The Automatic Data Processing Inc (ADP) Company: A Short SWOT Analysis

ADP shows strong revenue growth and solid financial condition.

The company's investment in AI and technology enhancements strengthens its competitive position.

ADP faces challenges in the form of increasing competition and changing regulatory landscape.

Opportunities lie in the growing demand for HCM solutions and potential for global expansion.

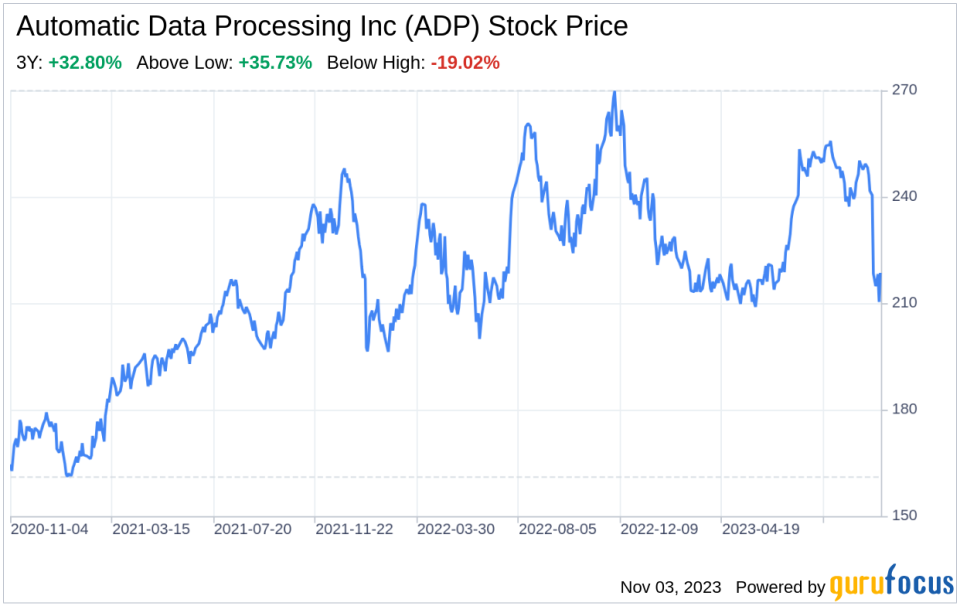

Automatic Data Processing Inc (NASDAQ:ADP), a leading provider of payroll and human capital management solutions, filed its 10-Q report with the SEC on November 2, 2023. The company's financial performance for the quarter ended September 30, 2023, shows a revenue growth of 7% to $4,512.4 million. The company's strong financial performance, coupled with its strategic investments in technology and global expansion, presents a promising outlook. However, the company also faces challenges in the form of increasing competition and a changing regulatory landscape. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats that ADP faces.

Strengths

Strong Financial Performance: ADP's financial performance for the quarter ended September 30, 2023, shows a solid revenue growth of 7% to $4,512.4 million. This growth is attributed to new business from New Business Bookings, strong client retention, an increase in zero-margin benefits pass-throughs, an increase in pays per control, and an increase in pricing. The company's strong financial performance indicates its ability to generate significant revenues and maintain a robust financial position.

Investment in Technology: ADP has been investing heavily in technology to enhance its HCM solutions. The company has integrated generative AI features into its products, including the integration of gen AI into Roll to enhance its conversational user interface. The company also launched ADP Assist, an embedded smart support AI designed to make HR work easier and smarter. These investments in technology strengthen ADP's competitive position and enhance its product offerings.

Weaknesses

Dependence on the U.S. Market: While ADP serves clients globally, a significant portion of its revenue is generated from the U.S. market. This heavy reliance on a single market exposes the company to risks associated with economic downturns, regulatory changes, and market saturation in the U.S.

Competitive Market: The market for payroll and human capital management solutions is highly competitive. ADP faces competition from both established players and emerging startups. The intense competition could put pressure on the company's market share and profitability.

Opportunities

Growing Demand for HCM Solutions: The demand for HCM solutions is growing as businesses increasingly recognize the importance of effective human capital management. This growing demand presents a significant opportunity for ADP to expand its client base and increase its revenues.

Global Expansion: ADP has been making efforts to expand its presence globally. The company recently acquired the payroll business of BTR, its long-time partner in Sweden, and launched Roll in Ireland to expand its SMB business outside of the U.S. These initiatives present opportunities for ADP to tap into new markets and diversify its revenue streams.

Threats

Regulatory Changes: As a provider of payroll and human capital management solutions, ADP is subject to various regulations in the countries it operates in. Changes in these regulations could impact the company's operations and increase its compliance costs.

Technological Disruptions: The rapid pace of technological advancements poses a threat to ADP. The company needs to continuously innovate and upgrade its solutions to stay competitive. Failure to do so could result in loss of clients to competitors with more advanced solutions.

In conclusion, ADP's strong financial performance and strategic investments in technology position it well for future growth. However, the company needs to address its weaknesses and navigate the threats it faces to maintain its competitive position. The growing demand for HCM solutions and opportunities for global expansion present promising prospects for the company.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.