AutoNation Inc (AN) Navigates Market Dynamics with Mixed 2023 Results

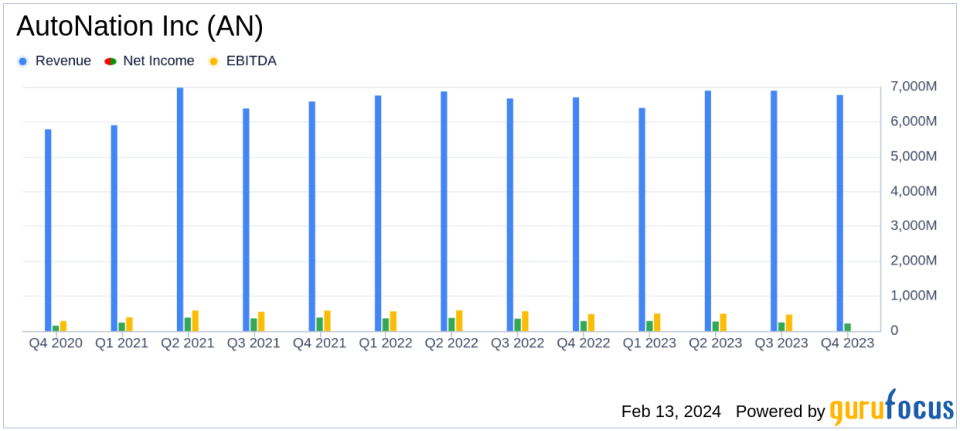

Revenue: Q4 2023 saw a slight increase to $6.8 billion, with full-year revenue remaining stable at $26.9 billion.

Net Income: Q4 net income decreased by 25% YoY to $216.2 million, with a full-year drop of 26% to $1.02 billion.

Earnings Per Share (EPS): Adjusted EPS for Q4 was $5.02, down 21% YoY, and full-year adjusted EPS decreased by 6% to $23.00.

After-Sales Growth: After-sales revenue increased by 11% in Q4 and for the full year, highlighting a strong performance in this segment.

Share Repurchases: AutoNation repurchased $864 million in shares throughout 2023, reducing shares outstanding by 13%.

Liquidity: As of December 31, 2023, AutoNation reported $1.5 billion in liquidity, maintaining a strong financial position.

On February 13, 2024, AutoNation Inc (NYSE:AN) released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year of 2023. AutoNation, the second-largest automotive dealer in the United States, reported a slight increase in Q4 revenue to $6.8 billion and maintained stable full-year revenue at $26.9 billion despite a challenging market environment.

Performance Highlights and Challenges

AutoNation's Q4 2023 GAAP EPS stood at $5.04, with adjusted EPS at $5.02, reflecting a decrease from the previous year's figures. The company experienced a 1% increase in Q4 revenue, driven by an 8% increase in new vehicle unit sales and an 11% increase in after-sales revenue. However, used vehicle unit sales saw a 4% decline. The full-year results mirrored this trend, with a 6% increase in new vehicle unit sales but a 9% decrease in used vehicle sales.

The company's gross profit for Q4 was $1.2 billion, a 5% decrease from the previous year, primarily due to lower new and used vehicle gross profits, which were partially offset by a 13% increase in after-sales gross profit. For the full year, gross profit decreased by 3% to $5.1 billion. Selling, General, and Administrative (SG&A) expenses as a percentage of gross profit were slightly higher, reflecting investments in technology and growth initiatives.

Financial Achievements and Industry Significance

AutoNation's after-sales segment showed significant growth, with an 11% increase in revenue for both Q4 and the full year. This growth is crucial as it demonstrates the company's ability to generate consistent revenue streams beyond vehicle sales, which is particularly important in the face of fluctuating new and used vehicle market conditions.

The company's share repurchase program also highlights its commitment to returning value to shareholders. In 2023, AutoNation repurchased 6.4 million shares for $864 million, reducing shares outstanding by 13% during the year. This aggressive buyback strategy underscores the company's confidence in its financial health and future prospects.

Financial Metrics and Importance

Key financial metrics from AutoNation's earnings report include:

Financial Metric | Q4 2023 | Full Year 2023 |

|---|---|---|

New Vehicle Revenue | $3.4 billion | $12.8 billion |

Used Vehicle Revenue | $1.9 billion | $8.2 billion |

After-Sales Revenue | $1.1 billion | $4.5 billion |

Customer Financial Services Revenue | $347 million | $1.4 billion |

These metrics are important as they provide insights into the company's core operations, including the profitability of each segment and the company's ability to manage costs and generate income. The gross profit per vehicle retailed, a key indicator of profitability, was $3,653 for new vehicles and $1,455 for used vehicles in Q4 2023.

Analysis of Company's Performance

AutoNation's performance in 2023 reflects the resilience of its business model amidst market normalization. The company's focus on after-sales services and customer financial services has helped to mitigate the impact of lower vehicle sales margins. However, the challenges in the used vehicle market and the decrease in gross profit per vehicle indicate that AutoNation must continue to adapt to changing market conditions.

The company's strong balance sheet, with $1.5 billion in liquidity, positions it well for future growth and operational investments. AutoNation's strategic focus on capital allocation and share repurchases demonstrates a balanced approach to driving shareholder value while investing in the business.

Overall, AutoNation's mixed financial results for 2023 highlight the company's ability to navigate a dynamic automotive market, with a clear strategy to leverage its strengths in after-sales services and financial services to sustain growth and profitability.

Explore the complete 8-K earnings release (here) from AutoNation Inc for further details.

This article first appeared on GuruFocus.