Autoliv Inc (ALV) Reports Record Sales and Strong Profitability in Q4 2023

Net Sales: $2,751 million, an 18% increase year-over-year.

Organic Sales Growth: 16%, outperforming global LVP growth.

Operating Margin: Improved to 8.6%; Adjusted Operating Margin reached 12.1%.

Earnings Per Share (EPS): $2.71, a 51% increase; Adjusted EPS at $3.74, up 105%.

Operating Cash Flow: Remained strong at $447 million, with robust free cash flow.

Full Year 2024 Guidance: Around 5% organic sales growth and 10.5% adjusted operating margin.

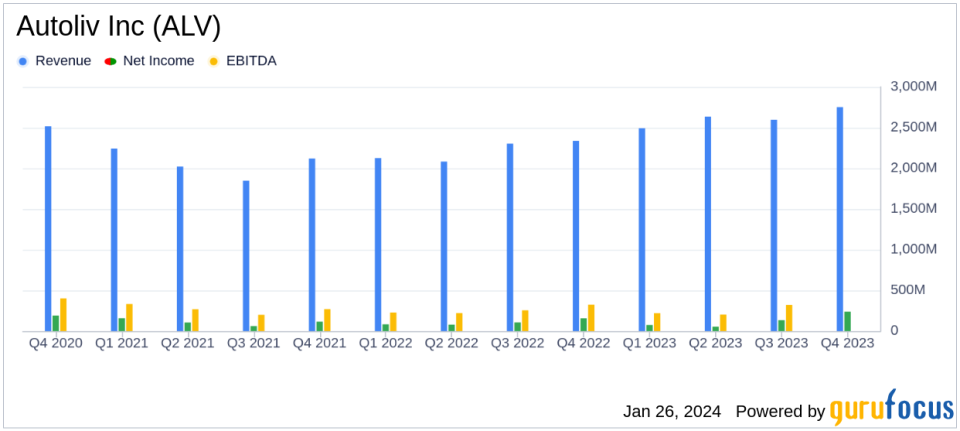

On January 26, 2024, Autoliv Inc (NYSE:ALV), the global leader in automotive safety systems, released its 8-K filing, showcasing a quarter of record sales and substantial profitability improvements. The company, known for its comprehensive range of safety products including airbags, seatbelts, and steering wheels, has reported an impressive finish to the year with significant growth in both sales and earnings per share.

Financial Performance Overview

Autoliv's fourth quarter saw net sales soar to $2,751 million, marking an 18% increase compared to the same period last year. This growth was driven by a 16% organic sales growth, which notably exceeded the global Light Vehicle Production (LVP) growth of 9%. Despite challenges in China, where LVP growth was dominated by domestic OEMs with typically lower safety content, Autoliv outperformed in all other regions, benefiting from new product launches and higher prices.

The company's profitability also saw a substantial uptick, with operating income reaching $237 million and operating margin improving to 8.6%. Adjusted operating income and margin experienced even more significant growth, jumping to $334 million and 12.1%, respectively. Earnings per share increased by 51% to $2.71, while adjusted EPS more than doubled to $3.74, a 105% increase. These figures reflect Autoliv's ability to navigate cost pressures and maintain strong profitability amidst a challenging economic environment.

Strategic and Operational Highlights

Autoliv's President & CEO, Mikael Bratt, commented on the company's performance, noting the achievement of all 2023 indications and the highest order intake in five years, supporting their approximately 45% market share. The company's structural cost reductions are on track, with around 75% of the planned indirect workforce reductions detailed and announced, contributing to improved direct labor productivity.

As we indicated throughout the year, we finished 2023 strong. We achieved or exceeded all of our 2023 indications. Sales and adjusted operating income hit new records while operating cash flow remained strong. I am pleased that gross margin improved substantially. 2023 order intake was the highest in the past five years, supporting our around 45% market share.

Autoliv's strong operating cash flow of $447 million and unchanged free cash flow of $297 million highlight the company's financial health and ability to generate shareholder value. The leverage ratio improved to 1.2X, reflecting a solid balance sheet and prudent financial management.

Looking Ahead

For the full year 2024, Autoliv has provided guidance anticipating around 5% organic sales growth and an adjusted operating margin of around 10.5%. The company expects to continue improving call-off stability, outgrow LVP, and benefit from strategic and structural initiatives. These projections underscore Autoliv's confidence in its business model and its ability to adapt to market conditions.

Autoliv's latest earnings report paints a picture of a company that is not only leading in its industry but also adept at managing operational efficiencies and capitalizing on market opportunities. For value investors, Autoliv's strong performance and positive outlook may represent an attractive investment proposition in the Vehicles & Parts sector.

For a more detailed analysis of Autoliv Inc (NYSE:ALV)'s financials and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Autoliv Inc for further details.

This article first appeared on GuruFocus.