaborative synergy between Westport and key partners in the transportation and energy sectors.

Disfirmur SL, a prominent transport and logistics enterprise dedicated to efficient and eco-friendly transport, took the helm in executing refrigerated goods transportation. The refueling of the hydrogen-powered vehicle was managed by Enagás' subsidiary, Scale Gas, at its hydrogen refueling station in Madrid. Furthermore, Versallis Tech Services, a specialist in hydrogen and renewable energy services, rendered technical coordination and support throughout the operation. This venture was brought to fruition by Mercadona, a leading supermarket chain in Spain. Mercadona facilitated the test through its distribution service in Madrid, thereby reinforcing its commitment to pioneering sustainable logistics solutions.

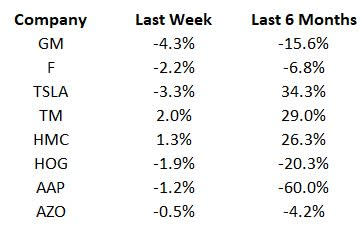

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What's Next in the Auto Space?

The third-quarter 2023 earnings season for the auto sector will kick off on Oct 18 with Tesla's quarterly release. Industry watchers will keep a tab on September 2023 new car registrations to be released by the European Automobile Manufacturers Association soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Westport Fuel Systems Inc. (WPRT) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report