Autodesk Could Be Worth More Based on Its FCF Guidance

Autodesk Inc. (NASDAQ:ADSK) is an extremely profitable company that looks underappreciated by the market. I estimate it could be worth at least 27% more or over $318 per share versus its price on March 6 of $250.61. This analysis will describe how I derive this price target for the stock.

A high-margin, low-capex model

Autodesk reported on Feb. 29 that its GAAP revenue for the quarter ending Jan. 31 was up 11%. For the fiscal year ending the same date, it rose 10% to $5.50 billion.

This surprised investors as its quarterly revenue was higher by over $37 million.

Moreover, subscription revenue comprised over 99% of sales and came in strong. It was 10% higher than the prior-year quarter and up 13% on a constant currency basis. Autodesk also says that 98% of revenue is recurring.

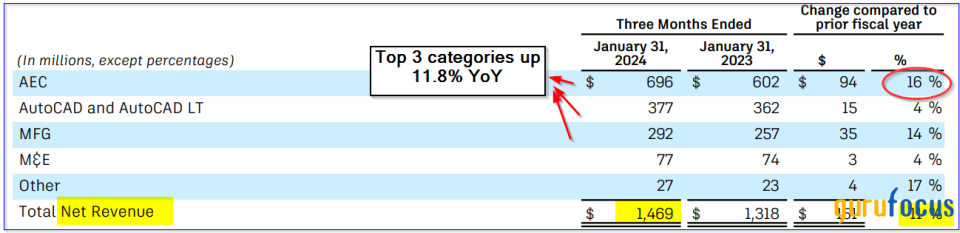

In addition, most of the company's sales components were strong during the quarter. For example, Autodesk reported its largest category of revenue, Architecture, Engineering and Construction (AEC), which is over 47% of sales, rose 16%.

The table below shows this, although its second largest category, computer-aided design was not as strong with just 4% year-over-year growth.

Source: : Autodesk earnings release

Nevertheless, its top three categories came in at $1.36 billion, up 11.80% from the $1.22 billion it made last year. That shows the underlying fundamentals of Autodesk's revenue growth are solid.

Profits and margins are strong

On top of this, its gross margins are extremely high at over 90.90%, or about $5 billion on $5.47 billion in revenue for the fiscal year. This means Autodesk has plenty of room to control its operating margins.

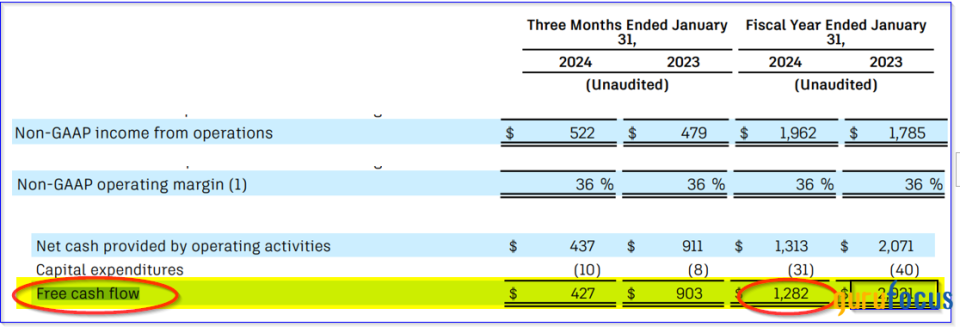

For example, in the latest fiscal year, it produced $1.96 billion in adjusted operating income, which represents 36% of net revenue. That was on par with last year's margin results.

Moreover, Autodesk's free cash flow came in at $1.28 billion for the year. This was lower than the prior year's $2.03 billion. However, the market had already discounted this.

One reason is the company explained its free cash flow headwinds will begin to abate. In a statement, Chief Financial Officer Debbie Clifford said:

The most significant free cash flow headwinds from our transition from up-front to annual billings for multi-year contracts are now behind us, which means our free cash flow troughed during fiscal 24 and will mechanically rebuild over the next few years.

Source: Autodesk earnings release

Nevertheless, Autodesk's FCF margins are strong. Its $1.28 billion in FCF represents 23.40% of its $5.50 billion in revenue for the year.

Granted, this was lower than the 40% FCF margin it made in the prior year ($2 billion/$5 billion in revenue). But the market had already anticipated this.

In fact, since Oct. 27, the stock has risen from a trough of $195.15 to $250.61 on March 6. That represents a gain of over 28%. This could be the result of the market's anticipation of higher profits and free cash flow for 2024.

We can use Autodesk's guidance to forecast the company's future free cash flow and also its valuation.

Forecasting FCF and its value

Autodesk is one of the few companies that forecasts its full-year free cash flow. Management said it expects to generate between $1.43 billion and $1.50 billion in FCF for fiscal 2025.

The company also projected revenue in 2024 will be between $5.81 billion and $5.96 billion. This means Autodesk expects its free cash flow margins will be between 24% and 25.80%.

So to be conservative, let's use a 25% margin estimate to forecast free cash flow. Moreover, sell-side analysts now estimate that revenue this year will be $6.03 billion. Therefore, we can estimate free cash flow will be at least $1.51 billion this year (0.25 x $6.03 billion = $1.507 billion).

That implies an increase of 17.60% in FCF over the $1.28 billion that Autodesk generated in 2024.

Moreover, for the next year ending Jan. 31, 2026 analysts now estimate revenue will rise to $6.71 billion. That means that sometime in the next 12 months free cash flow could be $1.67 billion. This implied a 30.80% gain over last year's $1.28 billion.

So just using these inputs, we can project Autodesk shares might rise 30% sometime in the next 12 months. However, there is also another way to value the stock using an FCF yield metric.

Using FCF yield to value Autodesk

Here is how that works. Let's assume Autodesk's forecast of $1.50 billion in free cash flow occurs, or that the market believes it will occur.

What if they paid out all of that FCF in a dividend? Autodesk uses over 60% of its FCF to buy back stock, ($800 million in buybacks last year out of the total $1.28 billion in FCF).

Theoretically, Autodesk could pay out the projected $1.5 billion in FCF next year as a dividend. As a result, the stock could end up having at least a 2% dividend yield.

For example, last year Autodesk generated $1.28 billion in free cash flow, and its market cap today is $53.60 billion. That means its FCF yield currently is 2.39%.

We can use a similar FCF yield metric to value Autodesk going forward. For example, let's take our $1.50 billion FCF estimate for this year and divide it by 2%. That would come out to an estimated $75 billion market cap.

That $75 billion projected market valuation estimate is 40% over the current market valuation of $53.60 billion. However, just to be conservative, let's use a higher FCF yield metric of 2.20%. That would equate to $68.20 billion, or 27% over the current market cap.

So shares of Autodesk could be worth 27% more, or $318.27 per share.

The bottom line is that using two different methods, the stock can be valued using expected FCF growth as well as FCF margins with yield estimates. The result is that Autodesk could be worth between 27% and 30% more.

This article first appeared on GuruFocus.