Autoliv (ALV) Q3 Earnings Miss Estimates, Sales Rise Y/Y

Autoliv Inc. ALV reported third-quarter 2023 adjusted earnings of $1.66 per share, lagging the Zacks Consensus Estimate of $1.74 but rising 34.9% year over year. Lower-than-expected revenues from the Seatbelts and Associated Products segment resulted in the underperformance. The company reported net sales of $2,596 million in the quarter, which topped the Zacks Consensus Estimate of $2,561 million and soared 12.8% year over year.

Organic sales rose 11% year over year and breezed past our estimate of a 6.9% rise due to new product launches and higher prices. Autoliv reported an adjusted operating income of $243 million, surging 40% year over year. Adjusted operating margin was 9.4%, higher than 7.5% in the year-ago period due to higher gross profit.

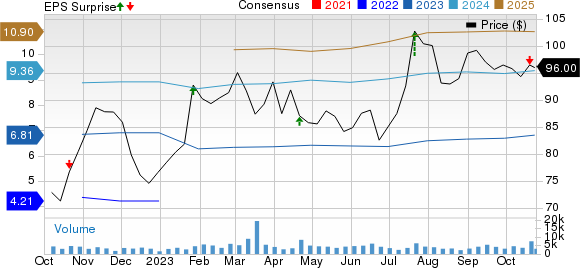

Autoliv, Inc. Price, Consensus and EPS Surprise

Autoliv, Inc. price-consensus-eps-surprise-chart | Autoliv, Inc. Quote

Segmental Performance

Sales in the Airbags and Associated Products segment totaled $1,761 million, beating our projection of $1,659.8 million. Revenues rose 17% on a year-over-year basis. All major categories within the segment witnessed organic sales growth. The primary reason for the upside was a rise in sales of steering wheels, followed by inflatable curtains, side airbags and passenger airbags.

Sales in the Seatbelts and Associated Products segment totaled $835 million, up 5.5% from the prior-year quarter and missing our projection of $864.5 million. Organic growth in Asia, excluding China and Europe, followed by the Americas, contributed to the year-over-year increase.

Region-wise, overall sales in the Americas during the quarter under review totaled $918 million, which surpassed our estimate of $855.7 million and increased 16% year over year. Sales in Europe totaled $646 million, topping our forecast of $623.2 million and surging 17% year over year. Sales in China came in at $538 million, missing our projection of $562.1 million but up 0.1% year over year. Sales in the Rest of Asia totaled $495 million, up 18% year over year and above our projection of $483.4 million.

Financial Position

Autoliv had cash and cash equivalents of $475 million as of Sep 30, 2023. Long-term debt totaled $1,277 million. Net capital expenditure jumped to $151 million compared with $164 million during the corresponding period of 2022. At quarter-end, free cash flow was $50 million compared with $68 million in the year-ago period. During the quarter under review, Autoliv paid dividends of 66 cents per share and repurchased 1.23 million shares at an average price of $97.23 per share.

Updated 2023 Guidance

The company now forecasts full-year 2023 organic sales growth of around 17%, up from prior guidance of 15%. Adjusted operating margin is anticipated within the 8.5-9% range. Operating cash flow is expected to be $900 million in 2023.

Zacks Rank & Key Picks

ALV currently carries a Zacks Rank #3 (Hold).

Some top-ranked players in the auto space are Toyota Motor TM, Allison Transmission Holdings ALSN and Honda Motor HMC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s 2023 sales and earnings implies year-over-year growth of 10.6% and 27.6%, respectively. The EPS estimates for 2023 and 2024 have moved up by 18 cents and 37 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for ALSN’s 2023 sales and earnings indicates year-over-year rises of 9.4% and 26.8%, respectively. The EPS estimate for 2023 increased by a penny in the past seven days. The EPS estimate for 2024 increased by 32 cents in the past 30 days.

The Zacks Consensus Estimate for HMC’s 2023 sales and earnings suggests year-over-year improvements of 7.7% and 29.4%, respectively. The EPS estimates for 2023 and 2024 have moved up by 4 cents each in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report