Auto Roundup: KMX Beats on Q1 Earnings, BWA to Buy Eldor's EHS Business & More

Last week, the European Automobile Manufacturers Association (“ACEA”) released passenger car registration data for May 2023. The European Union passenger vehicle market rose 18.5% last month to 938,950 units, marking the 10th straight month of growth. Registrations in Italy, Germany, Spain and France witnessed a year-over-year rise of 23.1%, 19.2%, 8.3% and 14.8%, respectively. For the five months ending May, new car registrations rose 18.8% to 4.4 million units. During this span of five months, the key markets, including Spain (+26.9%), Italy (+26.1%), France (+16.3%), and Germany (+10.2%), experienced growth in double digits.

On the news front, recreational vehicle maker Winnebago Industries WGO and used car retailer CarMax, Inc. KMX unveiled their quarterly results. Both companies delivered earnings beat. One of the leading auto retailers, Lithia Motors, Inc. LAD, which is on an acquisition spree, purchased Wade Ford dealership in Smyrna, GA, to expand its market in the southeast region. Automotive equipment provider BorgWarner, Inc. BWA announced plans to acquire Eldor Corporation’s Electric Hybrid System (EHS) business. Finally, Italian-American automaker Stellantis STLA and Archer Aviation progressed from the concept to the execution phase, constructing a high-volume eVTOL production facility in Georgia.

While STLA sports a Zacks Rank #1 (Strong Buy), LAD, BWA, KMX and WGO carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks Rank #1 stocks here.

Last Week’s Top Stories

Winnebago delivered adjusted earnings of $2.13 per share for third-quarter fiscal 2023 (ended May 27, 2023), which topped the Zacks Consensus Estimate of $1.74 on higher-than-expected EBITDA across Towable and Marine segments. However, the bottom line fell 48.4% year over year. The company reported revenues of $900.8 million in the quarter under review, missing the Zacks Consensus Estimate of $951 million. The top line declined 38.2% year over year.

Winnebago had cash and cash equivalents of $225.9 million as of May 27, 2023. Long-term debt (excluding current maturities) increased to $591.7 million from $545.9 million, recorded on Aug 27, 2022. The company approved a dividend of 27 cents per share, to be paid out on Jun 28, 2023, to shareholders of record at the close of business on Jun 14, 2023. WGO bought back $20 million in shares during the quarter under review.

CarMax delivered first-quarter fiscal 2024 (ended May 31, 2023) adjusted earnings per share of $1.16, topping the Zacks Consensus Estimate of 74 cents on higher year-over-year gross profit per unit in the used and wholesale vehicle segments. The bottom line fell from $1.56 per share recorded in the year-ago period. Revenues of $7,687.1 million for the May-end quarter, outpaced the Zacks Consensus Estimate of $7,293 million. The top line contracted 17.4% year over year.

The firm had cash/cash equivalents and long-term debt of $264.2 million and $1,906.5 million, respectively, as of May 31, 2023. During the fiscal first quarter, CarMax did not buy back shares of common stock under the share repurchase program. As of May 31, 2023, it had $2.45 billion remaining under the share repurchase authorization. The company opened one new store in the fiscal first quarter. KMX currently operates more than 240 used car stores. In fiscal 2024, it targets opening five new stores.

Lithia made progress in its expansion effort with the acquisition of Wade Ford in Smyrna, GA. Wade Ford will help Lithia expand its footprint in the southeast region. The buyout is expected to add $285 million in annualized revenues. Wade Ford, operational since 1933, is a local Atlanta area dealership. Bryan DeBoer, president and CEO of Lithia, said that Wade Ford’s strong reputation with customers and community support would allow Lithia to expand its operation in the highly competitive market. The transaction was funded using Lithia’s existing on-balance sheet capacity.

With this buyout, Lithia has acquired more than $3.5 billion in annualized revenues year to date, setting the stage for another solid year of acquisition growth. Last year, Lithia acquired companies with total expected annualized revenues in excess of $3.5 billion. It has acquired $17.5 billion in revenues since announcing its 2025 plan, which targets $50 billion in revenues. Out of the $25 billion of the 2025 Plan network development target, LAD has brought off 70%.

BorgWarner inked a deal to buy the Eldor EHS business segment for €75 million. The buyout is expected to complement and consolidate BorgWarner’s electric product portfolio. Eldor’s EHS segment manufactures components like onboard chargers, DC/DC converters and integrated high-voltage boxes. All these components are expected to complement BorgWarner’s existing electric product portfolio. The transaction is subject to the satisfaction of closing conditions and is expected to be completed by the third quarter of 2023.

The acquisition will enhance BorgWarner’s engineering capabilities. With the acquired potential, it can design compact and efficient 400V and 800V onboard chargers that are compatible with the variety of regional grid configurations found globally. It will also add innovative and cost-efficient high-frequency DC/DC converter technology to the portfolio. BorgWarner anticipates Eldor's EHS division to yield €25 million in revenues throughout 2023. With regard to BorgWarner's Charging Forward 2027 goals, the company foresees revenues of approximately €250 million by 2027.

Stellantis and Archer announced that their strategic manufacturing partnership has reached the next level with the ongoing construction of the world’s first high-volume eVTOL (electric vertical take-off and landing) aircraft manufacturing facility located on the nearly 100-acre Covington campus in Georgia. The automaker increased its exposure in Archer via a series of stock purchases in the open market.Carlose Tavares, CEO of Stellantis, said that both companies are putting their best foot forward to bring scalable manufacturing of Archer’s aircraft online in mid-2024.

Archer intends to achieve commercialization at scale and attaining high-volume manufacturing is critical to its plan. The goal of both companies is to leverage their respective strengths in the manufacturing ramp-up phase to acquire the desired aircraft production scale to meet Archer’s commercialization plan.Initially, the manufacturing operation will produce up to 650 aircraft per year. The capacity can be expanded to achieve the production of 2,300 aircraft per year, which could make this site the world’s leading aircraft manufacturing facility by volume.

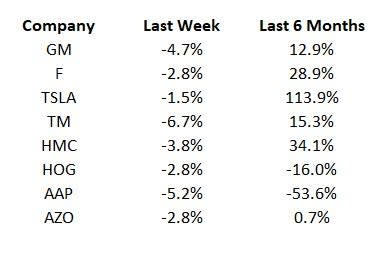

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What's Next in the Auto Space?

Industry watchers will keep a tab on May commercial vehicle registrations to be released by the ACEA soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

CarMax, Inc. (KMX) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report