Auto strike dents Pam Transportation’s Q4

Pam Transportation Services said an auto strike during the fall was to blame for its net loss in the last quarter of the year.

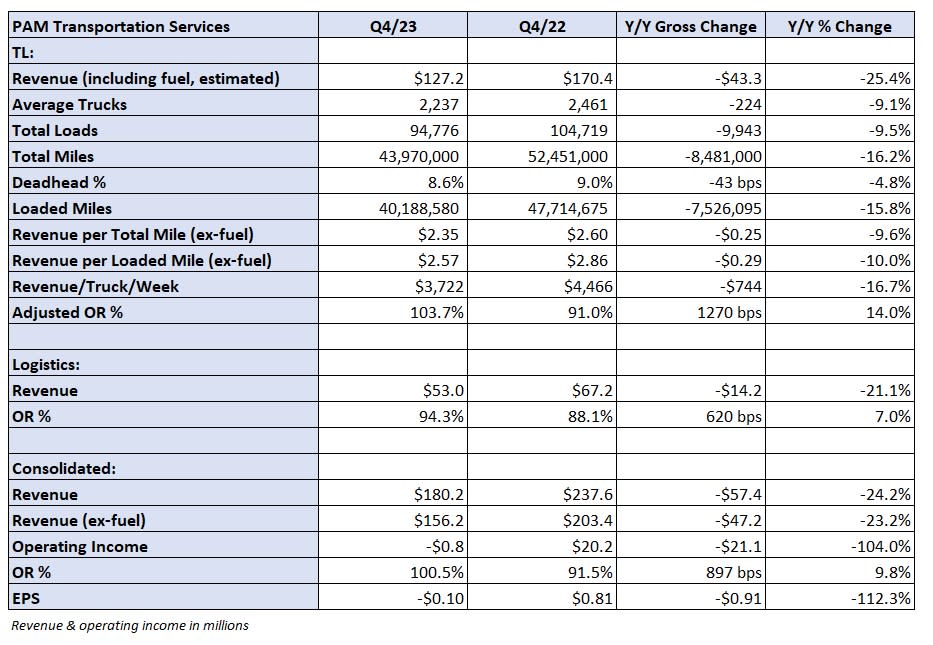

Pam (NASDAQ: PTSI) reported a net loss of $2.2 million, or 10 cents per share, for the 2023 fourth quarter. The result was below a lone 20-cent estimate from an analyst and well below earnings per share of 81 cents in the year-ago quarter.

The company recorded a $132,000 loss from the disposal of equipment compared to a gain of $587,000 in the 2022 fourth quarter. Gains generated from equity holdings were $2.3 million lower year over year (y/y).

“Unlike previous UAW strikes, the approach taken in the 2023 strike was impactful to the majority of our auto customer base including both auto manufacturers and suppliers,” said Joe Vitiritto, president at Pam.

Truckload revenue fell 25% y/y to $127 million as revenue per truck per week fell 17% and average trucks in service were down 9%. Loaded miles fell 16% and revenue per loaded mile excluding fuel surcharges was down 10% to $2.57.

Compared to the third quarter, loads in the TL division were off 10%.

The TL segment recorded an operating ratio of 103.7% excluding the impacts of fuel surcharges, 1,270 basis points worse y/y and 790 bps worse than the third quarter.

“While the strike ended by mid-November, the negative impact carried on through the typical holiday shutdowns with no post-strike surge in automotive business that we have sometimes experienced after past UAW strikes,” Vitiritto continued.

The logistics segment reported a 21% y/y decline in revenue to $53 million. Pam doesn’t provide gross profit margins for the unit or operating metrics like load counts and revenue per load. The logistics OR was 94.3%, which was 620 bps worse y/y and 100 bps worse than the third quarter.

Vitiritto pointed to some recovery in the business, saying he is “seeing sustainable progress in areas that will put us in a position to get back to profitable growth.”

More FreightWaves articles by Todd Maiden

The post Auto strike dents Pam Transportation’s Q4 appeared first on FreightWaves.