Auto Roundup: LAD's Sweetened Bid for Pendragon, Ford's 7th Offer to UAW & More

The United Auto Workers (UAW) decided against further strikes at Detroit Three auto plants on Friday, marking the first week without strike expansion since the work stoppages began on Sep 15. This pause in strikes came as talks progressed, and General Motors GM agreed to include battery cell workers in the company's national agreement. GM's Arlington Assembly plant, which manufactures lucrative full-size SUVs, narrowly avoided closure with a last-minute proposal to integrate the automaker's battery cell workers into the national agreement. Also, GM secured a new $6 billion line of credit extending through October 2024. This move is seen as a strategic step to ensure financial stability amid the uncertainty surrounding the strike’s resolution.

Early last week, Ford F presented its seventh proposal to the UAW, featuring what the company touts as unmatched compensation and benefits packages. At present, approximately 25,200 workers, accounting for about 17% of UAW members, are on strike.

Last week, auto biggies reported third-quarter U.S. vehicle sales numbers. Most automakers experienced year-over-year sales growth thanks to improving inventory levels and a rebound in fleet shipments. Many companies like General Motors, Honda and Toyota among others recorded double-digit percentage gains. The demand for automobiles has remained strong so far despite high vehicle financing costs. Per GlobalData, the seasonally adjusted annualized sales rate for September 2023 was 15.2-15.5 million vehicles, up from 13.7 million vehicles a year earlier. Per Automotive News, U.S. light vehicle sales in the third quarter of 2023 topped 3.8 million units, up 17% year over year.

On the news front, leading engine manufacturer Cummins CMI successfully acquired two Faurecia commercial vehicle manufacturing plants in the United States and Netherlands to enhance its emissions control capabilities and ensure a stable supply of low-emission components.

The bidding war for the acquisition of Pendragon, UK’s third-largest automotive dealership group, escalated a notch higher when Lithia Motors LAD announced a 42% increase in its initial acquisition offer for Pendragon. The increased bid was in response to rival propositions from AutoNation and a joint bid from Hedin Mobility Group and Penske Automotive.

Last Thursday, General Motors touched a three-year low amid the strike coupled with a looming airbag recall threatening to strain the automaker's finances further.

Japan’s auto giant Toyota TM has partnered with LG Energy Solution to procure lithium-ion battery modules for its forthcoming U.S.-assembled electric vehicles (EVs) from 2025, with an annual capacity of 20 GWh. This aligns with Toyota's goal of creating a lineup of 30 BEVs globally by 2030 and marks LG Energy Solution's significant investment in its Michigan facility.

Last Week’s Top Stories

1. Lithia upped its bidding offer for Pendragon last week. The revised bid from Lithia now totals £397 million, valuing each share for existing Pendragon shareholders at around 35.4 pence. This revision is anticipated to augment the cash dividend payable to Pendragon's shareholders by 49% to 24.5 pence per share, while allowing them to retain roughly 83.3% ownership in Pinewood Tech. Besides, this acquisition paves the way for a rewarding joint venture to proliferate Pinewood's software in the North American market.

Currently, the revised offer from Lithia has overshadowed the 32 pence per share bid from the Penske/Hedin alliance and AutoNation, setting the stage for a three-pronged tussle. The deal is expected to be funded with Lithia's existing on-balance sheet capacity, pending approval from Pendragon shareholders. If the deal goes through, it would broaden Lithia’s horizon and diversify its business operations by establishing a formidable presence in the UK market.

2. Per Wall Street Journal’s report, at least 20 million General Motors vehicles are fitted with potentially hazardous airbag inflators added to the woes of the U.S. auto giant. The government is recommending recall of the same to avoid fatalities and injuries, possibly leading General Motors to incur significant costs for replacements and repairs.

The recall concerns about 52 million airbag inflators supplied by Tennessee-based auto supplier ARC Automotive. So far, GM has recalled approximately 1 million vehicles due to this issue. However, the company contested the NHTSA's findings, stating that the current evidence and data do not necessitate any further recalls beyond what has already been done. Despite this defense, the shadow of a larger recall looms, threatening to impose significant financial and reputational costs on GM.

3. Cummins completed its acquisition of two Faurecia commercial vehicle manufacturing plants in the United States and the Netherlands, showing its commitment to low-emission solutions. These facilities have been integrated into Cummins Emission Solutions, bolstering its technical and manufacturing capabilities. The move ensures the continued supply of vital aftertreatment components and assemblies, critical for reducing emissions.

This strategic acquisition, financed with €199.2 million from Cummins' cash reserves, strengthens Cummins' position in the commercial vehicle industry. It aligns with the company’s commitment to sustainability and low-emission technology. This move positions Cummins to meet the rising demand for eco-friendly products and ensures continuity for employees and customers.

4. Toyota and LG Energy Solution have signed a battery supply agreement, per which the latter will provide lithium-ion battery modules to power Toyota’s battery EVs planned to be assembled in the United States. LG will supply Toyota with 20 GWh of battery modules annually, starting from 2025. The supply will be sufficient for the production of 250,000 electric vehicles (EVs) per year. Per the agreement, the battery modules will consist of high-nickel NCMA (nickel, cobalt, manganese, aluminum) pouch-type cells.

LG plans to invest $3 billion in its Holland, MI, plant to set up exclusive battery production lines for Toyota. The line will increase battery module supply to Toyota’s Kentucky plant. In the plant, the battery modules will be assembled into battery packs and used to power EVs in the United States. Tetsuo Ogawa, president and CEO of Toyota Motor North America, said that the battery supply agreement is critical to meeting Toyota’s manufacturing and carbon reduction plans.

5. Ford presented its seventh and most robust offer to the union aiming to resolve crucial economic matters. In this offer, Ford has outlined remarkable enhancements in terms of wages, positioning its employees among the top 25% in the United States, encompassing both hourly and salaried positions, while also providing substantial benefits, product commitments for all UAW factories, and a strong commitment to job security. Simultaneously, the proposal ensures Ford's capability to invest and expand its operations. The offer includes a notable wage increase to $21 per hour, a significant 26% raise for temporary workers, and the conversion of all temporary employees with at least three months of service to permanent status upon ratification.

Ford currently sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

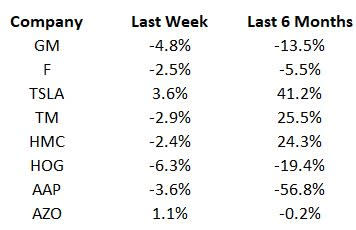

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What's Next in the Auto Space?

The third-quarter 2023 earnings season for the auto sector kicks off next week. Investors are keenly awaiting Tesla’s results, set to be released on Oct 18. Industry watchers will also track China vehicle sales data for September 2023, which will be released by the China Association of Automobile Manufacturers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report