Auto Sector Q2 Earnings Roster for Jul 27: F, HOG & More

The second-quarter 2023 earnings for the Auto-Tires-Trucks sector kicked off last week. So far this earnings season, four S&P sector components — namely Tesla, Genuine Parts, PACCAR and General Motors — have come up with quarterly numbers. EV king Tesla, trucking giant PACCAR and U.S. legacy automaker General Motors managed to pull off a comprehensive beat and witnessed year-over-year growth in the top and bottom lines. Meanwhile, auto replacement parts provider Genuine Parts’ earnings topped estimates but sales missed the same. Revenues and profit, however, increased on a year-over-year basis.

Ford F, Harley-Davidson HOG, Allison Transmission Holdings ALSN and LKQ Corp LEA are some of the auto stocks lined up to report tomorrow. Before checking the key projections for these stocks, let's take a look at the general factors that are likely to shape the companies’ upcoming results.

With supply chain issues easing this year, the U.S. auto market has regained momentum. Most automakers experienced year-over-year vehicle sales growth in the second quarter of 2023, thanks to improving inventory levels. Additionally, the demand for automobiles remained strong, indicating that the rise in interest rates has not yet significantly affected purchasing decisions.

The seasonally adjusted annualized sales rate for June 2023 was 15.7-15.8 million vehicles, up from 15.1 million vehicles in May 2023 and 12.9 million units in June 2022. Per Cox Automotive, new vehicle sales in the second quarter of 2023 topped 4 million units, implying year-over-year and sequential growth of roughly 15% and 13%, respectively.

Per the latest Earnings Trend report dated Jul 19, the auto sector’s earnings for the second quarter of 2023 are expected to grow 1.7% on a year-over-year basis. Revenues are estimated to rise 17.1% year over year.

Key Releases on Jul 27

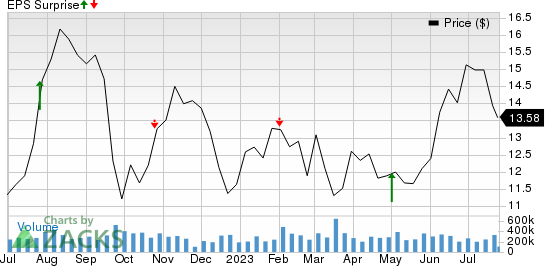

Ford: This legacy automaker surpassed earnings estimates in the last reported quarter on higher-than-expected revenues. Over the trailing four quarters, Ford topped earnings estimates on two occasions for as many misses, with the average surprise being 24.35%. This is depicted in the graph below:

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our proven model predicts an earnings beat for Ford this time around. This is because it has an Earnings ESP of +6.43% and a Zacks Rank #1. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for the company’s second-quarter earnings is pegged at 50 cents per share. F is set to report quarterly results after the closing bell.

Ford recorded sales growth of 11.2% in the United States during the second quarter of 2023. Its F-Series became America’s top-selling truck, with a 34% rise in sales in the quarter. Ford’s second-quarter revenues are likely to have been aided by a projected increase in Ford Blue wholesale units. For the to-be-reported quarter, our estimate for Ford Blue wholesale shipments is pegged at 720,000 units, indicating an increase from 670,000 units in the year-ago period.

Our forecast for second-quarter Ford Blue sales is $24,061 million, implying an uptick from $23,834 million recorded in the corresponding quarter of 2022. On the flip side, we expect a year-over-year decline in the adjusted EBIT from Ford Blue, Ford Credit and Ford Next. Our projection for operating loss from Model e unit is at $907.8 million, wider than $510 million recorded a year ago.

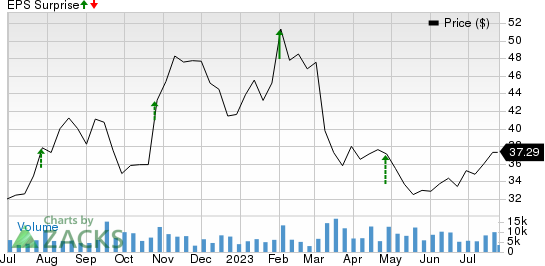

Harley-Davidson: This iconic motorcycle manufacturer posted an earnings beat in the last reported quarter on higher-than-anticipated revenues from the Motorcycles & Related Products and Financial Services segments. HOG surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 230.1%. This is depicted in the graph below:

Harley-Davidson, Inc. Price and EPS Surprise

Harley-Davidson, Inc. price-eps-surprise | Harley-Davidson, Inc. Quote

Our model does not conclusively predict an earnings beat for Harley-Davidson this time around, as it carries a Zacks Rank #3 and an Earnings ESP of -3.57%. The Zacks Consensus Estimate for second-quarter earnings is pegged at $1.40 a share. HOG will unveil results before market open.

Harley-Davidson is likely to have benefited from the Hardwire strategic plan, which aims at growth through refreshed product offerings. Our estimate for HOG’s revenues from the Motorcycles and Related Products segment — which constitutes the bulk of the firm’s overall revenues — is pegged at $1,325.5 million for the June-ended quarter, suggesting an increase of 4.7% year over year.

We project operating profit from the segment to grow around 23% from the year-ago period. On the flip side, our forecast for revenues from Financial Services is pegged at $200.9 million, suggesting a fall from $202.6 million generated in the year-ago period. Our model estimate for operating profit from the segment is $66.7 million, implying a decline from $85.9 million recorded in the second quarter of 2022.

LKQ: This automotive replacement parts provider posted an earnings beat in the last reported quarter due to better-than-expected revenues from Wholesale North American, European and Self-Service segments. LKQ surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with the average surprise being 2.54%. This is depicted in the graph below:

LKQ Corporation Price and EPS Surprise

LKQ Corporation price-eps-surprise | LKQ Corporation Quote

Our model does not conclusively predict an earnings beat for LKQ this time around, as it carries a Zacks Rank #2 and an Earnings ESP of 0.00%. The Zacks Consensus Estimate for second-quarter earnings is pegged at $1.06 a share. LKQ will unveil results before market open.

LKQ’s North America segment results are likely to get a boost from pricing initiatives. The company’s 1 LKQ Europe program is expected to aid the performance of the Europe segment. Moreover, the strength in LKQ’s Specialty unit on the back of solid demand for recreational vehicles bodes well.Our estimate for revenues from parts and services in Europe is pegged at $1,500 million, suggesting a rise from $1,470 million recorded in the prior-year quarter.

We expect revenues from parts and services in the North America unit at around $1,103.7 million, indicating a rise from $1,050 million recorded in the prior-year period. However, our projection for the Specialty segment stands at $447.5 million, implying a decline from $512 million reported in the prior-year quarter.

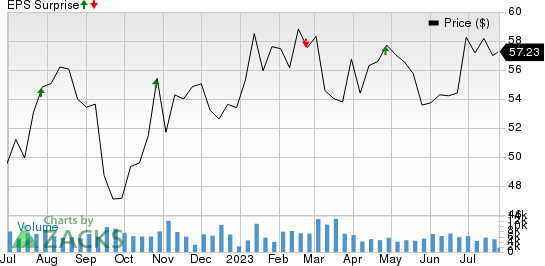

Allison: The transmission manufacturer posted an earnings beat in the last reported quarter on higher-than-anticipated sales from North America On-Highway, North America Off-Highway and Service Parts, Support Equipment & Other end markets. ALSN surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with the average surprise being 12.84%. This is depicted in the graph below:

Allison Transmission Holdings, Inc. Price and EPS Surprise

Allison Transmission Holdings, Inc. price-eps-surprise | Allison Transmission Holdings, Inc. Quote

Our model does not conclusively predict an earnings beat for ALSN this time around, as it has a Zacks Rank #4 (Sell) and an Earnings ESP of +0.11%. The Zacks Consensus Estimate for second-quarter earnings is pegged at $1.59 a share. ALSN will unveil results after market close.

For second-quarter 2023, we estimate North America On-Highway and Off-Highway market revenues to be around $358 million and $23.7 million, up from $340 million and $20 million, respectively, reported in the corresponding quarter of 2022. Our forecast for Outside North America On-Highway market revenues is $119 million, up from $105 million recorded in the year-ago period. Our projections for Outside North America Off-Highway market revenues suggest a year-over-year decline of 2.9%.

We expect revenues from the Defense and the Service Parts, Support Equipment/ Other segments at $35.5 million and $162 million, respectively, suggesting an uptick from $29 million and $138 million, respectively. While expected sales growth from most segments boost optimism, logistics challenges, including air and ocean freight and port delays, labor constraints and high engineering costs are likely to have played a spoiler in the to-be-reported quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report