Auto Roundup: Q3 Earnings in Spotlight, GM Beats, F Misses & More

Last week, the European Automobile Manufacturers Association released data for commercial car registrations for the first nine months of 2023. During the said time period, new European Union (EU) van, truck and bus sales grew 14.3%, 23% and 18.5%, respectively, on a year-over-year basis. Van sales volume totaled 1 million units, while bus and truck sales volume totaled 23,645 and 268.766 units, respectively.

A host of auto giants, including five S&P 500 sector components — General Motors GM, Ford F, PACCAR PCAR, O’Reilly Automotive ORLY and LKQ Corp. LKQ — released third-quarter results last week. While U.S. auto giant GM beat earnings estimates, its crosstown rival F missed the same. Trucking giant PCAR and auto parts retailer ORLY delivered a comprehensive beat. Auto replacement parts provider LKQ lagged earnings estimates in the September end quarter.

Meanwhile, the United Auto Workers (UAW) reached a tentative agreement with Ford and Stellantis after nearly six weeks of specific labor strikes in the United States. This agreement is currently pending approval from union leaders and subsequent ratification by the members. Although there were optimistic expectations for the UAW to secure a deal with General Motors, this optimism waned on Saturday when the union extended its strike to encompass a GM assembly plant located in Spring Hill, TN.

Inside the Headlines

General Motors reported third-quarter 2023 adjusted earnings of $2.28 per share, which surpassed the Zacks Consensus Estimate of $1.84 on higher-than-expected profit from GMNA, GMI and Financial segments. The bottom line also increased from the year-ago quarter’s earnings of $2.25 per share. Revenues of $44,131 million beat the Zacks Consensus Estimate of $43,296 million and increased from $41,889 million recorded in the year-ago period.

General Motors had cash and cash equivalents of $25,224 million as of Sep 30, 2023. Long-term automotive debt at the end of the quarter was $15,962 million. General Motors’ net automotive cash provided by operating activities amounted to $6,749 million during the quarter under review. The company recorded an adjusted automotive free cash flow of $4,910 million in third-quarter 2023, surging from $4,593 million recorded in the year-ago period. Amid strike-related volatility, GM withdrew its 2023 guidance.

Ford reported adjusted earnings of 39 cents per share for third-quarter 2023, which missed the Zacks Consensus Estimate of 40 cents but increased from 30 cents recorded in the year-ago quarter. The company’s consolidated third-quarter revenues came in at $43,801 million, rising 11.2% year over year. Ford’s total automotive revenues came in at around $41,176 million, surpassing our estimate of $36,588 million on stronger-than-expected results from Ford Blue and Ford Pro units.

Ford reported an adjusted free cash flow of $1,225 million for the quarter. It had cash and cash equivalents of $26,427 million as of Sep 30, 2023. Long-term debt, excluding Ford Credit, totaled $19.33 billion at the end of the third quarter of 2023. Despite a tentative agreement with the United Auto Workers, the strike has brought uncertainty to Ford’s fiscal year results. Given the extent of its influence and the pending ratification of the agreement, Ford withdrew its previously issued financial guidance.

PACCAR recorded earnings of $2.34 per share for third-quarter 2023, which surged 59.2% from the year-ago figure. The bottom line also surpassed the Zacks Consensus Estimate of $2.07 per share thanks to higher-than-expected pre-tax profits from the Trucks and Parts segments. Consolidated revenues (including trucks and financial services) came in at $8,696.4 million, up from $7,058.9 million in the corresponding quarter of 2022. Sales from Trucks, Parts and Others were $8,232.3 million, which surpassed the Zacks Consensus Estimate of $8,063.2 million.

PACCAR’s cash and marketable debt securities amounted to $7,440 million as of Sep 30, 2023, compared with $6,158.9 million on Dec 31, 2022. The company declared a quarterly dividend of 27 cents per share, payable on Dec 6 to shareholders as of Nov 15. Capex and R&D expenses for 2023 are envisioned in the band of $650-$675 million and $410-$420 million, respectively. For 2024, capex and R&D costs are estimated in the range of $675-$725 million and $470-$520 million, respectively.

O’Reilly reported third-quarter 2023 adjusted earnings per share of $10.72, beating the Zacks Consensus Estimate of $10.36. The bottom line increased from $9.17 in the prior-year quarter. The automotive parts retailer registered quarterly revenues of $4,203.4 million, crossing the Zacks Consensus Estimate of $4,070 million. The top line increased 10.6% year over year. During the quarter, comps grew 8.7%. The company opened 40 new stores in the United States and Mexico. The total store count was 6,111 as of Sep 30, 2023.

ORLY had cash and cash equivalents of $82.6 million at the end of the reported quarter. Its long-term debt was $5,102.3 million. During the reported quarter, O’Reilly generated $866.3 million in cash from operating activities. Capital expenditures totaled $293 million. Free cash flow came in at $564.4 million. Encouragingly, the company has lifted full-year guidance. For 2023, O’Reilly now envisions total revenues in the range of $15.7-$15.8 billion, up from the prior guidance of $15.4-$15.7 billion. Earnings per share are now expected between $37.80 and $38.30, up from the previous estimate of $37.05-$37.55.

ORLY currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

LKQ delivered adjusted earnings of 86 cents per share for third-quarter 2023, down from 97 cents reported in the year-ago period and missing the Zacks Consensus Estimate of 95 cents. The company registered quarterly revenues of $3,568 million, surpassing the Zacks Consensus Estimate of $3,489 million. The top line also grew from the year-ago level of $3,104 million. Parts and services organic revenues increased 3% year over year.

LKQ had cash and cash equivalents of $401 million on Sep 30, 2023. The long-term obligations (excluding the current portion) amounted to $3,763 million as of Sep 30, 2023. During the quarter, cash flow provided by operating activities totaled $441 million. The company recorded a positive free cash flow of $344 million. On Oct 24, 2023, LKQ hiked its quarterly dividend by 9% to 30 cents per share. For 2023, the company lowered its adjusted EPS guidance to the range of $3.68-$3.82 from the prior guidance of $3.90-$4.10.

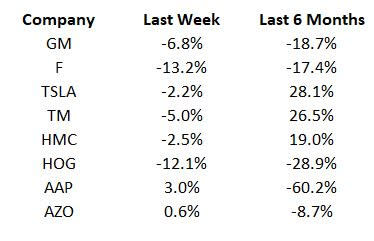

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on U.S. vehicle sales data for October. Investors are also awaiting the quarterly releases of a host of auto companies that are slated to report this week. Stay tuned for any updates related to the UAW strike.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report