Auto Stocks' Q3 Earnings Lineup for Oct 26: F, HOG & More

The third-quarter earnings season for the Auto-Tires-Trucks sector began on Oct 18. So far, four S&P 500 sector components — Tesla, Genuine Parts, PACCAR and General Motors — have reported quarterly numbers. While Genuine Parts, PACCAR and General Motors managed to pull off an earnings beat, Tesla’s 10 consecutive quarter-long beat streak snapped as it reported lower-than-expected earnings for the third quarter of 2023.

Per the latest Earnings Trend report dated Oct 18, the auto sector’s earnings for the third quarter of 2023 are expected to decline 12.2% on a year-over-year basis. Revenues are estimated to rise 5.8% year over year.

Ford F, Harley-Davidson HOG, LKQ Corp LKQ, Oshkosh Corp OSK and Lear Corp LEA are some of the auto stocks lined up to report tomorrow. Before checking the key projections for these stocks, let's take a look at the general factors that are likely to shape the companies’ upcoming results.

Things to Note

Per Automotive News, U.S. light vehicle sales in the third quarter of 2023 topped 3.8 million units, up 17% year over year, thanks to improving retail inventories and strong fleet shipments. The seasonally adjusted annualized sales rate for September 2023 was 15.2-15.5 million vehicles, up from 13.7 million vehicles a year earlier, per GlobalData.

At the beginning of September, U.S. inventories had 2.2 million vehicles, representing an increase of approximately 813,000 cars and light trucks compared to September 2022, according to Cox Automotive. This marked a 60% increase from the year-ago levels and the highest new-vehicle inventory since early 2021.

The generous incentives offered by automakers are expected to have played a crucial role in boosting retail deliveries in the third quarter of 2023, offsetting the impact of high interest rates. However, discounts might have impacted margins. Also, commodity costs, forex woes, tough labor market and logistical challenges are likely to have played spoilsport. Moreover, high operating expenses, including R&D to develop technologically advanced products to adapt to the changing dynamics of the auto industry, are expected to have dented earnings.

Key Releases on Oct 26

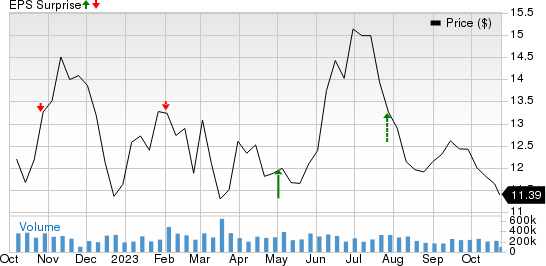

Ford: This legacy automaker surpassed earnings estimates in the last reported quarter on higher-than-expected automotive revenues. Over the trailing four quarters, Ford topped earnings estimates on two occasions for as many misses, with the average surprise being 20.1%. This is depicted in the graph below:

Ford Motor Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Our proprietary model clearly indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our proven model predicts an earnings beat for Ford this earnings season. This is because it has an Earnings ESP of +14.57% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for the company’s third-quarter earnings is pegged at 40 cents per share. F is set to report quarterly results after the closing bell.

Ford saw its U.S. sales increase 7.7% year over year to 500,504 units. Sales of hybrid vehicles, ICE and EVs in the United States came in at 34,861, 444,681 and 20,962 units, up 41.4%, 5.4% and 14.8%, respectively, on a yearly basis. Our estimate for global wholesale shipments of Ford Blue, Ford Model e and Ford Pro segments is pegged at 750,000, 43,000 and 382,000 units, implying a year-over-year uptick of 1.2%, 73.8% and 19%, respectively.

Our forecast for third-quarter Ford Blue and Ford Pro adjusted EBIT implies an uptick of 6.2% and a whopping 370.1% on a year-over-year basis. However, we expect the Model e segment to incur an operating loss of $1.43 billion amid high costs.

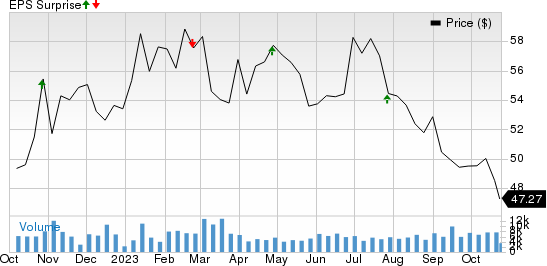

Harley-Davidson: This iconic motorcycle manufacturer missed earnings estimates in the last reported quarter on lower-than-anticipated revenues from the Motorcycles & Related Products. HOG surpassed the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed in the other, with the average surprise being 221.7%. This is depicted in the graph below:

Harley-Davidson, Inc. Price and EPS Surprise

Harley-Davidson, Inc. price-eps-surprise | Harley-Davidson, Inc. Quote

Our model predicts an earnings beat for Harley-Davidson this time around as it carries a Zacks Rank #3 and has an Earnings ESP of +1.68%. The Zacks Consensus Estimate for third-quarter earnings is pegged at $1.39 a share. HOG will unveil results before market open.

Harley-Davidson is likely to have benefited from the Hardwire strategic plan, which aims at growth through refreshed product offerings. Our estimate for HOG’s revenues from the Motorcycles and Related Products segment — which constitutes the bulk of the firm’s overall revenues — is pegged at $1,362 million for the September-ended quarter, suggesting an increase from $1,205.2 million recorded in the second quarter of 2023. Our forecast for revenues from Financial Services is pegged at $202 million, suggesting a fall from $240 million generated in the second quarter of 2023.

We project operating profit from the HDMC segment to come in at around $220 million, suggesting an increase from $194.3 million generated in the last reported quarter. Our model estimate for operating profit from the HDFS segment is $60 million, compared with $59 million recorded in the second quarter of 2023.

LKQ: This automotive replacement parts provider posted an earnings beat in the last reported quarter due to better-than-expected revenues from Wholesale North American and European segments. LKQ surpassed the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, with the average surprise being 1.53%. This is depicted in the graph below:

LKQ Corporation Price and EPS Surprise

LKQ Corporation price-eps-surprise | LKQ Corporation Quote

Our model does not conclusively predict an earnings beat for LKQ this time around, as it carries a Zacks Rank #3 and an Earnings ESP of 0.00%. The Zacks Consensus Estimate for third-quarter earnings is pegged at 95 cents a share. LKQ will unveil results before market open.

In 2023, the average age of a new vehicle in the United States rose to 12.5 years, up from 12.2 years in 2022. Ageing vehicles are likely to have boosted demand for LKQ’s products. However, LKQ is witnessing supply chain disruptions, which might have resulted in product scarcity and freight delays. Problems related to freight costs and container capacity constraints are expected to have played spoilsport in the third quarter.

Our estimate for quarterly revenues from parts and services in Europe is pegged at $1,533.8 million, suggesting a rise from $1,376 million recorded in the prior-year quarter. We expect third-quarter revenues from parts and services in the North America unit to be $1,255 million, indicating a rise from $1,026 million recorded in the prior-year period. However, we expect quarterly revenues from parts and services in the Specialty segment to be $402.7 million, implying a decline from $452 million reported in the prior-year quarter.

Oshkosh: The automotive equipment provider posted an earnings beat in the last reported quarter on high operating margins in the Access and Vocational segments. OSK surpassed the Zacks Consensus Estimate for earnings in two of the trailing four quarters for as many misses, with the average surprise being 27.45%. This is depicted in the graph below:

Oshkosh Corporation Price and EPS Surprise

Oshkosh Corporation price-eps-surprise | Oshkosh Corporation Quote

Our model predicts an earnings beat for OSK this earnings season, as it has a Zacks Rank #3 and an Earnings ESP of +8.24%. The Zacks Consensus Estimate for third-quarter earnings is pegged at $2.18 a share. Oshkosh will unveil results before the opening bell.

Strategic acquisitions like Pratt Miller, CartSeeker Technology, JBT's AeroTech business and Hinowa coupled with investment in Robotics are likely to boost the to-be-reported quarter’s results. Frequent business wins and a comprehensive offering of innovative new products are expected to aid Oshkosh’s upcoming results.

For third-quarter 2023, we estimate Access Equipment revenues — which form more than 50% of the total revenues — to be around $1,273.4 million, implying an uptick of 22.7% from the year-ago period. Our forecast for the segment’s operating profit is $182.3 million, suggesting growth of 48% on a yearly basis. Profits from Defense and Vocational segments are also estimated to rise year over year, thereby boosting OSK’s overall third-quarter earnings.

Lear: This manufacturer of automotive seating and electronic systems posted an earnings beat in the last reported quarter on higher-than-expected revenues and profits across both segments. LEA surpassed the Zacks Consensus Estimate of earnings in the trailing four quarters, with the average surprise being 8.07%. This is depicted in the graph below:

Lear Corporation Price and EPS Surprise

Lear Corporation price-eps-surprise | Lear Corporation Quote

According to our model, it seems Lear is poised to maintain its beat streak this earnings season as well. The company has a Zacks Rank #3 and an Earnings ESP of +2.63%. The Zacks Consensus Estimate for third-quarter earnings is pegged at $2.56 a share. Lear will unveil results before the opening bell.

Lear is riding high on acquisitions, which are set to boost its upcoming results. The buyout of M&N Plastics has increased vertical integration in Lear’s E-Systems unit. The Kongsberg acquisition has strengthened Lear’s Seating business. The acquisition of Xevo has enhanced Lear’s capabilities in software, services and data analytics. The buyout of IGB has further expanded Lear’s product offerings in the growing thermal comfort solutions market.

Rising consumer demand for vehicle content— requiring signal, data and power management— and increasing electrification efforts by the company bode well for the results of the to-be-reported quarter. Our estimate for quarterly revenues from the Seating segment is pegged at $4,005 million, suggesting a rise of 3% from the prior-year quarter. We expect revenues from E Systems unit for the third quarter to be $1,371 million, indicating a rise from $1,353 million recorded in the prior-year period.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report